This week, LLDPE spot prices decreased, while contract prices quoted flat in the European region.

An industry source in Europe informed a Polymerupdate team member, "Prices trended lower in line with the current seasonal lull, as evidenced by tepid demand and a supply glut situation. Market participants remained primarily focused on holding minimal inventories or destocking material with the year drawing to a close. Spot pricing was significantly affected by competitive import offers, with domestic quotes considerably underbid by import prices. A noticeable price gap has been observed between domestic and imported material, with no additional discounts being offered by overseas and local suppliers. Meanwhile, buyers wanting to make bulk purchases are able to procure import material at attractive prices with U.S. suppliers offloading inventories to steer clear of year-end tax liabilities on unsold cargoes."

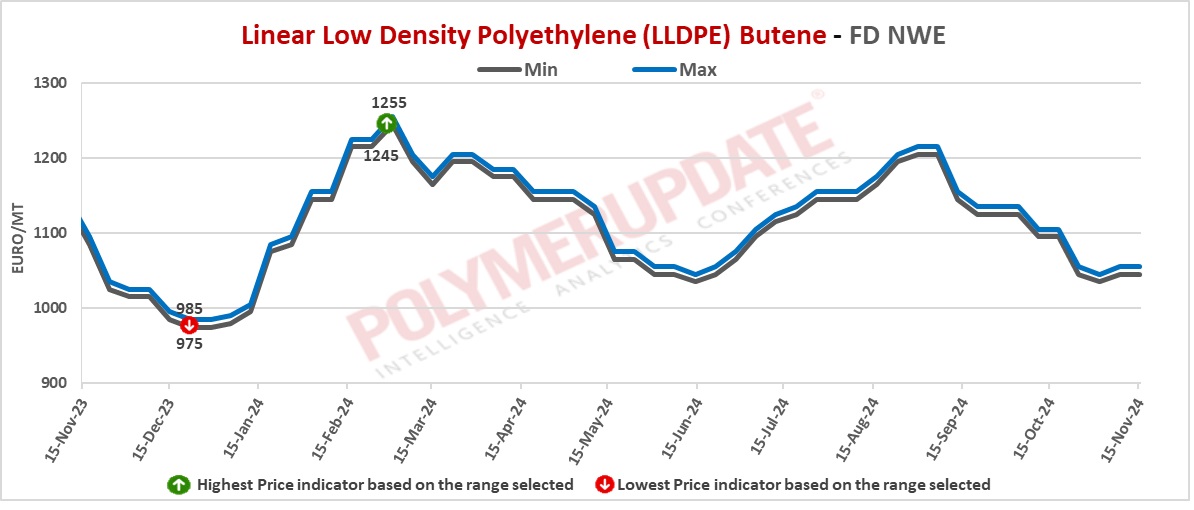

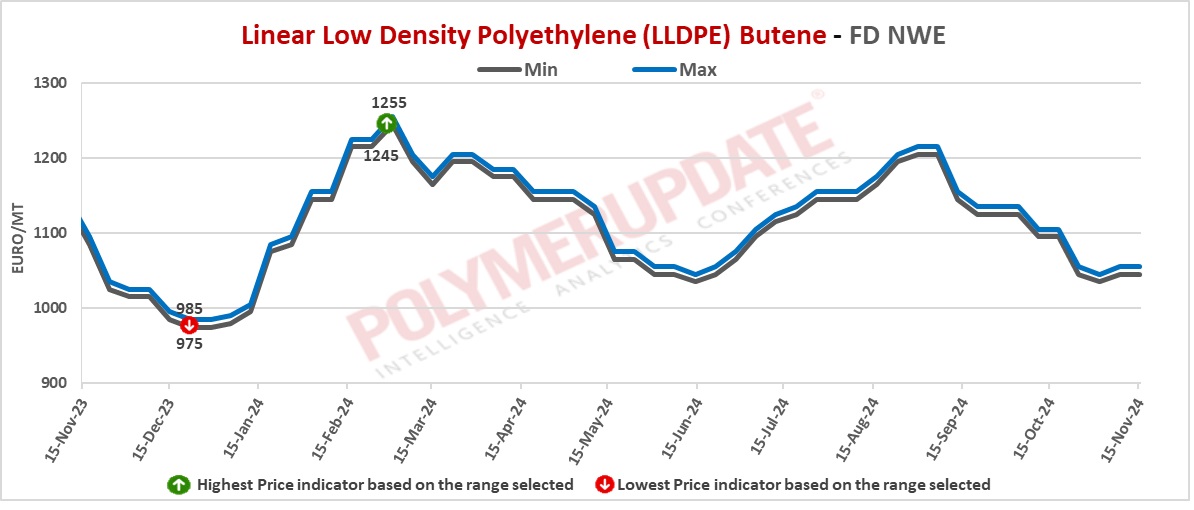

In the spot markets, LLDPE prices were assessed at the Euro 1035-1045/mt FD Northwest Europe levels, a fall of Euro (-10/mt) from the previous week.

