Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

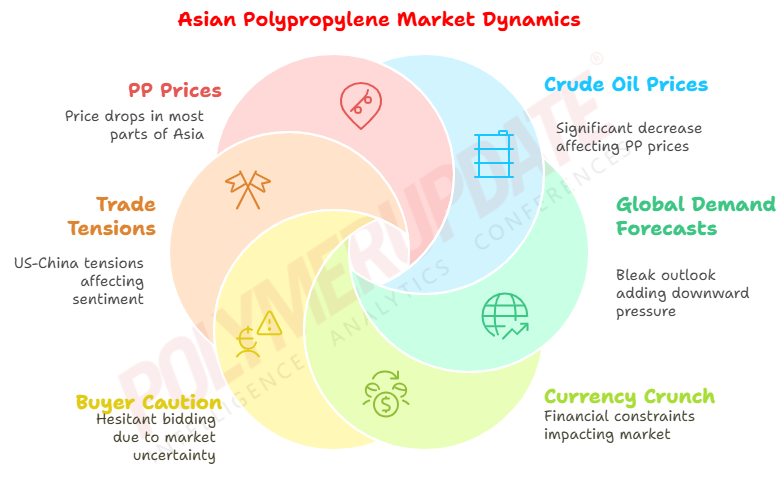

This week, Polypropylene prices down adjusted in the Asian region. An industry source in Asia, on condition of anonymity, informed a Polymerupdate team member, "Crude oil prices have experienced a substantial decrease, reaching their lowest level since February 2021. This drop is linked to the OPEC+ alliance approving a hike in production for June, even as Saudi Arabia issued warnings that it would further raise output levels significantly if fellow oil-producing member countries continue to breach their quotas and engage in overproduction. Additionally, the market is encountering downward pressure due to bleak global demand forecasts and increasing oil inventories.”

An industry source in Asia, on condition of anonymity, informed a Polymerupdate team member, "Crude oil prices have experienced a substantial decrease, reaching their lowest level since February 2021. This drop is linked to the OPEC+ alliance approving a hike in production for June, even as Saudi Arabia issued warnings that it would further raise output levels significantly if fellow oil-producing member countries continue to breach their quotas and engage in overproduction. Additionally, the market is encountering downward pressure due to bleak global demand forecasts and increasing oil inventories.”

The source added, “A currency crunch situation, muted demand sentiments, and lower import offers from overseas suppliers further led to prices trending lower. In the current bearish market scenario, in spite of sellers offering low prices, buyers remained largely unwilling to bid at the stated price points. The current situation has been further exacerbated with converters exercising caution while entering into price negotiations.”

