Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

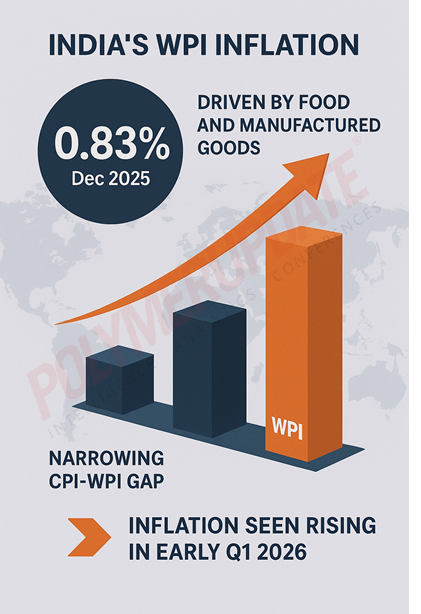

India’s bulk inflation, measured by the Wholesale Price Index (WPI), rose for the second consecutive month in December to 0.83 percent after two successive months of deflation, according to official data released by the Ministry of Commerce and Industry on Wednesday. The December wholesale inflation print was driven by rising prices across multiple segments, including other manufactured products, minerals, machinery and equipment, and food products, among others. A Ministry statement said, “The annual rate of inflation based on the All-India Wholesale Price Index (WPI) is 0.83 percent (provisional) for the month of December 2025 (over December 2024). The positive rate of inflation in December 2025 is primarily due to an increase in prices of other manufactured products, minerals, machinery and equipment, food products, and textiles, among others. The month-on-month change in the WPI for December 2025 stood at 0.71 percent compared with November 2025.”

A Ministry statement said, “The annual rate of inflation based on the All-India Wholesale Price Index (WPI) is 0.83 percent (provisional) for the month of December 2025 (over December 2024). The positive rate of inflation in December 2025 is primarily due to an increase in prices of other manufactured products, minerals, machinery and equipment, food products, and textiles, among others. The month-on-month change in the WPI for December 2025 stood at 0.71 percent compared with November 2025.”

Rahul Agrawal, Senior Economist at ICRA Ltd, said, “While the WPI expectedly reverted to inflation of 0.8 percent in December 2025 after a gap of two months, the reading was mildly higher than our expectation (+0.4 percent). The sequential hardening in year-on-year (YoY) WPI inflation was largely led by the WPI food index, which was flat compared with year-ago levels following a 2.6 percent contraction in November 2025. This accounted for as much as 81 basis points of the 115 basis-point uptick in the headline print between these months. With this increase, the gap between Consumer Price Index (CPI) and WPI inflation narrowed to just 50 basis points in December 2025 from 100 basis points in November 2025.”

Sector-wise performance

Notably, core WPI (non-food manufactured items) inflation rose to a 34-month high of 2.0 percent in December 2025 from 1.5 percent in the previous month. On a sequential basis, the core index increased by 0.5 percent in December 2025—the steepest uptick in 19 months—reflecting firming global commodity prices and depreciation in the USD/INR pair over recent months, which likely put upward pressure on the landed cost of imports.

Looking ahead, WPI food inflation is expected to harden further in January 2026 and remain on an upward trajectory thereafter due to an unfavourable base. In addition, global commodity prices continued to rise on a sequential basis in January 2026, led by sharp gains in precious metals and some firming in industrial metal prices, even as oil prices cooled.

Driven by hardening year-on-year food inflation on account of an unfavourable base, rising global commodity prices, and sustained pressure on the USD/INR pair over the past few months, ICRA expects year-on-year WPI inflation to rise to 1.5 percent in January 2026, the highest level in 10 months. During the January–March 2026 quarter, WPI inflation is projected to average around 1.5–2.0 percent after recording a 0.2 percent deflation in the October–December 2025 quarter, which is expected to lift growth in the gross domestic product (GDP) deflator for the quarter.

Global challenges

Globally, commodity prices have remained broadly stable, supported by oversupply in the global crude oil market and persistent overcapacity in China. The global crude oil supply glut is likely to persist through calendar year 2026, with production continuing to exceed consumption. OPEC+ production policies and elevated inventory levels are expected to cap any significant upside in crude oil prices. Recent tensions in Venezuela are unlikely to have a material impact on oil markets, given the country’s limited share of global production. Nonetheless, geopolitical risks—particularly in the Middle East—warrant close monitoring due to their potential implications for energy prices.

Rajani Sinha, Chief Economist at Care Ratings Ltd, said, “WPI inflation increased to 0.8 percent in December, reversing the deflation of 0.3 percent recorded in November. This uptick was primarily driven by a moderation in food price deflation and higher inflation in manufactured products. Looking ahead, robust agricultural activity, a favourable base effect, and adequate reservoir levels are expected to help contain food price pressures. Deflation in the fuel and power category remained unchanged at 2.3 percent. Overall, WPI inflation continues to remain at comfortable levels.”

Although prices of several base metals, including copper and aluminium, have risen sharply in recent months, this has been driven by strong industrial demand from renewable energy and AI-related sectors. Factors such as U.S. Federal Reserve rate cuts and expectations of fiscal stimulus in China are not considered major concerns for the domestic inflation outlook. Going forward, WPI inflation is expected to edge up marginally due to the low base of last year; however, it is likely to remain largely benign, averaging around 0.4 percent in financial year (FY) 2025–26.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com