This week, LLDPE spot prices down adjusted in the European region.

An industry source in Europe informed a Polymerupdate team member, "European spot LLDPE prices continued to decline, with tepid demand sentiments proving to be a drag on the market. The market has been seesawing between weak demand and ample supplies. Participants have been exercising caution amid persistent economic challenges, with no pick up seen in post- summer holiday demand. Current weak market sentiments have pushed most sellers to lower their September pricing targets, with buyers prioritizing the restocking of immediate requirements."

The source added, "Sharply oscillating feedstock price movements have kept buyers on tenterhooks with many preferring to adopt a wait and watch approach. In some cases, buyers have already purchased cargoes required for September in July-August. Most buyers have been witnessing a systemic decline across value chains amid a prevailing bleakness in Europe’s industrial outlook."

Meanwhile, buyers in the contract market were seen exercising caution while tracking developments in market fundamentals. Weak demand prompted producers to make corrections to price increases announced early in the month.

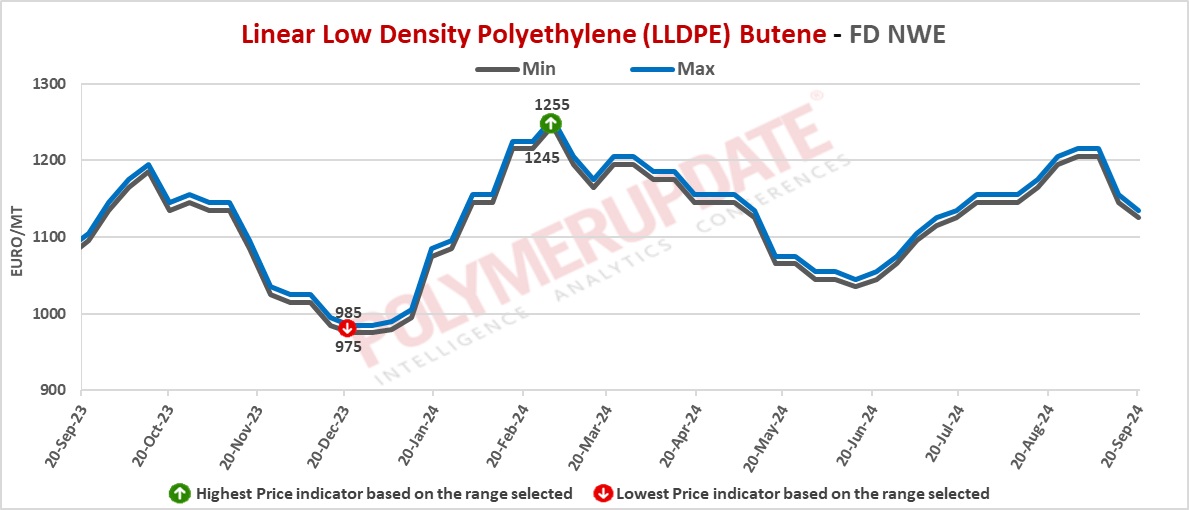

In the spot markets, LLDPE prices were assessed at the Euro 1125-1135/mt FD Northwest Europe levels, a week on week decline of Euro (-20/mt).

In the contract markets, LLDPE grade prices were assessed at the Euro 1620-1625/mt FD NWE Germany and FD NWE France levels, both rolled over from last week. LLDPE grade prices were assessed at the Euro 1620-1625/mt FD NWE Italy levels, constant week on week. Meanwhile, LLDPE grade prices were assessed at the GBP 1365-1370/mt FD NWE UK levels, a fall of GBP (-5/mt) from the previous week.

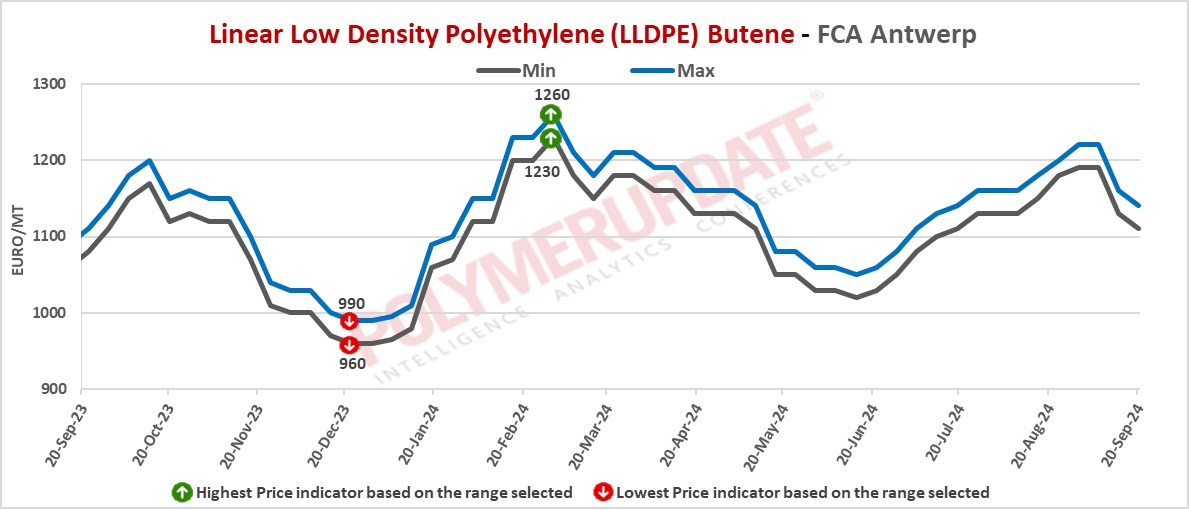

FCA Antwerp LLDPE film prices were assessed at the Euro 1110-1140/mt levels, a week on week decrease of Euro (-20/mt).

Ethylene spot prices on Thursday were assessed at the Euro 910-920/mt FD North West Europe levels, lower by Euro (-15/mt) from last week.

European ethylene feedstock contract price for September 2024 settled at the Euro 1215/MT FD North West Europe levels. This price represents a decline of Euro (-25/mt) from its August 2024 settlement levels.