Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

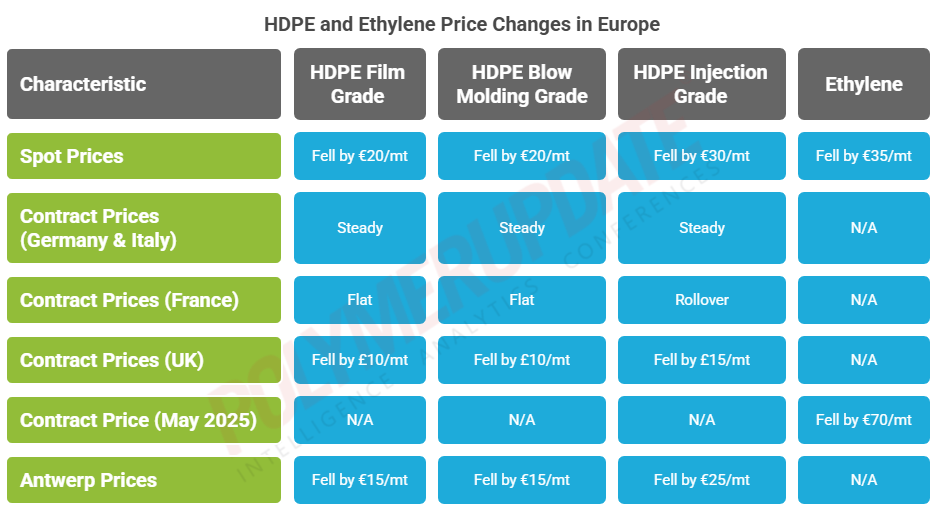

This week, HDPE spot prices slipped while contract prices remained flat in the European region.

An industry source in Europe informed a Polymerupdate team member, "The European high-density polyethylene (HDPE) market has experienced a period of inactivity, largely due to a reduced working week in several countries following the Easter holiday and a backwardated pricing structure as May drew near. Most market participants have taken a cautious stance, opting to remain on the sidelines until the ethylene monthly contract price (MCP) for May was finalized, which was anticipated to show a significant decline compared to April. This expected reduction is attributed to lower upstream crude oil prices in April and a stronger euro against the US dollar, which has increased pressure on feedstock costs. Nevertheless, uncertainty surrounding tariffs on polyethylene imports from the United States has complicated the market dynamics, leading to differing pricing views among stakeholders. Although the European Commission postponed the proposed tariffs for 90 days on April 10, the timing during a short working month did little to alleviate pricing pressures or stimulate active discussions.”  The initial tariff proposal on March 13 had already raised considerable concerns, resulting in the cancellation of numerous US-origin HDPE shipments in late March and early April. This disruption temporarily benefited European manufacturers in terms of pricing, as supply concerns led to a slight reduction in availability.

The initial tariff proposal on March 13 had already raised considerable concerns, resulting in the cancellation of numerous US-origin HDPE shipments in late March and early April. This disruption temporarily benefited European manufacturers in terms of pricing, as supply concerns led to a slight reduction in availability.

Nevertheless, numerous purchasers adopted a wait-and-see approach, aiming to gain insight into the changing tariff landscape. The effects of plant closures during the holiday season also diminished the urgency to replenish stocks, which further curtailed overall spot transactions and postponed any significant price changes. In the contract market, April settlements were largely noted as rollovers from March, even in light of declining feedstock prices and initial efforts by manufacturers to push for price hikes.

Looking forward, market sentiment remains largely uncertain as the sector contends with tariff-related issues and a potential surplus from imports. Although domestic manufacturers have exhibited cautious optimism for improvements in May, traders persist in voicing apprehensions regarding a possible increase in imported volumes that could disrupt the fragile equilibrium between supply and demand.