In the contract markets, LLDPE grade prices were assessed at the Euro 1600-1605/mt FD NWE Germany and FD NWE France levels, both steady from last week. LLDPE grade prices were assessed at the Euro 1600-1605/mt FD NWE Italy levels, stable week on week. Meanwhile, LLDPE grade prices were assessed at the GBP 1330-1335/mt FD NWE UK levels, unchanged from the previous week.

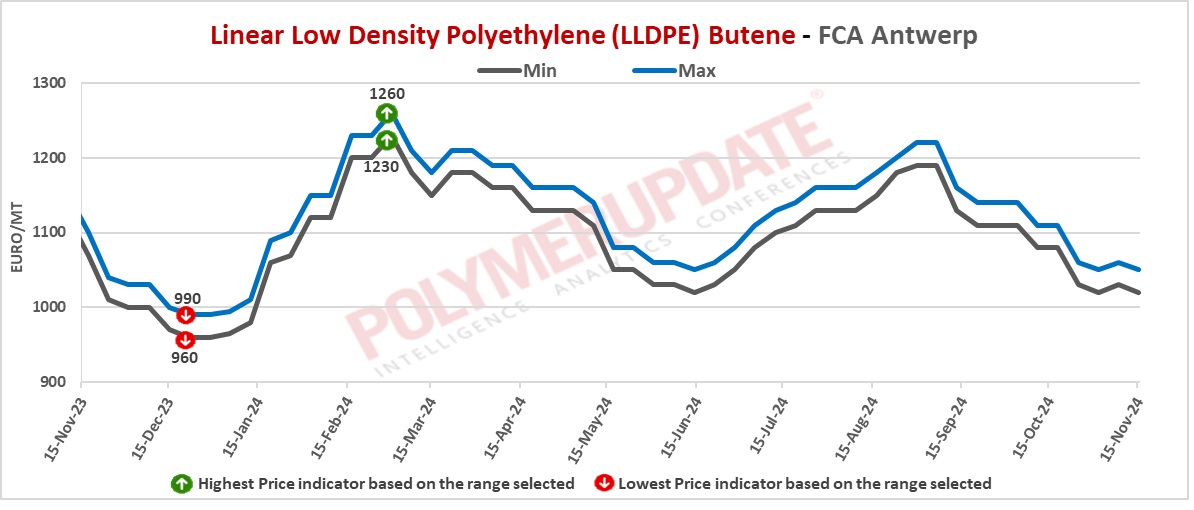

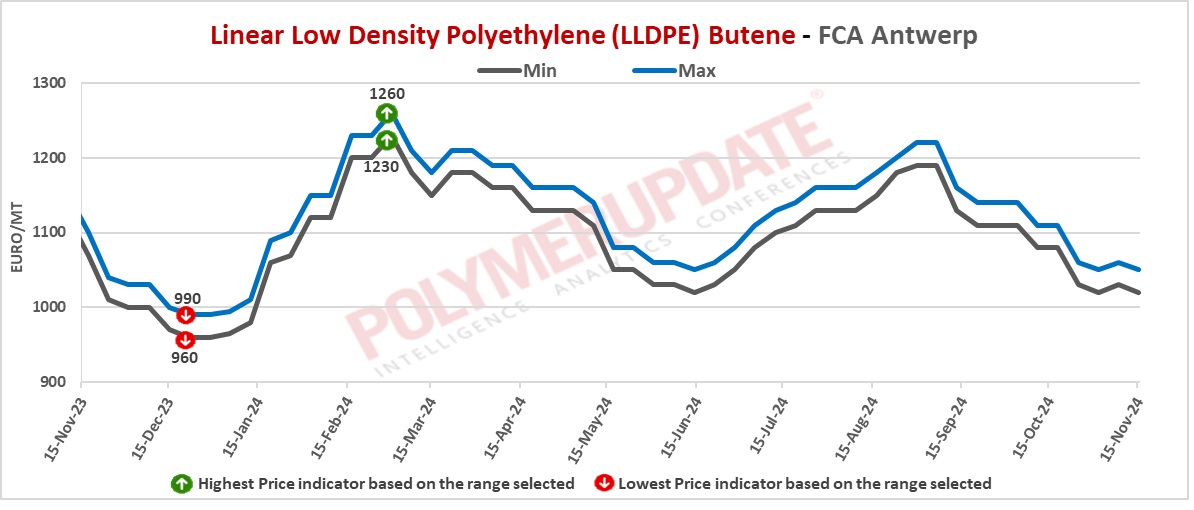

FCA Antwerp LLDPE film prices were assessed at the Euro 1020-1050/mt levels, down Euro (-10/mt) week on week.

Ethylene spot prices on Thursday were assessed at the Euro 790-800/mt FD North West Europe levels, a gain of Euro (+5/mt) from last week.

European ethylene feedstock contract price for November 2024 settled at the Euro 1212.50/MT FD North West Europe levels. This price represents a sharp gain of Euro (+30/mt) from its October 2024 settlement levels.