Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

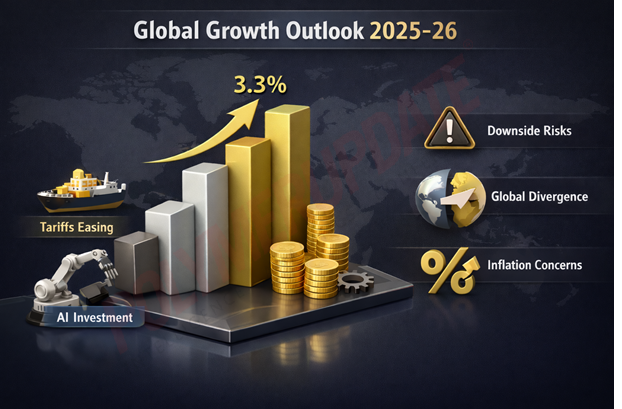

The International Monetary Fund (IMF) has projected the world economy to grow by 3.3 percent in 2026, as businesses adapt to easing US tariffs in recent months, followed by swelling investment in artificial intelligence (AI), which is likely to fuel wealth creation and productivity gains. The resilient growth marks a 0.2 percentage point upward revision from the 3.1 percent economic expansion for 2026 projected in October 2025. For the calendar year 2025 as well, the IMF raised its economic growth projection by 0.1 percentage point to 3.3 percent. The IMF made no change to the world economic growth outlook for 2027 due to divergent forces. Headwinds from shifting trade policies are being offset by tailwinds from surging investment related to technology, including artificial intelligence—more so in North America and Asia than in other regions—as well as fiscal and monetary support, broadly accommodative financial conditions, and the adaptability of the private sector.

The IMF made no change to the world economic growth outlook for 2027 due to divergent forces. Headwinds from shifting trade policies are being offset by tailwinds from surging investment related to technology, including artificial intelligence—more so in North America and Asia than in other regions—as well as fiscal and monetary support, broadly accommodative financial conditions, and the adaptability of the private sector.

While releasing its quarterly publication titled World Economic Outlook, IMF Chief Economist Pierre-Olivier Gourinchas said, “Global economic growth remains quite resilient. The IMF’s 2025 and 2026 economic growth forecasts now exceed predictions made in October 2024, before Trump was elected to a second term. So, in a sense, the global economy is shaking off the trade and tariff disruptions of 2025 and is coming out ahead of what we were expecting before it all started.”

Vulnerable sector

Risks to the global economic outlook remain tilted to the downside. The resilience exhibited so far has been driven largely by a few sectors and often supported by monetary and fiscal accommodation. This resilience could be disrupted by sector-specific dynamics or shocks emanating from long-standing, broader risk factors. Should expectations of AI-driven productivity gains prove overly optimistic and outcomes disappoint, a sharp decline in real investment in the high-tech sector—along with reduced spending on AI adoption in other sectors—and a more prolonged correction in stock market valuations, which have increasingly been lifted by only a few technology firms, could ensue.

The rapid obsolescence of unused or misaligned assets, the costly reallocation of capital and labour accompanied by a decline in business dynamism, and negative wealth effects would weigh on private consumption and investment. Spillovers would spread directly through trade flows to export-oriented economies specializing in technology products and would then radiate to the rest of the world through a tightening of global financial conditions. The impact on growth remains highly uncertain and will depend on how financial conditions respond.

Region-wise performance

Global growth is expected to remain steady, with momentum in high-tech sectors set to slow but continuing to partly offset the drag elsewhere. While tariffs and uncertainty are projected to continue weighing on the level of activity, their effect on growth is expected to fade during 2026 and 2027. There are, however, significant revisions for some countries, with changes moving in different directions.

Economic growth in advanced economies is projected at 1.8 percent in 2026 and 1.7 percent in 2027. In the United States, the economy is projected to expand by 2.4 percent in 2026, supported by fiscal policy and a lower policy rate, while the impact of higher trade barriers gradually wanes. This 0.3 percentage point upward revision from the October forecast reflects a stronger-than-expected GDP outturn in the third quarter of 2025, a rebound in activity in the first quarter of 2026 compared with the fourth quarter of 2025 following the end of the federal government shutdown, and the associated carryover effects.