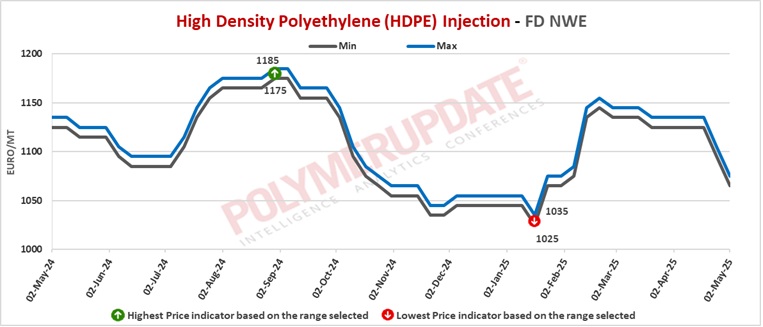

In the spot markets, HDPE film grade prices were assessed at the Euro 1095-1105/mt FD North West Europe levels, while HDPE BM grade prices were assessed at the Euro 1095-1105/mt FD North West Europe levels, both dropped by Euro (-20/mt) from the previous week. Meanwhile, HDPE injection grade prices were assessed at the Euro 1065-1075/mt FD North West Europe levels, a decline of Euro (-30/mt) from last week.

In the contract markets, HDPE film grade prices were assessed at the Euro 1640-1645/mt FD NWE Germany and FD NWE Italy levels, both steady week on week. HDPE film grade prices were assessed at the Euro 1640-1645/mt FD NWE France levels, flat from last week. Meanwhile, HDPE film grade prices were assessed at the GBP 1395-1400/mt FD NWE UK levels, a fall of GBP (-10/mt) from the previous week.

In the contract markets, HDPE BM grade prices were assessed at the Euro 1620-1625/mt FD NWE Germany and FD NWE Italy levels, both left unchanged week on week. HDPE BM grade prices were assessed at the Euro 1620-1625/mt FD NWE France levels, flat from the previous week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1375-1380/mt FD NWE UK levels, a drop of GBP (-10/mt) from last week.

In the contract markets, HDPE injection grade prices were assessed at the Euro 1580-1585/mt FD NWE Germany and FD NWE Italy levels, both steady week on week. HDPE injection grade prices were assessed at the Euro 1580-1585/mt FD NWE France levels, rolled over from the previous week. Meanwhile, HDPE injection grade prices were assessed at the GBP 1340-1345/mt FD NWE UK levels, down by GBP (-15/mt) from last week.

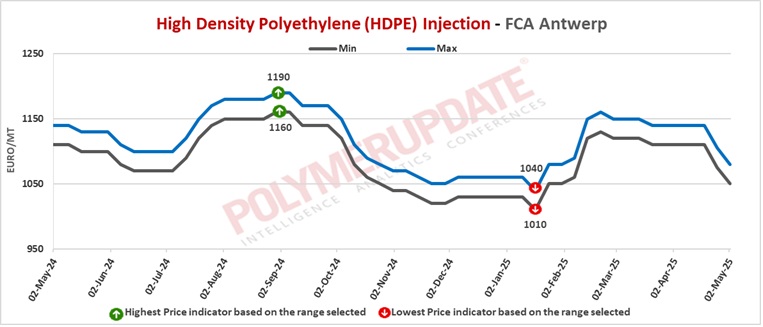

FC Antwerp HDPE film prices were assessed at the Euro 1080-1120/mt levels while FCA Antwerp HDPE BM prices were assessed at the Euro 1080-1120/mt levels, both falling by Euro (-15/mt) from the previous week. Meanwhile, HDPE injection prices were assessed at the Euro 1050-1080/mt levels, a decline of Euro (-25/mt) from week on week.

Ethylene spot prices on Thursday were assessed at the Euro 755-765/mt FD North West Europe levels, a sharp fall of Euro (-35/mt) week on week.

European Ethylene contract price for May 2025 settled at the Euro 1135/MT FD North West Europe levels. This price represents a plunge of Euro 70/MT from its April 2025 settlement levels.