This week, LLDPE spot prices trended sharply higher in the European region.

A European industry source while requesting to remain unidentified informed a Polymerupdate team member, "European Linear low density polyethylene (LLDPE) spot market prices gained on the back of supply constraints, with availability of LLDPE grades declining across Europe. Reduced domestic output coupled with a decrease in import shipments from the US and Asia could be cited as key factors contributing to a tight supply situation across Europe."

The source informed, "Global purchase prices are trending sharply up on the back of excessively higher freight rates. While import cargoes are likely to arrive towards September end, their quantum is expected to be lower than previously shipped volumes. The overall trading momentum was sluggish, as most market players were unlikely to return from their holiday till the end of the month."

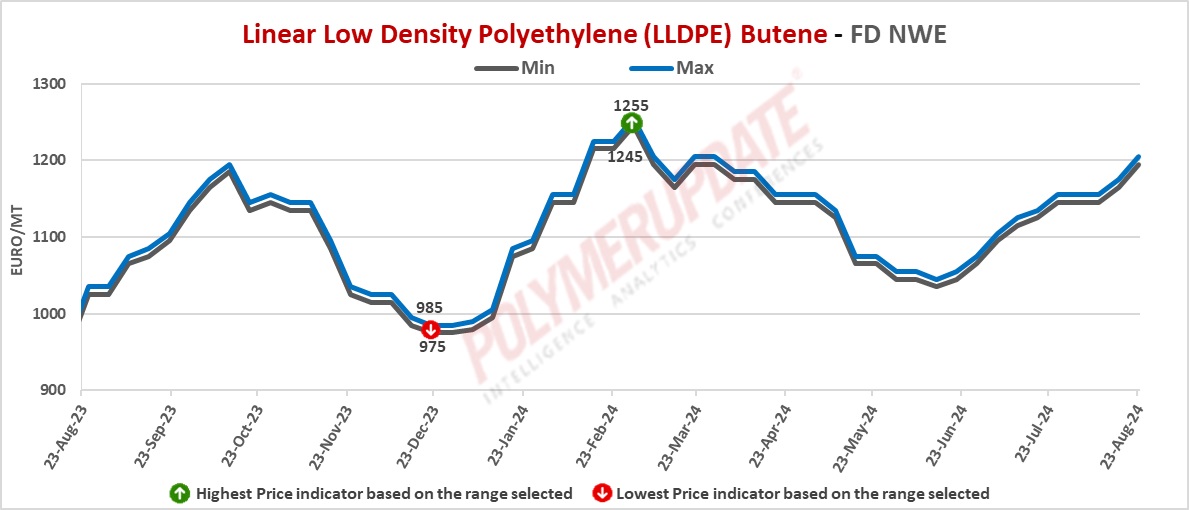

In the spot markets, LLDPE prices were assessed at the Euro 1195-1205/mt FD Northwest Europe levels, a sharp rise of Euro (+30/mt) from the previous week.

In the contract markets, LLDPE grade prices were assessed at the Euro 1600-1605/mt FD NWE Germany and FD NWE France levels, both rolled over from last week. LLDPE grade prices were assessed at the Euro 1600-1605/mt FD NWE Italy levels, flat from the previous week. Meanwhile, LLDPE grade prices were assessed at the GBP 1360-1365/mt FD NWE UK levels, down GBP (-10/mt) from the previous week.

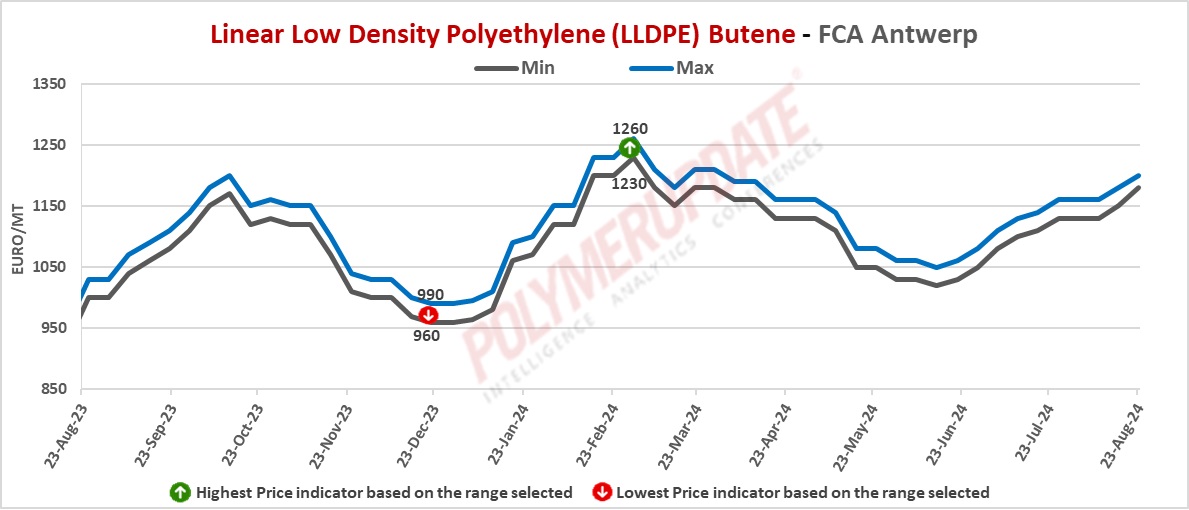

FCA Antwerp LLDPE film prices were assessed at the Euro 1180-1210/mt levels, an increase of Euro (+30/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 870-880/mt FD North West Europe levels, a surge of Euro (+60/mt) from the previous week.

European ethylene feedstock contract price for August 2024 settled at the Euro 1240/MT FD North West Europe levels. This price represents a rise of Euro (+20/mt) from its July 2024 settlement levels.