Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

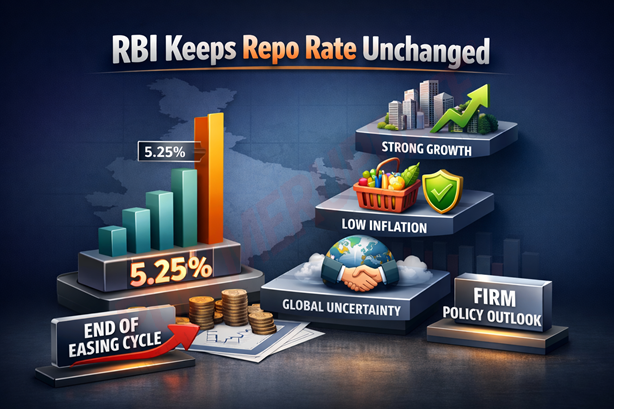

The Reserve Bank of India (RBI) has decided to keep the policy repo rate unchanged at 5.25 percent, signalling an end to the easing cycle amid expectations of strong gross domestic product (GDP) growth in the current year. The decision was taken unanimously at the six-member Monetary Policy Committee (MPC) meeting, chaired by Governor Sanjay Malhotra, held from February 4–6, 2026. Consequently, the standing deposit facility (SDF) rate under the liquidity adjustment facility (LAF) remains at 5 percent, while the marginal standing facility (MSF) rate and the Bank Rate stay at 5.5 percent. The MPC also decided to maintain its neutral policy stance. In its December policy, the MPC had cut the repo rate by 25 basis points to 5.25 percent, taking the cumulative rate cuts in 2025 to 125 basis points. The RBI has now urged public and private sector lenders to fully pass on the rate cuts to consumers.

Consequently, the standing deposit facility (SDF) rate under the liquidity adjustment facility (LAF) remains at 5 percent, while the marginal standing facility (MSF) rate and the Bank Rate stay at 5.5 percent. The MPC also decided to maintain its neutral policy stance. In its December policy, the MPC had cut the repo rate by 25 basis points to 5.25 percent, taking the cumulative rate cuts in 2025 to 125 basis points. The RBI has now urged public and private sector lenders to fully pass on the rate cuts to consumers.

RBI Governor Sanjay Malhotra said, “The MPC meeting was convened to deliberate and decide on the policy repo rate. After a detailed assessment of evolving macroeconomic conditions and the outlook, the Committee voted unanimously to keep the policy repo rate unchanged at 5.25 percent. We have witnessed momentous developments on the geopolitical and trade-tariff fronts so far this year. Amid heightened geopolitical tensions and elevated uncertainty, the Indian economy is in a good position, supported by strong growth and low inflation.”

External environment

The MPC noted that since the last policy meeting, external headwinds have intensified, although the successful completion of trade deals augurs well for the economic outlook. Global growth, supported by technology investments, accommodative financial conditions, and large-scale fiscal stimulus, is expected to be marginally stronger in 2026 than projected earlier. However, the confluence of escalating geopolitical frictions and rising trade tensions is unravelling the existing world economic order. Overall, the near-term domestic inflation and growth outlook remains positive. While inflation remains below the tolerance band, its outlook continues to be benign.

High-frequency indicators suggest a continuation of strong growth momentum in the October–December 2025 quarter and beyond. With the signing of a landmark trade deal with the European Union and a US trade agreement in sight, growth momentum is likely to be sustained over a longer period.

On the external financing side, gross foreign direct investment (FDI) into India increased at a robust pace during April–November 2025. Net FDI also rose as repatriations declined, despite an increase in outward FDI. India continues to remain an attractive destination for greenfield FDI projects. However, foreign portfolio investment (FPI) into India so far this year (April–February 3) recorded net outflows of US$ 5.8 billion. As of January 30, 2026, India’s foreign exchange reserves stood at US$ 723.8 billion, providing a robust merchandise import cover of over 11 months. Overall, India’s external sector remains resilient.

Retail inflation

Headline inflation during November–December 2025 remained below the tolerance band of the inflation target. Headline CPI inflation stayed low in November and December, even as it firmed up by one percentage point over these two months, driven largely by a lower rate of deflation in the food group. Excluding gold, core inflation remained stable at 2.6 percent in December.

The near-term outlook suggests that food supply prospects remain bright, supported by healthy kharif production, sufficient buffer stocks of foodgrains, favourable rabi sowing, and adequate reservoir levels. Core inflation, barring potential volatility induced by precious metal prices, is expected to remain range-bound. However, geopolitical uncertainty, coupled with volatility in energy prices and adverse weather events, poses upside risks to inflation.

In terms of the headline inflation trajectory, despite muted underlying momentum, unfavourable base effects stemming from the large decline in prices observed during January–March 2025 are expected to lead to an uptick in year-on-year inflation in the corresponding period this year. Considering all these factors, CPI inflation for the full financial year 2025–26 (April–March) is now projected at 2.1 percent, with the January–March 2026 quarter at 3.2 percent. CPI inflation for the April–June 2026 and July–September 2026 quarters is projected at 4.0 percent and 4.2 percent, respectively. Excluding precious metals, underlying inflationary pressures remain muted.

Inflation outcomes remain heterogeneous across jurisdictions, staying above target in most major advanced economies, prompting a divergence in monetary policy actions as central banks approach the end of their current easing cycles. Against an increasingly cautious global backdrop, bond market sentiment remains bearish, reflecting concerns over fiscal sustainability. However, equity markets, driven by technology stocks, remain upbeat.

Economic growth target

The Indian economy continues on a steadily improving trajectory, with real GDP poised to register significantly higher growth of 7.4 percent in 2025–26 compared with the previous year. Amid global headwinds, private consumption and fixed investment supported growth. Net external demand, however, remained a drag, with imports outpacing exports. On the supply side, growth in real gross value added (GVA), driven by a strong contribution from the services sector and a revival in manufacturing activity, is estimated at 7.3 percent in 2025–26.

Going forward, economic activity is expected to hold up well in 2026–27. Agricultural activity will be supported by healthy reservoir levels, robust rabi sowing, and improved crop vegetation conditions. Improving corporate sector performance and sustained momentum in the informal sector should boost manufacturing activity. Growth in the construction sector is expected to remain firm. The services sector should continue to be resilient, supported by strengthening domestic demand. Early results from IT firms suggest an improvement in business activity.

Several measures announced in the Union Budget are also expected to be conducive to growth. The recently concluded India–EU free trade agreement (FTA) and the prospective India–US trade deal, along with several other trade agreements, will support exports over the medium term. Services exports should remain resilient. However, spillovers from geopolitical tensions, volatility in international financial markets, and shifting trade patterns pose risks to the outlook. Taking all these factors into consideration, real GDP growth projections for the April–June 2026 and July–September 2026 quarters have been revised upwards to 6.9 percent and 7.0 percent, respectively.

Outlook

The near-term outlook suggests that food supply prospects remain bright, supported by healthy kharif production, sufficient buffer stocks of foodgrains, favourable rabi sowing, and adequate reservoir levels. Core inflation, barring potential volatility induced by precious metal prices, is expected to remain range-bound. However, geopolitical uncertainty, coupled with volatility in energy prices and adverse weather events, poses upside risks to inflation.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com