Growth is projected to remain solid at 2 percent in 2027, with a near-term fiscal boost from tax incentives for corporate investment under the One Big Beautiful Bill Act of 2025. Technology-driven momentum is expected to moderate but still provide some offset to lower immigration and moderating consumption.

In the euro area, growth is expected to remain steady at 1.3 percent in 2026 and 1.4 percent in 2027. The slightly faster growth in 2027 reflects projected increases in public spending, notably in Germany, alongside continued strong performance in Ireland and Spain. The forecast is broadly unchanged from October, with the subdued growth rate reflecting unresolved structural headwinds. The impact of the planned increase in defence spending is expected to materialize only in subsequent years, given commitments to reach target levels gradually by 2035.

Compared with other regions, the euro area benefits less from the recent technology-driven investment boost. Lingering effects of persistently higher energy prices following Russia’s invasion of Ukraine will continue to weigh on manufacturing, with additional pressure from the real appreciation of the euro relative to the currencies of countries exporting similar products. In Japan, growth is projected to moderate from 1.1 percent in 2025 to 0.7 percent in 2026 and 0.6 percent in 2027. This marks a small upward revision from the October forecast, reflecting in part the fiscal stimulus package announced by the new government.

Emerging markets

In emerging market and developing economies, growth is expected to continue hovering just above 4 percent in 2026 and 2027. Relative to the October projection, China’s growth for 2025 has been revised upward by 0.2 percentage point to 5.0 percent. This revision reflects stimulus measures and additional policy bank lending for investment. Growth for 2026 has also been revised upward by 0.3 percentage point to 4.5 percent, reflecting lower US effective tariff rates on Chinese goods following the yearlong trade truce agreed in November, as well as stimulus measures assumed to be implemented over two years.

China’s growth rate is expected to decelerate to 4 percent in 2027 as structural headwinds assert themselves. In India, growth has been revised upward by 0.7 percentage point to 7.3 percent for 2025, reflecting a better-than-expected outturn in the third quarter and strong momentum in the fourth quarter. Growth is projected to moderate to 6.4 percent in 2026 and 2027 as cyclical and temporary factors wane.

The Middle East

In the Middle East and Central Asia, growth is projected to accelerate from 3.7 percent in 2025 to 3.9 percent in 2026 and 4.0 percent in 2027, supported by higher oil output, resilient domestic demand, and ongoing reforms. Growth is also expected to accelerate in sub-Saharan Africa, from 4.4 percent in 2025 to 4.6 percent in both 2026 and 2027, supported by macroeconomic stabilization and reform efforts in key economies.

In Latin America and the Caribbean, growth is projected to moderate to 2.2 percent in 2026 before rebounding to 2.7 percent in 2027, as countries in the region approach potential from different cyclical positions. In emerging and developing Europe, a sharp slowdown in 2025 to a growth rate of 2.0 percent is expected to reverse, with economies in the region expanding at an average rate of 2.3 percent in 2026 and 2.4 percent in 2027. In most regions, the rebound also reflects the fading effects of shifting trade policies.

Global inflation

Global inflation is projected to continue its decline, with headline inflation falling to 3.8 percent in 2026 and 3.4 percent in 2027. This outlook is virtually unchanged from the WEO October 2025, with the overarching trends of softening demand and lower energy prices remaining intact. Divergence between the United States and most other countries persists. As pass-through from higher tariffs gradually materializes, US core inflation is projected to return to the country’s 2 percent target in 2027.

Australia and Norway are also projected to experience some prolonged persistence of above-target inflation. In the United Kingdom, inflation—which rose last year partly due to one-off regulated price changes—is expected to return to target by the end of 2026, as a weakening labour market continues to exert downward pressure on wage growth. In Japan, inflation is expected to moderate in 2026 and converge toward the country’s target in 2027, as food and commodity prices ease.

In the euro area, headline inflation is projected to hover around 2 percent, with core inflation expected to decline to that level in 2027. Inflation in China is projected to begin rising from low levels, while inflation in India is expected to return to near-target levels after a marked decline in 2025 driven by subdued food prices.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com