Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, LLDPE spot prices eased in the European region.

An industry source in Europe informed a Polymerupdate team member, "European LLDPE spot price has decreased due to a lack of robust market activity, while negotiations for April contracts remain uncertain. The supply of LLDPE in Europe is significantly reliant on imports, mainly from the United States. However, in the absence of clear information, buyers are expected to resist any price hikes. This week, stakeholders in the European polyethylene (PE) market adopted a cautious approach, given the unclear supply forecast for April and the second quarter. Central to the current scenario is the potential introduction of EU tariffs on LLDPE imports from the US. Ongoing discussions suggest that these tariffs may be implemented as early as April 13, with no indications of a reduction in trade tensions. Furthermore, the EU is contemplating broadening its proposed tariffs to encompass the US services sector in retaliation for the 25% tariffs imposed by the US on all automotive imports, indicating a possible escalation in trade conflicts in the near future.” The source added, “With naphtha prices decreasing by $44.56/mt in March and a drop in the April monthly contract price (MCP) for feedstock ethylene, European manufacturers are contemplating keeping PE contract prices stable in April. Nonetheless, there are concerns about a potential supply shortage for certain LLDPE grades in April and May due to the cancellation of new shipments from the US. This situation, coupled with the possible introduction of tariffs, may lead some sellers to advocate for price increases. Nevertheless, global trade patterns are anticipated to adjust after the second quarter, with Europe likely to see an influx of LLDPE imports from other regions, particularly the Middle East and Asia-Pacific. Given that shipping times from these areas are longer than from the US, European producers may have a pricing leverage for a prolonged period, especially if supply remains constrained.”

The source added, “With naphtha prices decreasing by $44.56/mt in March and a drop in the April monthly contract price (MCP) for feedstock ethylene, European manufacturers are contemplating keeping PE contract prices stable in April. Nonetheless, there are concerns about a potential supply shortage for certain LLDPE grades in April and May due to the cancellation of new shipments from the US. This situation, coupled with the possible introduction of tariffs, may lead some sellers to advocate for price increases. Nevertheless, global trade patterns are anticipated to adjust after the second quarter, with Europe likely to see an influx of LLDPE imports from other regions, particularly the Middle East and Asia-Pacific. Given that shipping times from these areas are longer than from the US, European producers may have a pricing leverage for a prolonged period, especially if supply remains constrained.”

Numerous buyers have thus far hesitated to make definitive commitments, even in the face of challenging market conditions. The degree of buyer commitment to purchases differs throughout the value chain. Those involved with film grades have a more urgent requirement to replenish their inventories, while sectors such as infrastructure, construction, rigids, and durables have seen a decline in demand. This situation has led polyethylene (PE) buyers in these areas to exercise caution, with some even opting to decline spot offers for the time being. Presently, buyers perceive adequate availability and remain cautious about potential downward risks to PE prices, especially if the anticipated tariffs do not materialize. Nonetheless, many still require restocking, having delayed some of their procurement in March in expectation of a price decrease in April prior to the announcement of the proposed tariffs. Although there was a slight uptick in demand in March, the overall demand across various value chains remains low. Most market participants anticipate that weak demand conditions will continue, given the sluggish economic environment. Additionally, the ongoing trade conflict with the US is heightening concerns regarding cost-push inflation, which could further suppress consumption.

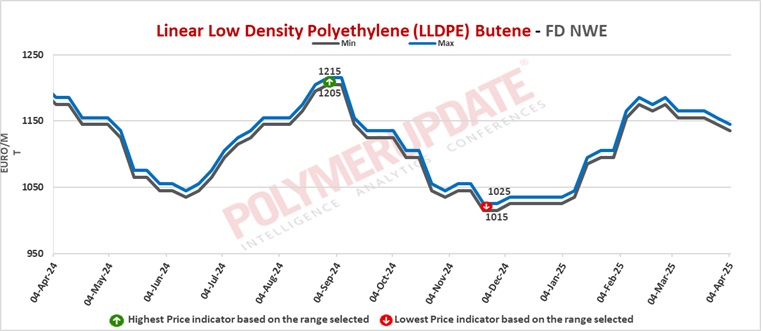

In the spot markets, LLDPE prices were assessed at the Euro 1135-1145/mt FD Northwest Europe levels, down Euro (-10/mt) from the previous week.

In the contract markets, LLDPE grade prices were assessed at the Euro 1700-1705/mt FD NWE Germany and FD NWE France levels, both stable week on week. LLDPE grade prices were assessed at the Euro 1700-1705/mt FD NWE Italy levels, steady from last week. Meanwhile, LLDPE grade prices were assessed at the GBP 1420-1425/mt FD NWE UK levels, unchanged from the previous week.

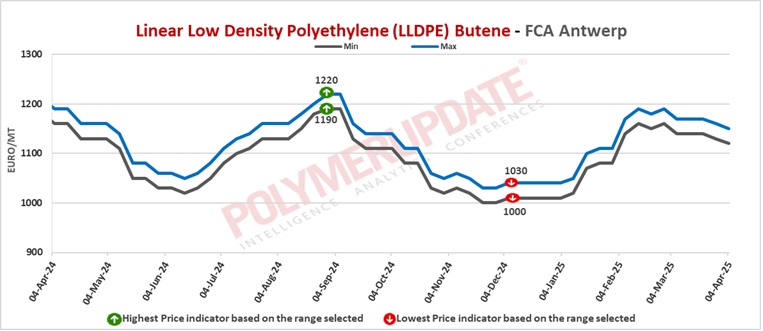

FCA Antwerp LLDPE film prices were assessed at the Euro 1120-1150/mt levels, a drop of Euro (-10/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 840-850/mt FD North West Europe levels, a marginal fall of Euro (-5/mt) from the previous week.

European ethylene contract price for April 2025 settled at the Euro 1205/MT FD North West Europe levels. This price represents a plunge of Euro 55/MT from its March 2025 settlement levels.