Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

The Reserve Bank of India (RBI) on Wednesday reduced its key repo rate by 25 basis points (bps), marking the second consecutive cut and bringing it down to 6 percent. The decision was prompted by ‘below-target’ retail inflation, driven by a significant decline in food prices. Consequently, the standing deposit facility (SDF) rate under the liquidity adjustment facility (LAF) has been adjusted to 5.75 percent, while the marginal standing facility (MSF) rate and the Bank Rate stand at 6.25 percent.

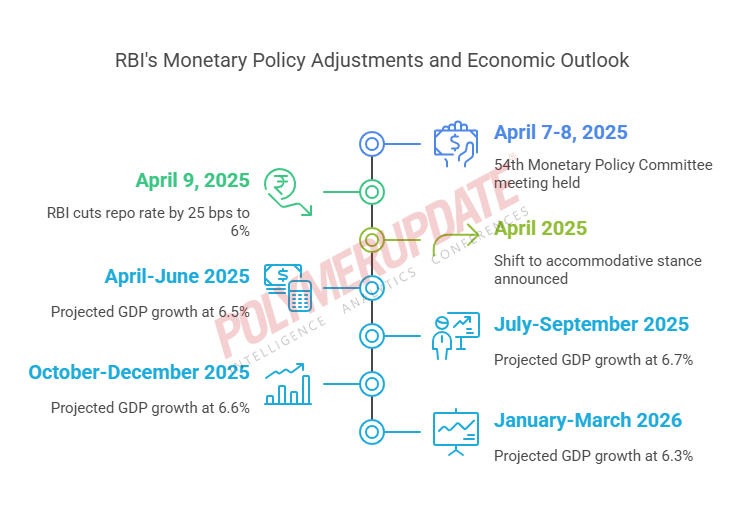

The decision was made unanimously during the 54th Monetary Policy Committee (MPC) meeting held on April 7–8, against the backdrop of a changing and challenging global economic environment. Recent trade tariff measures have heightened uncertainties, clouding the economic outlook across regions and posing new headwinds for global growth and inflation. Amid this turbulence, the U.S. dollar has weakened significantly, bond yields have softened, and equity markets are undergoing corrections.

Additionally, crude oil prices have plunged to their lowest levels in over four years, providing significant relief to retail inflation both globally and domestically. In this context, central banks are adopting cautious approaches, with signs of policy divergence across jurisdictions reflecting their unique domestic priorities.

RBI Governor Sanjay Malhotra stated, “After assessing the current and evolving macroeconomic situation, the MPC unanimously voted to reduce the policy repo rate by 25 bps to 6 percent with immediate effect. This decision aligns with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 percent within a band of +/- 2 percent, while supporting growth.”

Dharmakirti Joshi, Chief Economist at CRISIL, commented, “The monetary policy met expectations with a 25 bps rate cut. With downside risks to growth outweighing concerns since the February policy and weaker inflationary pressures due to falling crude prices, a rate cut was expected. The shift in stance supports the durability of the rate reduction cycle, and we anticipate at least two more rate cuts of 25 bps each within the fiscal year. The forecast of a normal monsoon could bode well for agriculture and food inflation, although heat waves and other weather-related disruptions remain a concern amidst rising climate change impacts.” Rationale behind the decision

Rationale behind the decision

India’s retail inflation is currently below the target, driven by a sharp decline in food inflation and a decisive improvement in the inflation outlook. Projections indicate increased confidence in a durable alignment of headline inflation with the target of 4 percent over a 12-month horizon.

On the other hand, growth remains on a recovery path, impeded by a challenging global environment, following an underwhelming performance in the first half of 2024–25. In such conditions, the benign inflation outlook and moderate growth necessitate continued support from the Monetary Policy Committee (MPC). Accordingly, the MPC unanimously voted to reduce the policy repo rate.

