Despite weaker crude values, PVC prices marched higher in the Asian markets this week.

An industry source in Asia wishing to remain unidentified informed a Polymerupdate team member, "Prices gained sharply as major overseas suppliers raised their December shipment offers to Asia."

In China, PVC prices were assessed at the USD 770-790/mt CFR levels, an increase of USD (+30/mt) from the previous week.

In China, a Taiwanese producer has offered its PVC resin suspension grade at the USD 775/mt levels for shipment in December 2023.

In Southeast Asia, PVC prices were assessed at the USD 770-800/mt CFR levels, a week on week rise of USD (+30/mt).

In SEA, a producer from Taiwan has offered its PVC resin suspension grade at the USD 770/mt levels for shipment in December 2023.

In India, PVC prices were assessed at the USD 790-820/mt CFR levels, a gain of USD (+20/mt) from last week. A domestic industry source informed a Polymerupdate team member, “Reliance Industries Limited has raised PVC prices by Re.1/kg basic, with effect from November 20, 2023.”

In India, a major Taiwanese producer has offered its PVC resin suspension grade at the USD 800/mt levels for shipment in December 2023 (LC at Sight). This offer is higher by USD 30/mt from last month's offer. Meanwhile, a producer from South Korea has offered its PVC resin suspension grade at the USD 800-810/mt levels for shipment in December 2023 (LC at Sight).

In Pakistan, PVC prices were assessed at the USD 800-860/mt CFR levels, a week on week surge of USD (+30/+60/mt).

In Pakistan, an Indonesian producer has offered its PVC resin suspension grade at the USD 860/mt levels for shipment in December 2023.

In Sri Lanka, PVC prices were assessed at the USD 800-820/mt CFR levels, a hike of USD (+30/mt) from the previous week.

In Sri Lanka, overseas suppliers have offered their PVC resin suspension grades in the range of USD 800-820/mt levels for shipment in December 2023.

In Bangladesh, PVC prices were assessed at the USD 800-830/mt CFR levels, sharply up USD (+40/mt) week on week.

In Bangladesh, a Taiwanese producer has offered its PVC resin suspension grade at the USD 815/mt levels for shipment in December 2023. A producer from Indonesia has offered its PVC resin suspension grade at the USD 835/mt levels for shipment in December 2023.

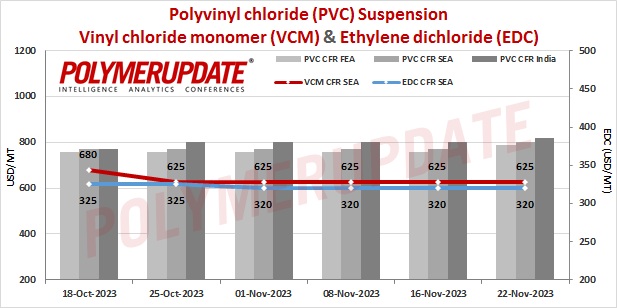

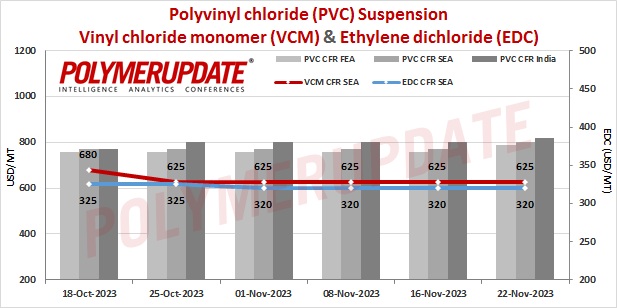

Feedstock EDC prices were assessed at the USD 275-285/mt CFR China levels, while CFR South East Asia EDC prices were assessed at the USD 310-320/mt levels, both steady from last week.

CFR South East Asia VCM prices were assessed at the USD 600-610/mt levels, while CFR China VCM prices were assessed at the USD 615-625/mt levels, both remaining flat week on week.

Meanwhile, feedstock ethylene prices on Tuesday were assessed at the USD 935-945/mt CFR South East Asia levels, while CFR North East Asia ethylene prices were assessed at the USD 855-865/mt levels, both unchanged from the previous week.

In plant news, Formosa Plastics Corporation (FPC) is likely to shut its Polyvinyl chloride (PVC) plants for a maintenance turnaround by end November 2023. Further details on the duration of the shutdown could not be ascertained. Located at Lin Yuan in Taiwan, the PVC plants have a production capacity of 236,000 mt/year.

In other plant news, Xinjiang Tianye has restarted its Polyvinyl chloride (PVC) unit early this week. The unit was shut for maintenance on November 3, 2023. Located in China, the carbide-based unit has a production capacity of 200,000 mt/year.