Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

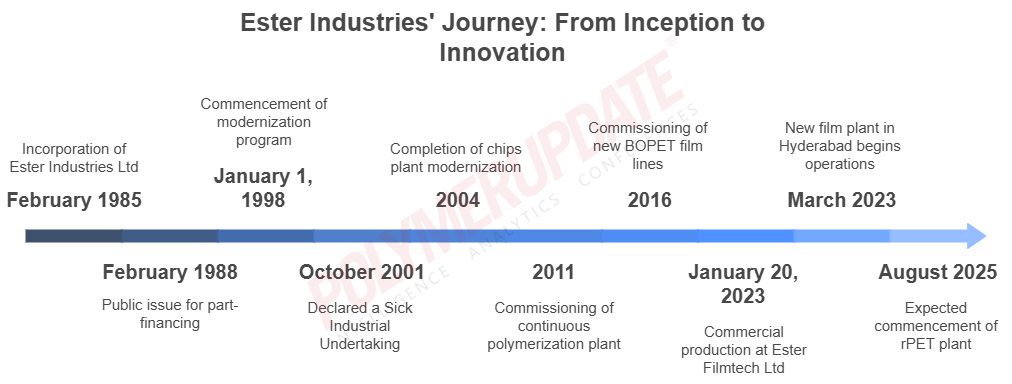

Ester Industries Ltd (EIL), a leading manufacturer of polyester films and specialty polymers, plans to commence commercial production at its proposed recycled polyethylene terephthalate (rPET) plant in August 2025. Located in Hyderabad, the brownfield project is in the advanced stages of development. The proposed plant will have an installed capacity of 20,000 tonnes, which will complement the existing 8,000 TPA rPET facility.

In an investors’ presentation, the company stated, “The proposed rPET facility with a 20,000 TPA capacity is currently at the installation stage in Hyderabad. Commercial production at this plant is expected to begin by August 2025.” Additionally, Ester Industries is developing another rPET plant as part of a joint venture with Loop Industries. This facility will produce rDMT (recycled dimethyl terephthalate) and rMEG (recycled monoethylene glycol) from waste polyesters. The project is expected to become operational by early 2027. EIL’s rPET mechanical recycling technology offers a cost-effective and sustainable solution, reinforcing the company’s commitment to environmentally friendly practices.

Humble beginning

Incorporated in February 1985, Ester Industries Ltd (EIL) is a manufacturer of PET film and engineering plastics. Promoted by Sitaram Singhania along with J.P. Shroff, the company has an installed capacity of 36,000 tonnes per annum (TPA) for polyester chips, 18,000 TPA for polyester films, and 6,000 TPA for dope-dyed coarse denier polyester filament yarn. The total cost of the project at the time of installation was Rs 84.4 crore, which was part-financed through a public issue in February 1988.

EIL was the first company in India to have integrated operations for manufacturing three products: polyester chips, polyester film, and dope-dyed polyester filament yarn. It operates a working plant in Khatima, Uttarakhand. The company has two wholly owned foreign subsidiaries: Ester International (USA) Ltd and Ester Europe GmbH. Additionally, it is planning to establish another subsidiary in Oman to manufacture 24,000 tonnes of polyester film.

The company’s expansion-cum-modernization program, with an investment of Rs 125 crore, aimed at increasing the annual production capacities of chips from 20,000 to 36,000 tonnes and polyester film from 4,000 to 18,000 tonnes. Commercial production under this program commenced on January 1, 1998. In October 2001, EIL was declared a Sick Industrial Undertaking, and a rehabilitation package for a one-time settlement of Rs 55.20 crore was approved by the Board for Industrial and Financial Reconstruction (BIFR).

In 2004, EIL completed the modernization of its chips plant, which significantly reduced production costs. A 4.10 MW base load power generation unit, operated with cheaper furnace oil, became operational in January 2004. The chips plant was commissioned in July 2004, followed by a metallizer plant with a 4,873 TPA capacity at the Khatima factory site in October 2005. The modernization of Film Line No. 1 was completed in March 2006, and the co-extruder system in Film Line No. 2 was commissioned in June 2006.

In 2011, EIL commissioned a continuous polymerization plant with a 71,000 TPA capacity, a polyester film plant with a 30,000 TPA capacity, and a metallizer plant with a 7,200 TPA capacity. During 2011-12, the company installed a recycling extruder, off-line coater, and thermic fluid heating system. By 2014, it had expanded the operating capacity in engineering plastics to 16,500 TPA by installing a state-of-the-art compounding extruder with an 8,000 TPA capacity.

In 2016, three new lines of thin BOPET film were commissioned in India, adding approximately 933 kilotonnes of capacity. The company expanded its BOPET film production in Telangana through its wholly owned subsidiary, Ester Filmtech Ltd, which commenced commercial production on January 20, 2023. Additionally, its new film plant in Hyderabad began commercial operations in March 2023.

| Installed capacity | ||

| Segments | Products | Capacity (‘000 TPA) |

| Polyester Films | Polyester Chips | 67 |

| Polyester Films | 108 | |

| Specialty Polymers | Specialty Polymers | 30 |

| rPET-Existing | 8 | |

| rPET-Proposed | 20 | |

Sources: Ester Industries Ltd, and Polymerupdate Research

Turnaround

EIL experienced a remarkable turnaround in its performance during the financial year 2024-25, driven by a surge in sales volumes of specialty products. The company reported a consolidated net profit of Rs 14 crore for FY 2024-25, a significant recovery from the net loss of Rs 121 crore recorded in the previous year. Total consolidated income grew by 19 percent, reaching Rs 1,298 crore in FY 2024-25, compared to Rs 1,090 crore in the prior year. For the quarter ended March 2025, EIL posted a consolidated net profit of Rs 2 crore on a consolidated turnover of Rs 321 crore, as opposed to a net loss of Rs 24 crore on a consolidated income of Rs 280 crore in the corresponding quarter of the previous year.

On a standalone basis, EIL reported a net profit of Rs 41 crore on a turnover of Rs 1,085 crore for FY 2024-25, in contrast to a net loss of Rs 43 crore on a turnover of Rs 882 crore in the previous year. Standalone net sales increased by a staggering 23 percent on an annual basis during FY 2024-25. For the quarter ending March 2025, the company achieved a standalone net profit of Rs 12 crore, a revers al from the net loss of Rs 9 crore in the same period of the previous year. Standalone turnover for the January-March 2025 quarter stood at Rs 261 crore, marking a 19 percent increase from Rs 220 crore in the corresponding quarter of the previous year.

Arvind Singhania, Chairman of Ester Industries, stated, “The film business witnessed a turnaround, with positive EBIT and a 15 percent increase in operational revenue. A higher share of value-added products and improved margins in commodity films bolstered overall profitability, supported by favourable demand-supply dynamics. With the Plastic Waste Management Rules mandating 10 percent recycled content in flexible packaging from April 1, 2025, the demand for BOPET Film is set to rise. We are equipped with the technology and certifications to supply BOPET Films with varied PCR content and are well-positioned to meet the growing demand.”

Singhania further added, “Our transformation from a commodity to a specialty film player is progressing well, with anticipated improvements in profitability through a better product mix and enhanced operational efficiency. Specialty polymers demonstrated robust growth, with a 72 percent increase in revenue and a 164 percent jump in EBIT, driven by strong demand for products like MB03 and innovative PBT. The performance of recycled PET also improved significantly. We remain confident about the growth prospects of this segment, supported by a strong product pipeline and minimal competition.”

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com