Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

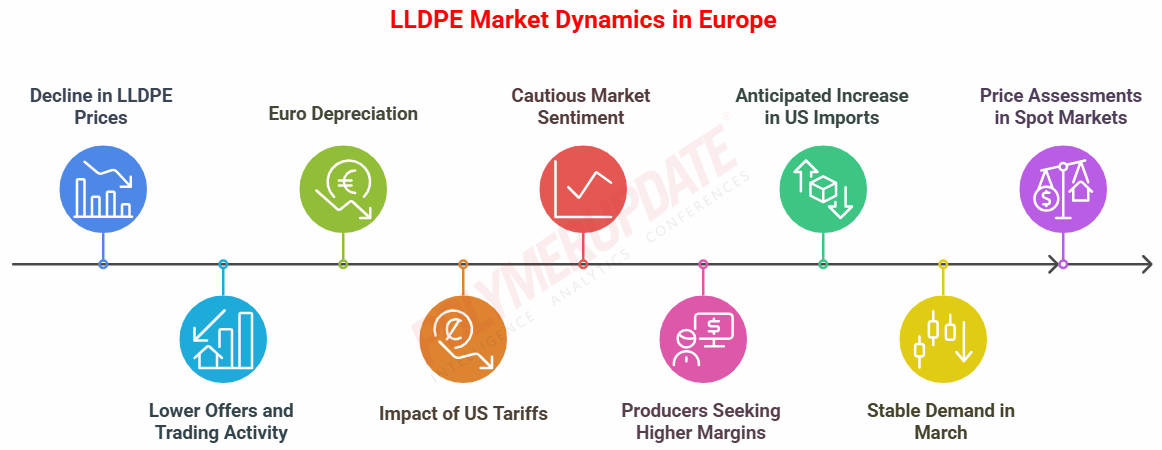

This week, LLDPE spot prices declined in the European region.

An industry source in Europe informed a Polymerupdate team member, "LLDPE spot prices have declined due to lower offers and subdued trading activity. The depreciation of the euro against the US dollar has influenced product costs within the regional market. Some sources in the spot market reported the availability of certain import materials throughout the week, specifically for various LLDPE grades. The LLDPE C4 market observed import offers of US materials aligning closely with domestic prices.”

In the European polyethylene markets, demand remained weak during the week, resulting in limited trading activity. Buyer interest diminished in the final days of February and into March, as converters adopted a cautious approach, showing little need for additional spot volumes. As March commenced, market activity was slow to gain momentum, with participants returning on first week of March and exhibiting no urgency to acquire materials.

Recent political developments may further impact demand. This week, US President Donald Trump targeted the EU, announcing intentions to impose 25% tariffs on all imports from the bloc, particularly affecting the automotive sector. The implementation date for these tariffs is still uncertain, and there remains a possibility of a trade agreement being reached in the interim. However, forecasts suggest that if these tariffs are fully enacted, they could trigger an economic shock and adversely affect various European manufacturing value chains. Consequently, many market participants are choosing to maintain lean operations and avoid taking on extended stock positions.

The source added, “Market sentiment continues to be cautious, with buyers primarily limiting their procurement activities to essential needs, despite some instances of building buffer stocks. This cautious approach is influenced by an uncertain economic outlook, prevailing headwinds, and diminished consumer confidence, which have collectively discouraged most market participants from engaging in riskier ventures. In response, producers are aiming for higher profit margins by seeking LLDPE price increases. They are attempting to capitalize on the relatively tight supply situation, exacerbated by reduced imports from the United States and a higher price floor for these shipments; however, the feasibility of achieving these price increases will become clearer in the upcoming weeks. The inventory levels among sellers vary significantly, with certain producers experiencing critically low stock levels and limited capacity in their order books.”

Although numerous LLDPE plants have ramped up production to address heightened demand in February, most producers remain cautious about further increasing their run rates, being wary of potential supply surpluses. An uptick in imports from the United States is anticipated in the coming weeks as the effects of a prior winter freeze diminish. Additionally, there is a possibility of a lower price floor for imports from both the United States and the Middle East, driven by an increase in LLDPE supply and declining feedstock costs in those regions. Another area of uncertainty is whether LLDPE demand will maintain stability in March. Demand appeared to cool in the latter half of February as feedstock prices stabilized, leading to speculation that buyers may have postponed further procurement until March. This could potentially sustain demand and provide some leverage to sellers. However, some buyers may have adequately restocked in February and could reduce their procurement activities. Demand may further decline in April with many converters winding down operations for the Easter holiday.

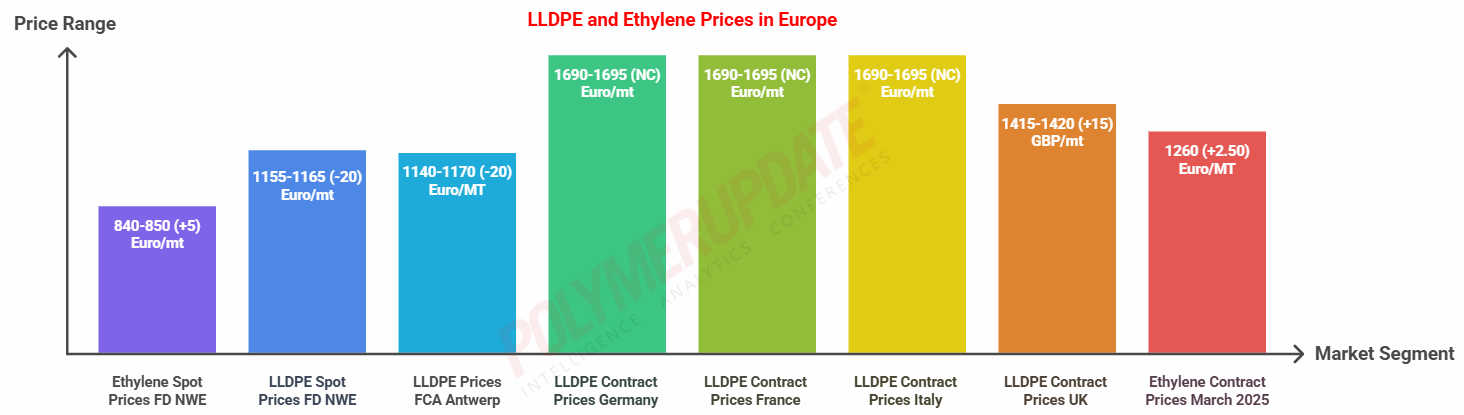

In the spot markets, LLDPE prices were assessed at the Euro 1155-1165/mt FD Northwest Europe levels, a drop of Euro (-20/mt) from last week.

In the contract markets, LLDPE grade prices were assessed at the Euro 1690-1695/mt FD NWE Germany and FD NWE France levels, both unchanged week on week. LLDPE grade prices were assessed at the Euro 1690-1695/mt FD NWE Italy levels, stable from last week. Meanwhile, LLDPE grade prices were assessed at the GBP 1415-1420/mt FD NWE UK levels, a gain of GBP (+15/mt) from the previous week.

FCA Antwerp LLDPE film prices were assessed at the Euro 1140-1170/mt levels, a fall of Euro (-20/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 840-850/mt FD North West Europe levels, marginally higher by Euro (+5/mt) from the previous week.

European ethylene contract price for March 2025 settled at the Euro 1260/MT FD North West Europe levels. This price represents a marginal gain of Euro 2.50/MT from its February 2025 settlement levels.