Changing stance

India’s central bank has also decided to shift its stance from ‘neutral’ to ‘accommodative,’ recognizing that the rapidly evolving situation requires continuous monitoring and reassessment of the economic outlook. Interestingly, from a global perspective, monetary policy stances are typically categorized as accommodative, neutral, or tightening.

An accommodative stance involves an easy monetary policy aimed at stimulating the economy through lower interest rates, whereas tightening refers to a contractionary policy where interest rates are raised to restrain spending and curb economic activity, primarily to control inflation. A neutral stance is generally associated with an economic state that neither necessitates stimulating activity nor curbing inflation. This stance provides flexibility to adjust policy in either direction based on evolving economic conditions.

The monetary policy stance signals the intended direction of policy rates going forward. With the current shift from ‘neutral’ to ‘accommodative,’ the MPC is now considering only two options—maintaining the status quo or implementing a rate cut, barring any unforeseen shocks. Clarifying the change, the governor stated, “The stance should not be directly linked to liquidity conditions. While liquidity management is crucial for monetary policy, including decisions related to the policy rate, it remains an operational tool of the RBI for various purposes, including monetary policy transmission.”

Rajani Sinha, Chief Economist at Care Ratings, commented, “The 25 bps policy rate cut was anticipated. The shift to an accommodative stance indicates that the MPC’s focus will now be on supporting growth amidst muted inflationary pressures. While the RBI has revised India’s economic growth projection for FY2025–26 to 6.5 percent, we believe growth could be slightly lower, around 6.2 percent. The direct impact of reciprocal tariffs is estimated at approximately 0.2–0.3 percent of GDP, with additional indirect effects likely amid heightened global uncertainties.”

GDP growth forecasts

India’s gross domestic product (GDP) growth is projected at 6.5 percent for 2024–25, compared to the 9.2 percent growth rate recorded in the previous year. For 2025–26, the agricultural sector’s prospects remain bright, supported by healthy reservoir levels and robust crop production. Manufacturing activity is showing signs of revival, with business expectations staying strong, while the services sector continues to demonstrate resilience.

For the April–June 2025 quarter, the Reserve Bank of India (RBI) has projected India’s GDP growth rate at 6.5 percent and 6.7 percent for the July–September 2025 quarter. The central bank estimates GDP growth at 6.6 percent for the October–December 2025 quarter and 6.3 percent for the January–March 2026 quarter. While the risks surrounding these baseline projections are balanced, uncertainties remain elevated due to the recent spike in global volatility.

Mahendra Patil, Founder and Managing Partner of MP Financial Advisory Services LLP, remarked, “The RBI’s current policy reflects a proactive response to escalating global trade uncertainties and rising export headwinds, especially as India’s merchandise exports have been contracting since November 2024. With CPI inflation easing and crude oil prices declining, the external disinflationary environment has created policy space for calibrated easing. This move not only supports domestic demand but also provides timely relief to MSMEs and corporates facing tighter global conditions, all while macroeconomic stability remains well-anchored by $676 billion in forex reserves.”

Retail inflation

India’s headline inflation moderated during the January–February 2025 quarter, driven by a sharp correction in food prices. The outlook for food inflation has turned decisively positive. Uncertainties surrounding rabi crops have diminished significantly, with the second advance estimates indicating record wheat production and higher output of key pulses compared to the previous year. Combined with robust kharif arrivals, this development is expected to pave the way for a sustained easing of food inflation.

Additionally, the decline in crude oil prices bodes well for the inflation outlook. However, lingering global market uncertainties and the potential recurrence of adverse weather-related supply disruptions pose upside risks to the inflation trajectory. Assuming a normal southwest monsoon, the Reserve Bank of India (RBI) has projected India’s retail inflation for the financial year 2025–26 at 4 percent. Quarterly projections stand at 3.6 percent for April–June 2025, 3.9 percent for July–September 2025, 3.8 percent for October–December 2025, and 4.4 percent for January–March 2026.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com