Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

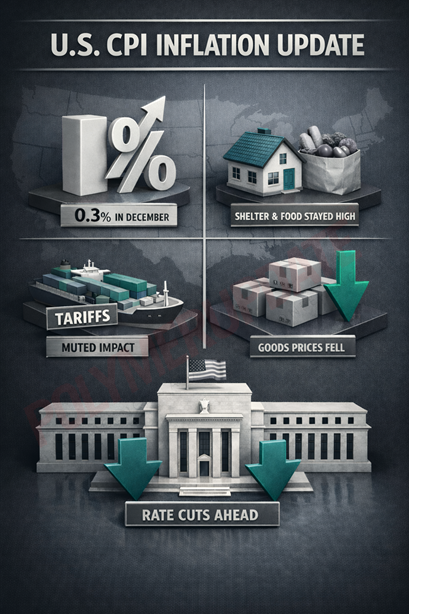

The Consumer Price Index (CPI)-based retail inflation in the United States rose by 0.3 percent, driven by higher shelter costs, including rents, the Labour Department’s Bureau of Labor Statistics said on Tuesday. The increase from the previous month was largely attributed to reciprocal and punitive tariffs imposed by U.S. President Donald Trump on much of the world, which kept some upward pressure on consumer prices. Meanwhile, December inflation for consumer staples such as food and electricity remained elevated. Economists said the data was also somewhat difficult to interpret due to distortions caused by the six-week government shutdown. The retail inflation gauge showed a year-on-year increase of 2.7 percent in December, unchanged from the previous month and broadly in line with expectations. Mark Zandi, Chief Economist, said in a note, “The bottom line is that inflation remains uncomfortably high. Inflation for staples and necessities continues to be elevated.”

Economists said the data was also somewhat difficult to interpret due to distortions caused by the six-week government shutdown. The retail inflation gauge showed a year-on-year increase of 2.7 percent in December, unchanged from the previous month and broadly in line with expectations. Mark Zandi, Chief Economist, said in a note, “The bottom line is that inflation remains uncomfortably high. Inflation for staples and necessities continues to be elevated.”

“The December inflation data was weaker than anticipated and confirms that tariffs are not having the immediate impact on prices that many feared. The fact that the effects are coming through so slowly provides greater scope for falling energy costs, easing housing rents, and weaker wage growth to mitigate the impact,” said James Knightley, Chief International Economist for the United States at ING Economics.

Undershooting expectations

The December CPI report delivered another soft inflation print, with headline prices rising 0.3 percent month-on-month, in line with the consensus forecast, while core inflation increased by only 0.2 percent, compared with the 0.3 percent consensus expectation. There had been a strong possibility of a higher print of 0.4 percent, largely due to timing issues related to the government shutdown, which amplified the impact of price discounting later in November 2025 relative to a more “normal” November 2024. This would have resulted in a larger seasonally adjusted rebound in December price levels.

The key takeaway is that goods prices were very benign, underscoring the point that tariffs have had a far more muted impact on inflation than initially feared. Goods that are often imported and therefore subject to tariffs include appliances (-4.3 percent MoM), furniture (-0.4 percent MoM), new vehicles (0.0 percent MoM), and video and audio equipment (-0.4 percent MoM). This is a remarkable development and suggests that U.S. retailers are absorbing costs by squeezing their profit margins. Used vehicle prices also declined, falling 1.1 percent month-on-month.

Two interest rate cuts

Among sectors that continue to run hotter, primary rent and owners’ equivalent rent each rose by 0.3 percent, medical care services increased by 0.4 percent, and transportation services climbed 0.5 percent, largely driven by a 5.2 percent jump in airline fares. Apparel prices rose 0.6 percent, while food prices increased 0.7 percent. Overall, this is a very positive outcome, and with Fed Chair Jerome Powell suggesting that the impact of tariffs has largely run its course and could peak in the current quarter, it indicates that policymakers remain on track to cut interest rates further.

“We still see some risk from tariffs, but the fact that the impact has come through so slowly and far less forcefully than feared provides scope for falling gasoline prices, easing housing rents, and weakening wage growth to help CPI continue trending lower this year, potentially moving very close to 2 percent toward year-end. As such, two Fed rate cuts appear entirely achievable, with risks skewed toward a third given the cooling labour market,” Knightley added.

Eyes on mid-terms

With regard to the jobs data, ADP private payroll figures suggest employment increased by an average of 11,750 per week over the four weeks to 20 December. This is consistent with the 50,000 monthly increase in non-farm payrolls reported by the Bureau of Labour Statistics (BLS) last week for December. However, Fed Chair Jerome Powell has indicated that the Federal Reserve believes payroll growth is being overstated by around 60,000 per month, which effectively suggests that the labour market is largely stagnant.

Household affordability concerns are set to be a key issue in the mid-term elections in November. While easing price pressures are a positive development, consumer confidence surveys indicate that households are not yet fully convinced. ING Economics believes the bigger driver of anxiety is the cooling labour market, where all sectors outside government, leisure and hospitality, and private education and healthcare services have shed jobs in seven of the past eight months.

BLS calculations

According to the BLS’s calculations, the share of economic growth accruing to workers through wages has declined from 64 percent in the 1950s to less than 54 percent today. As the corporate sector captures an increasing share of the gains from economic growth, this goes a long way toward explaining why consumer confidence remains weak despite robust GDP growth and record-high equity markets.

This calls for greater efforts by the Administration to generate positive headlines, including proposals to cap credit card borrowing costs, measures to improve mortgage availability and affordability, and the removal of certain items from the scope of tariffs. It also underscores the importance for the President of delivering on the proposed US$2,000 tariff dividend ahead of the mid-term elections.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com