This week, PP prices journeyed southward in the European region.

An industry source in Europe informed a Polymerupdate team member, "European polypropylene markets experienced steep price falls in the week amid a bearish market outlook stemming from consistently weak demand and surplus avails in the domestic and import sectors. PP prices have trended downward in October, in spite of persisting feedstock crude oil pricing volatilities. Buyer interest has been declining consistently in the week with players opting to steer clear of holding excess inventories. Additionally, supply reportedly increased during the week, as availability continued to rise from the conclusion of previous production disruptions and better import availability.”

The source added, "In spite of relatively ample offers, buying sentiment in Europe was not buoyed owing to unpredictable lead times and anticipated shipment inflows in December and January. Prices fell sharply in both homopolymer and copolymer segments owing to weak demand and surplus supplies. Buyers are focused on making need-based purchases, while producers are concentrating on running their plants at lower rates, to align production rates with weak demand projections.”

The source further stated, “Market players noted some variance in buyers’ appetite from different derivative sectors. Downstream segments like geotextiles and automotive continued to experience weakness, limiting the demand for PP. Market activity was largely muted in the week with participants attending a trade fair for plastics processing in Germany."

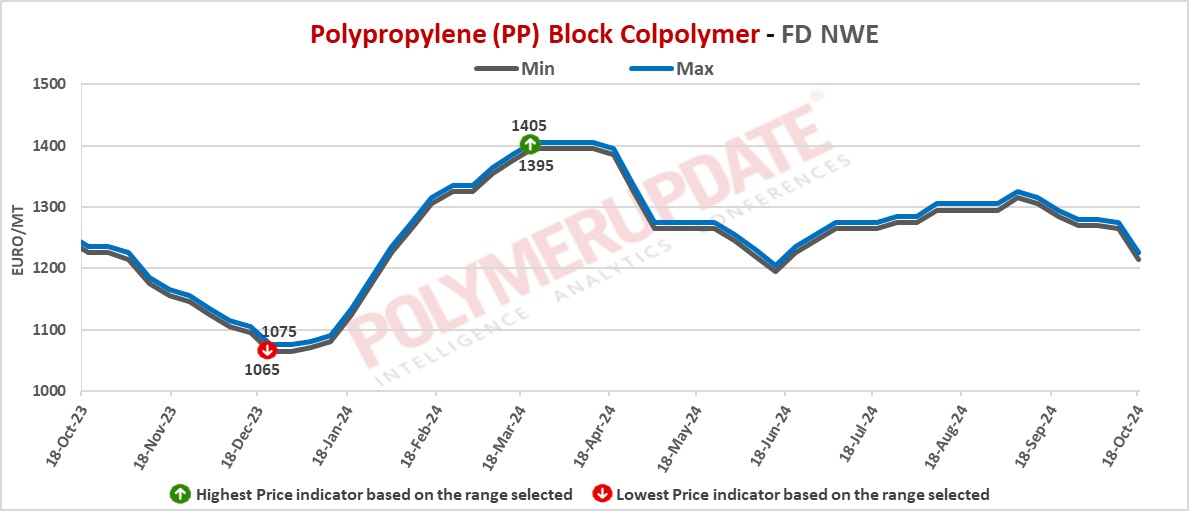

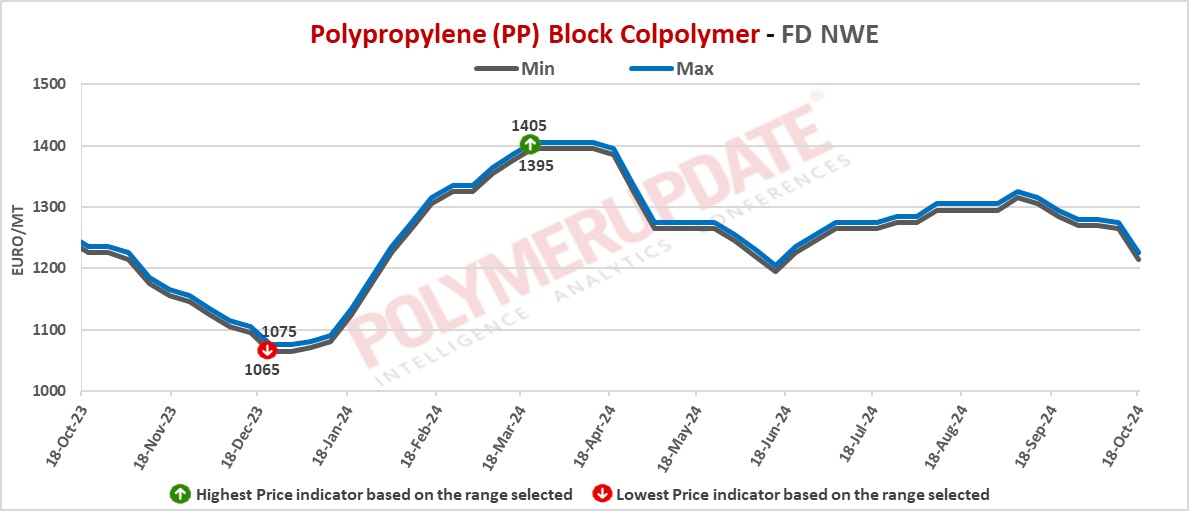

In the spot markets, PP injection moulding grade prices were assessed at the Euro 1145-1155/mt FD North West Europe mark, a sharp week on week drop of Euro (-40/mt). Meanwhile, PP block copolymer grade prices were assessed at the Euro 1215-1225/mt FD Northwest Europe levels, tumble by Euro (-50/mt) from last week.

