Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

The Indian rupee declined 0.39 percent to touch a new record low of 91.55 against the US dollar on January 21, amid intensifying geopolitical tensions after US President Donald Trump mulled a 10 percent penal tariff on the European Union for protesting America’s move to acquire Greenland. The record low level of the Indian currency marks a further decline from 91.04 against the greenback, driven by sustained demand for the US dollar and a broader market sell-off. Commenting on the move, Madan Sabnavis, Chief Economist at Bank of Baroda, said, “The rupee ended today (as per the RBI reference rate) at 91.55 against the US dollar, which is the lowest ever. Yesterday, the reference rate was 91.04 against the US dollar. During the day, the Indian currency crossed 91.70 against the dollar before retreating. The decline in the rupee has largely been attributed to escalating geopolitical tensions, a widening trade deficit, foreign portfolio investor (FPI) outflows, and nervousness over India’s trade deal with the United States.”

Commenting on the move, Madan Sabnavis, Chief Economist at Bank of Baroda, said, “The rupee ended today (as per the RBI reference rate) at 91.55 against the US dollar, which is the lowest ever. Yesterday, the reference rate was 91.04 against the US dollar. During the day, the Indian currency crossed 91.70 against the dollar before retreating. The decline in the rupee has largely been attributed to escalating geopolitical tensions, a widening trade deficit, foreign portfolio investor (FPI) outflows, and nervousness over India’s trade deal with the United States.”

High volatility

Extremely high volatility was registered in the Indian foreign exchange (forex) market on Wednesday, with the rupee hitting a new record low of 91.74 against the US dollar amid a deepening stock market sell-off. The Indian currency slumped 76 paise from its previous close of 90.98 against the dollar. Notably, the sharp reversal in the rupee’s movement came after it opened just 10 paise lower at 91.08 against the US dollar.

Commenting on the move, Akshat Garg, Head of Research and Product at Choice Wealth, said, “The rupee slipping to a record low on Wednesday reflects a combination of global risk aversion and sustained dollar demand rather than any single domestic shock. Persistent foreign fund outflows, elevated import requirements—especially energy—and a stronger dollar globally have intensified pressure on the currency.”

Garg added, “While exporters may benefit from improved competitiveness, a weaker rupee gradually feeds into higher costs for fuel, travel, and imported goods, impacting households and businesses alike. The key challenge for policymakers is to manage volatility without overreacting. With adequate forex buffers and calibrated intervention, the move appears more sentiment-driven than a signal of structural weakness.”

FPIs selling

A collateral impact of US President Donald Trump’s plan to acquire Greenland has been reflected in the Indian markets. Foreign portfolio investors (FPIs) have been net sellers in Indian equities in recent sessions, driven by a mix of global and domestic headwinds. Persistent strength in the US dollar, elevated US bond yields, and expectations of a “higher-for-longer” interest rate environment in advanced economies have prompted FPIs to rebalance portfolios in favour of safer assets. At the same time, bouts of global risk aversion triggered by geopolitical uncertainties and concerns over slowing global growth have weighed on emerging market inflows.

On the domestic front, relatively rich equity valuations and selective profit-booking after a strong rally have added to selling pressure, even as India’s medium-term growth outlook remains constructive and continues to attract long-term investor interest. Reports said FPI outflows, particularly from the equity market, stood at around US$ 4.9 billion since December 23. Meanwhile, discreet central bank intervention has been directed at curbing volatility rather than defending any specific currency level. Stop-loss triggers in the rupee were activated around Rs 91 per US dollar, leading to higher dollar demand and exacerbating the pressure on the currency.

Steep decline

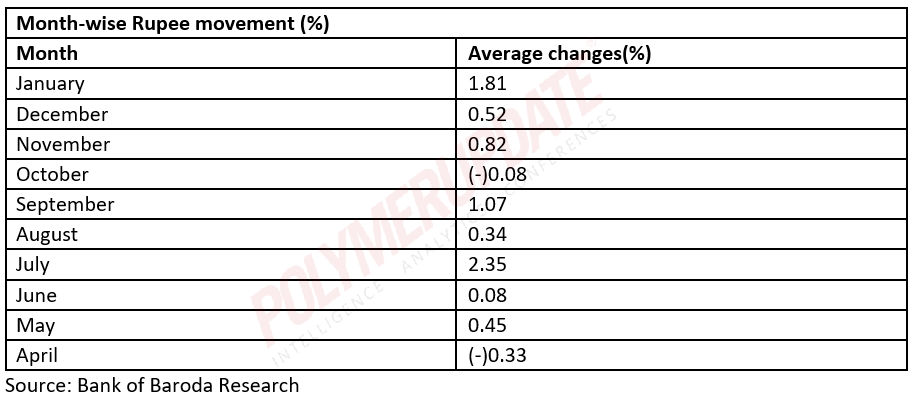

The rupee has depreciated by 7 percent, which is significantly higher than the 10-year average decline of 3.1 percent. In fact, the movement since December 31 stands at 1.81 percent. The market is awaiting signals from the Reserve Bank of India (RBI), which has been more active in the forwards market. Spot intervention at this juncture would be unusual, as any sale of dollars in the spot market would have an impact on liquidity. So far, the RBI has been using buy-sell swap operations to manage liquidity.

The rupee recorded appreciation in only two months since April 2025, while it depreciated in the remaining periods. On the positive side, the rupee’s movement offers an export advantage at a time when Indian exporters continue to face a 50 percent tariff in the United States. However, sustained depreciation also increases uncertainty for corporates and can prompt greater caution in decision-making. Annualised average daily volatility over the entire period stands at 4.9 percent.

Fundamentals, best represented by foreign exchange reserves, remain stable. Reserves have increased by US$ 18.9 billion since March 2025. However, within this, foreign currency assets declined by US$ 16.7 billion, while gold reserves rose by US$ 34.6 billion, clearly indicating a degree of diversification.

Widening trade deficit

India’s overall exports during April–December 2025 rose 4.33 percent to US$ 634.26 billion, compared with US$ 607.93 billion in the corresponding period of the previous fiscal. Merchandise exports during the period stood at US$ 330.29 billion, registering growth of 2.44 percent over US$ 322.41 billion in April–December 2024–25. Exports in December 2025 alone grew 1.87 percent to US$ 38.51 billion, reflecting sustained demand across key product segments.

This performance is particularly encouraging given the volatility in global trade flows and reflects the effectiveness of government initiatives aimed at boosting exports, including policy continuity, export facilitation measures, improved logistics, digitisation of trade processes, and targeted support for MSME exporters.

On the import side, India’s overall imports during April–December 2025 increased 4.95 percent to US$ 730.84 billion, compared with US$ 696.37 billion in the same period last year. Merchandise imports rose 5.90 percent to US$ 578.61 billion from US$ 546.36 billion in April–December 2024–25. Imports in December 2025 stood at US$ 63.55 billion, compared with US$ 58.43 billion a year earlier, resulting in a trade deficit of about US$ 25 billion for the month.

During April–December 2025, engineering goods, petroleum products, electronic goods, drugs and pharmaceuticals, gems and jewellery, chemicals, readymade garments, cotton textiles, handloom products, rice, and marine products emerged as the top export items. On the import side, key commodities included petroleum products, electronic goods, gold, machinery, transport equipment, non-ferrous metals, chemicals, coal, plastics, and iron and steel.

Outlook

Economists expect a correction toward the Rs 90–91 range over the next couple of sessions before the Rs 92 level is tested. However, it is difficult to assess at this point, as earlier estimates had placed Rs 88–89 as a fair value, with the possibility of a move toward Rs 90 only in an extreme scenario.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com