This week, PP prices quoted flat in the European region.

An industry source in Europe informed a Polymerupdate team member, "European polypropylene market spot and contract prices remained mostly unchanged, with hardly any pickup seen in market activity after the winter holidays. The general demand sentiment remained tepid with no rebound seen in restocking activity along expected lines following significant offloading towards the end of 2024. Reports of minor production glitches surfacing in December and early January failed to exert any major impact on market sentiment, with observers pointing to sufficient material supplies and weak demand among downstream users."

The source added, "There has been significant upswing in import activity, stemming from a rise in offers from South Korea, Vietnam, and China. Healthy import cargo inflows from the Far East coupled with reduced freight rates have resulted in a moderate rally in imports. Nevertheless, sources have pointed to imbalanced demand-supply dynamics in the region with supply outpacing demand. Purchase activities have broadly been guided by ample import supplies, with buyers veering towards satiating their requirements through spot buying on account of wider import alternatives being available. As market momentum remained largely muted through the week, spot prices for both homopolymer and copolymer material remained flat. Furthermore, no shift has been seen across contract prices, following reports of limited settlements after the year-end holiday."

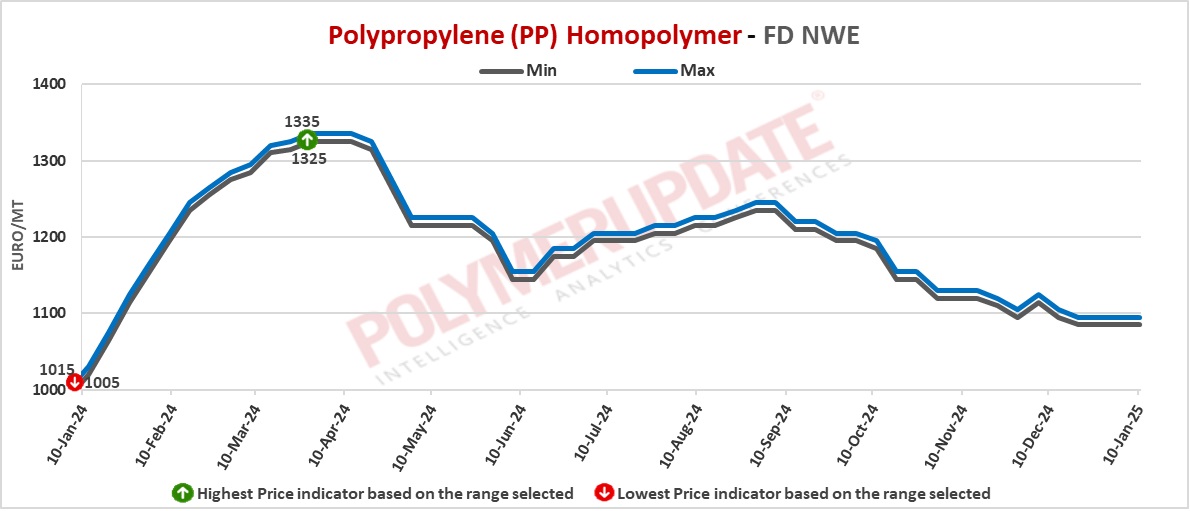

In the spot markets, PP injection moulding grade prices were assessed at the Euro 1085-1095/mt FD North West Europe mark while PP block copolymer grade prices were assessed at the Euro 1155-1165/mt FD Northwest Europe levels, both steady from last week.

Meanwhile in the contract markets, PP injection moulding grade prices were assessed at the Euro 1480-1485/mt FD NWE Germany and FD NWE France levels, both unchanged week on week. PP injection moulding grade prices were assessed at the Euro 1470-1475/mt FD NWE Italy levels, stable from last week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1235-1240/mt FD NWE UK levels, a gain of GBP (+15/mt) from the previous week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1550-1555/mt FD NWE Germany and FD NWE France levels, both left unchanged week on week. PP block copolymer grade prices were assessed at the Euro 1540-1545/mt FD NWE Italy levels, rolled over from last week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1290-1295/mt FD NWE UK levels, week on week up GBP (+10/mt).

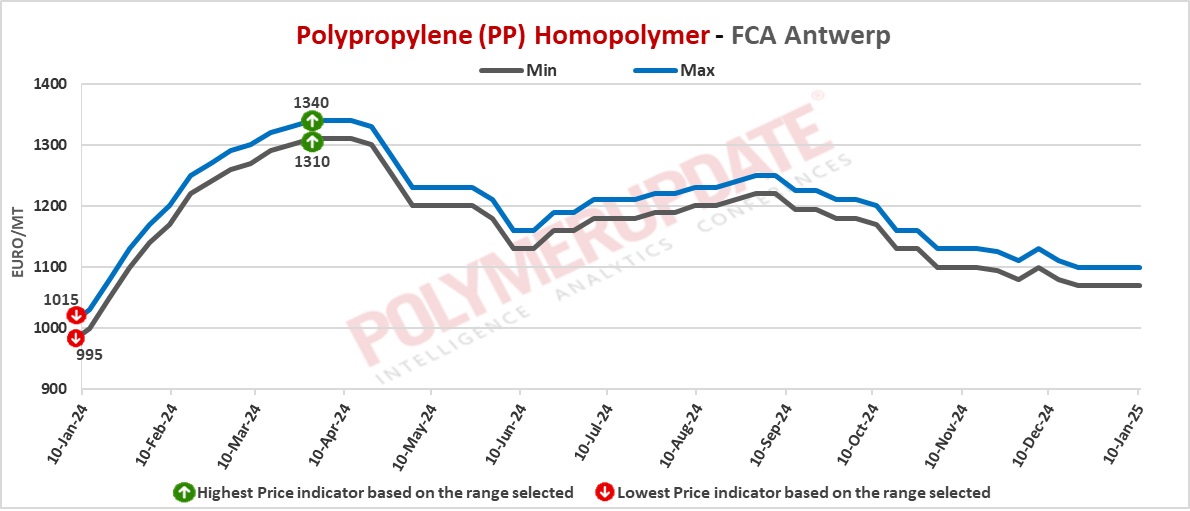

FCA Antwerp PP homopolymer prices were assessed at the Euro 1070-1100/mt level while FCA Antwerp PP copolymer prices were assessed at the Euro 1140-1170/mt levels, both remaining unchanged from the previous week.

Upstream propylene spot prices on Thursday were assessed at the Euro 850-860/mt FD Northwest Europe levels, an increase of Euro (+25/mt) from last week.

European propylene contract price for January 2025 settled at the Euro 1075/MT FD North West Europe levels. This price represents a rollover from its December 2024 settlement levels.