Meanwhile, in the contract markets, PP injection moulding grade prices were assessed at the Euro 1480-1485/mt FD NWE Germany and FD NWE France levels, both declining by Euro (-40/mt) week on week. PP injection moulding grade prices were assessed at the Euro 1470-1475/mt FD NWE Italy levels, lower by Euro (-40/mt) from last week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1235-1240/mt FD NWE UK levels, a decline of GBP (-35/mt) from the previous week.

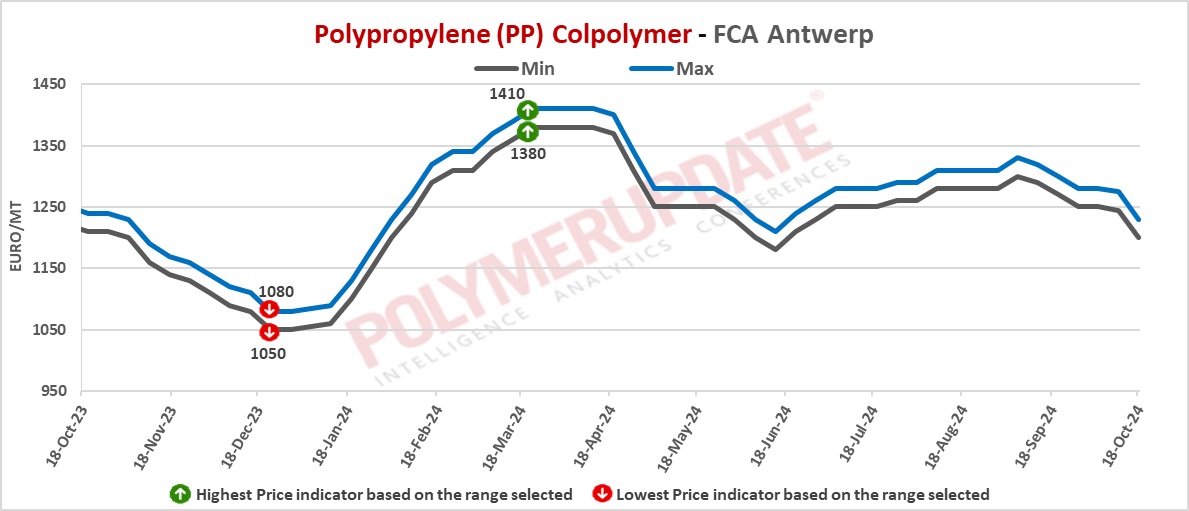

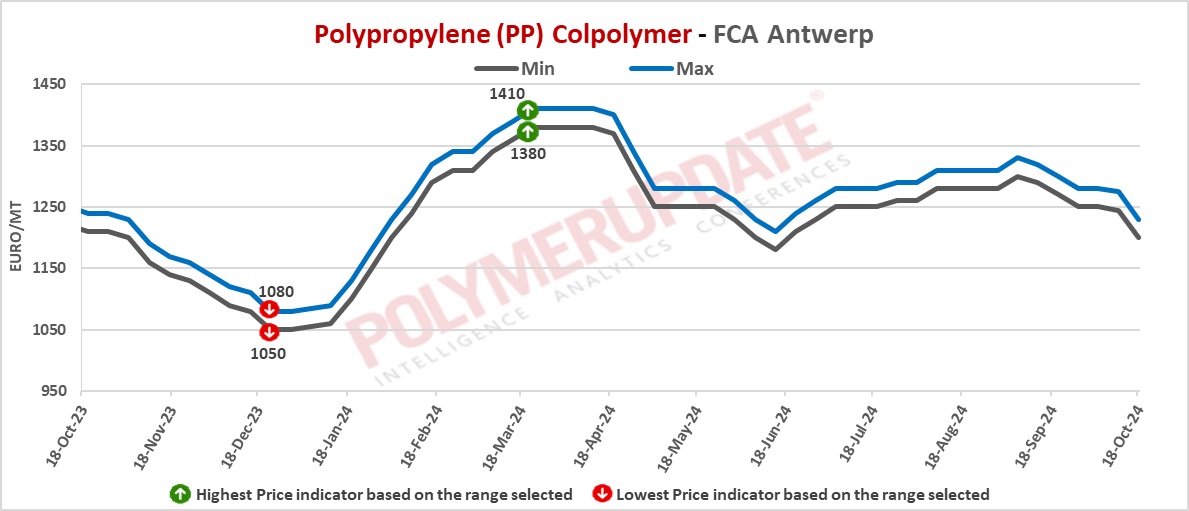

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1550-1555/mt FD NWE Germany and FD NWE France levels, both sharply lower by Euro (-40/mt) week on week. PP block copolymer grade prices were assessed at the Euro 1540-1545/mt FD NWE Italy levels, a sharp decrease of Euro (-40/mt) from last week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1295-1300/mt FD NWE UK levels, lower by Euro (-35/mt) week on week.

FCA Antwerp PP homopolymer prices were assessed at the Euro 1130-1160/mt level, a sharp fall of Euro (-40/mt) from the previous week, while FCA Antwerp PP copolymer prices were assessed at the Euro 1200-1230/mt levels, a steep week on week drop of Euro (-45/mt).

Upstream propylene spot prices on Thursday were assessed at the Euro 815-825/mt FD Northwest Europe levels, unchanged from last week.

European propylene feedstock contract price for October 2024 settled at the Euro 1060/MT FD North West Europe levels. This price represents a decline of Euro (-35/mt) from its September 2024 settlement levels.