This week, PP spot prices journeyed southward in the European region.

An industry source in Europe informed a Polymerupdate team member, "The European polypropylene market exhibited a muted outlook with activity decelerating ahead of the Christmas holidays in the region. Although sentiment across key downstream sectors like construction and automotive remained bearish, the market narrative was dominated by the seasonal lull, as evidenced by general illiquidity conditions in the market with most market players winding down activities for the year. A decline in transaction activity led to limited pricing movements through the week. Meanwhile, prices have been mostly steady in the contractual market from November end, with producers and converters corroborating the lack of difference in price levels from the previous month."

The source informed, "Market conditions vastly diverged for varied PP grades. Raffia and BOPP grades were heard to be surplus, with offers for the aforesaid grades surfacing at competitive rates as sellers were keen on offloading inventories ahead of the start of the holiday season. Contrastingly, supplies of homopolymer and copolymer products were comparatively tight, though reports of some supply disruptions not impacting access to these materials."

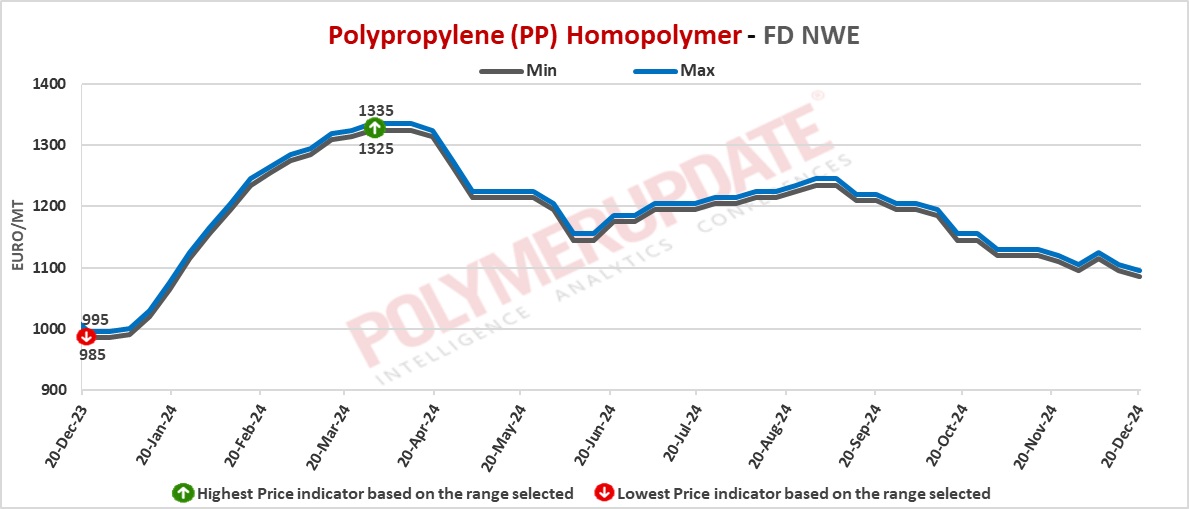

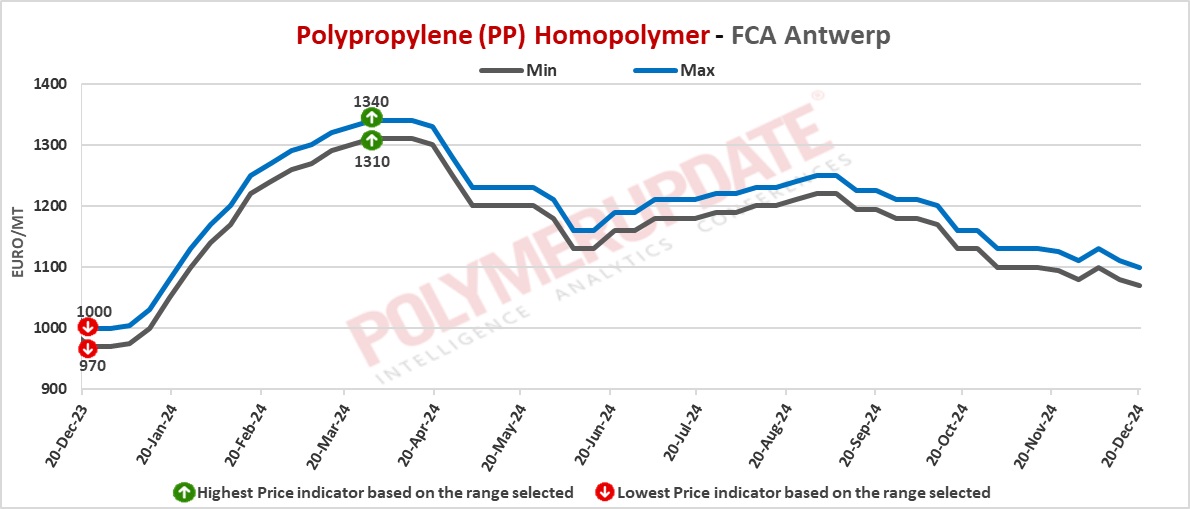

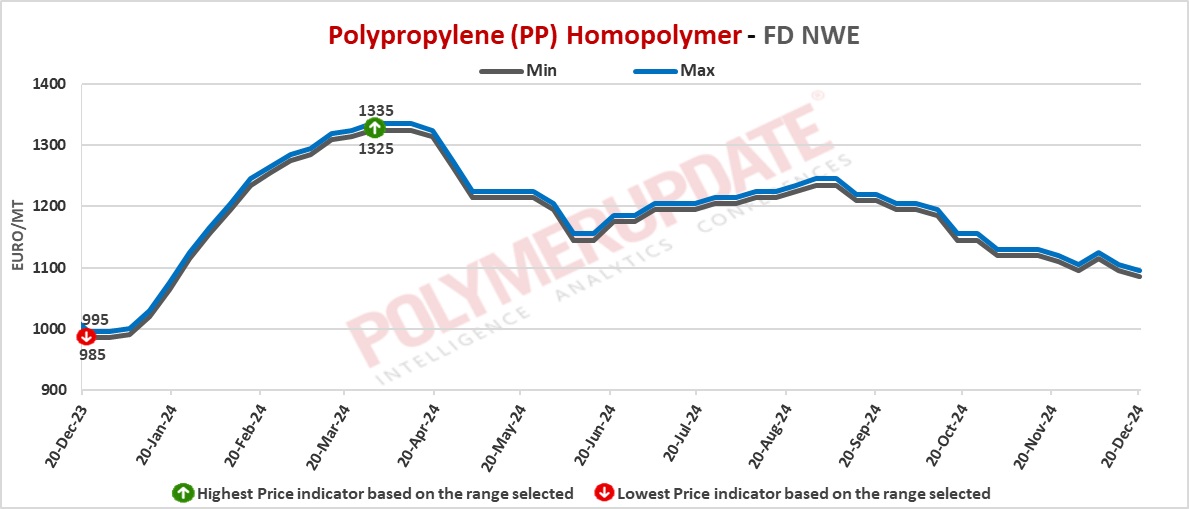

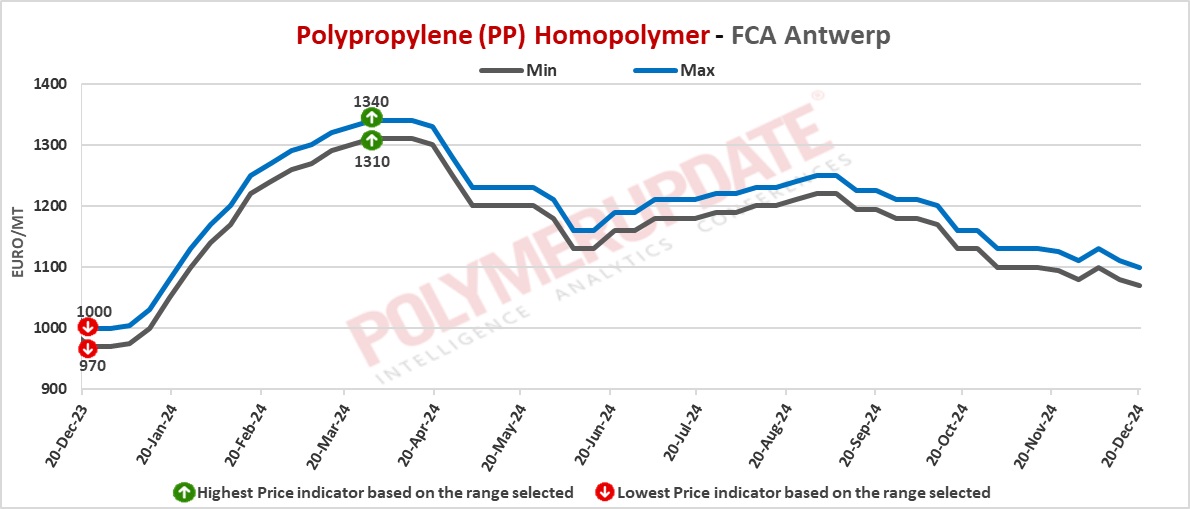

