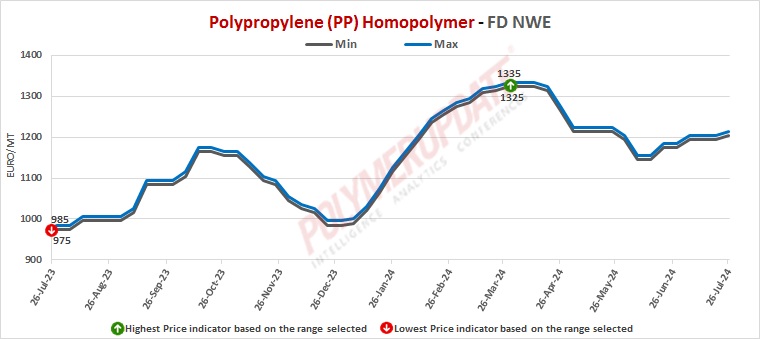

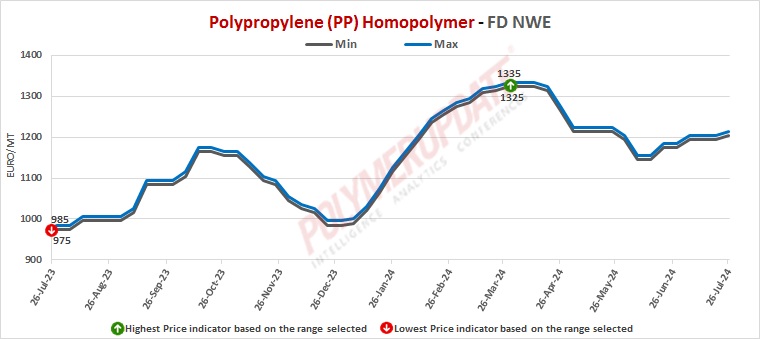

This week, PP spot prices trended upward in the European region.

In the spot markets, PP injection moulding grade prices were assessed at the Euro 1205-1215/mt FD North West Europe mark, while PP block copolymer grade prices were assessed at the Euro 1275-1285/mt FD Northwest Europe levels, both rising by Euro (+10/mt) from last week. An industry source in Europe informed a Polymerupdate team member, " The gains in European polypropylene spot prices arose from supply pressures as depleted stockpiles prompted buyers to replenish material, with some pre-buying seen in July prior to the onset of the summer holiday season when downstream demand is typically dull. Meanwhile, participants are reportedly exercising caution and making need-based purchases owing to a lack of clarity clouding market prospects in the short-term. Market participants stated that there has been a significant decline in imports while noting that there has been a rise in the lower end of market pricing. There was a paucity of import shipments, with key Asian and Middle Eastern suppliers not keen on offering material owing to steep hikes in freight rates combined with protracted transit times. Prevailing global supply chain impediments have led to material imported from these regions being rendered uncompetitive, driving local suppliers to seek price hikes. Plant overhauls scheduled in August and September has also prompted sellers to push for price rises although the rise till now has been restrained in July. Meanwhile, producers have been running their plants at curtailed rates to calibrate their production with weak demand."

The source reported, ”Most market players foresee the effect of limited material availability on market fundamentals to become profoundly noticeable in September, with buying activity anticipated to normalize following the summer holiday. The overall buying interest in the derivative markets did not show any signs of picking up, as demand for key end-user applications like appliances and automotive, continues to remain sluggish.”

In the contract markets, PP injection moulding grade prices were assessed at the Euro 1510-1515/mt FD NWE Germany and FD NWE France levels, both steady week on week. PP injection moulding grade prices were assessed at the Euro 1500-1505/mt FD NWE Italy levels, stable from the previous week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1270-1275/mt FD NWE UK levels, unchanged from last week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1570-1575/mt FD NWE Germany and FD NWE France levels, both remaining flat week on week. PP block copolymer grade prices were assessed at the Euro 1560-1565/mt FD NWE Italy levels, unchanged from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1320-1325/mt FD NWE UK levels, left unchanged from the previous week.

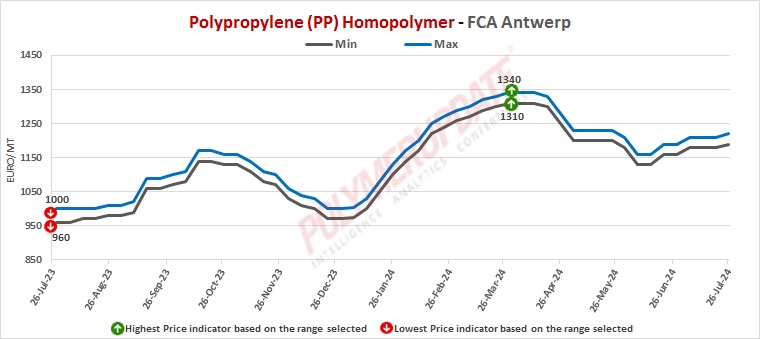

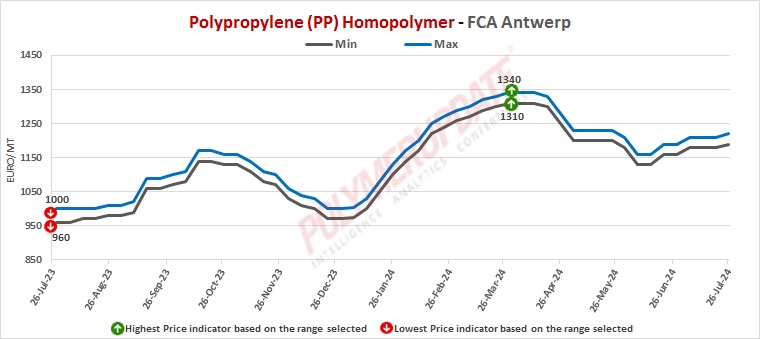

FCA Antwerp PP homopolymer prices were assessed at the Euro 1190-1220/mt level while FCA Antwerp PP copolymer prices were assessed at the Euro 1260-1290/mt levels, both gaining by Euro (+10/mt) week on week.

Upstream propylene spot prices on Thursday were assessed at the Euro 935-945/mt FD Northwest Europe levels, up Euro (+15/mt) from last week.

European propylene feedstock contract price for July 2024 settled at the Euro 1105/MT FD North West Europe levels. This price represents a rollover from its June 2024 settlement levels.