In the spot markets, PP injection moulding grade prices were assessed at the Euro 1085-1095/mt FD North West Europe mark, a drop of Euro (-10/mt) from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the Euro 1155-1165/mt FD Northwest Europe levels, a decline of Euro (-30/mt) from last week.

Meanwhile in the contract markets, PP injection moulding grade prices were assessed at the Euro 1480-1485/mt FD NWE Germany and FD NWE France levels, both unchanged week on week. PP injection moulding grade prices were assessed at the Euro 1470-1475/mt FD NWE Italy levels, stable from last week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1220-1225/mt FD NWE UK levels, up GBP (+5/mt) from the previous week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1550-1555/mt FD NWE Germany and FD NWE France levels, both rolled over week on week. PP block copolymer grade prices were assessed at the Euro 1540-1545/mt FD NWE Italy levels, left unchanged from last week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1280-1285/mt FD NWE UK levels, a week on week rise of GBP (+5/mt).

FCA Antwerp PP homopolymer prices were assessed at the Euro 1070-1100/mt level, a drop of Euro (-10/mt) week on week. Meanwhile, FCA Antwerp PP copolymer prices were assessed at the Euro 1140-1170/mt levels, lower by Euro (-30/mt) from the previous week.

Upstream propylene spot prices on Thursday were assessed at the Euro 820-830/mt FD Northwest Europe levels, a gain of Euro (+20/mt) from last week.

European Propylene contract price for December 2024 settled at the Euro 1075/MT FD North West Europe levels. This price represents a drop of Euro (-10/mt) from its November 2024 settlement levels.