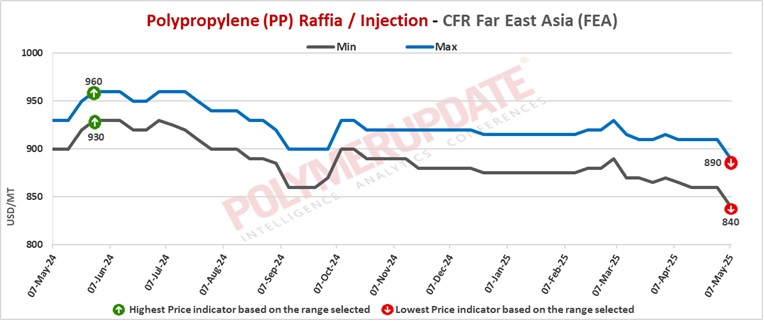

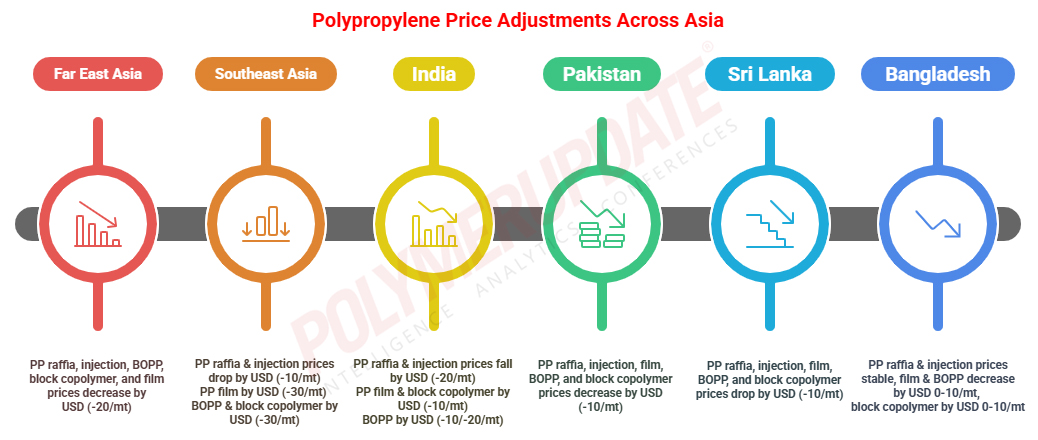

In Far East Asia, PP raffia and PP injection prices were assessed at the USD 840-890/mt CFR levels, both week on week decreased by USD (-20/mt). PP BOPP prices were assessed at the USD 860-910/mt CFR levels, a fall of USD (-20/mt) from the previous week. PP film prices were assessed at the USD 890-940/mt CFR levels, a fall of USD (-20/mt) from the previous week. PP block copolymer grade prices were assessed at the USD 900-930/mt CFR levels, a week on week decline of USD (-20/mt).

In China, Middle eastern producers have offered their PP raffia and PP injection at the USD 840-890/mt levels, for shipment in May 2025.

In China, the polypropylene market is currently experiencing weakness due to a seasonal decline in demand and cautious purchasing behavior from downstream buyers. While maintenance outages provide temporary relief in supply, increasing inventories and anticipated capacity expansions may exert renewed pressure. The lack of new orders and inadequate terminal digestion contribute to a bearish sentiment, with prices expected to fluctuate within a limited range.

The polypropylene (PP) market has shown continued signs of weakness, with futures prices declining alongside falling crude oil prices. Nevertheless, domestic spot prices have remained relatively stable, bolstered by reduced supply pressure from production halts and suppliers achieving their monthly sales targets. Major domestic suppliers, including state-owned enterprises, have upheld stable pricing strategies, resisting further downward adjustments despite the sluggish demand. Traders, anticipating uncertainty following the holiday, have begun to pre-sell cargoes scheduled for arrival post-holiday. However, buying interest has remained low, as many converters report sufficient inventory levels and choose to delay restocking, speculating on potential price declines after the holiday.

Additionally, ongoing US-China trade tensions have significantly impacted sentiment, further discouraging activity in the import market. Export interest from Chinese suppliers has also been limited, with many maintaining steady offers before the holiday, yet actual transactions have been scarce as overseas buyers adopt a cautious stance.

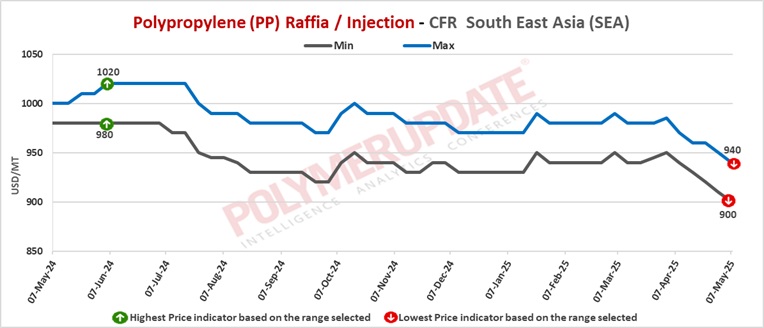

In Southeast Asia, PP raffia and PP injection grade prices were assessed at the USD 900-940/mt CFR levels, a week on week drop of USD (-10/mt). PP film prices were assessed at the USD 950-980/mt CFR levels, a fall of USD (-30/mt) from the previous week. BOPP prices were assessed at the USD 910-950/mt CFR levels while PP block copolymer prices were assessed at the USD 960-980/mt CFR levels, both week on week declined by USD (-30/mt).

In Southeast Asia, overseas suppliers have offered their PP raffia and injection grades in the range of USD 900-940/mt, for shipment in May 2025.

In Southeast Asia, the polypropylene (PP) market is currently experiencing a downturn, as weak demand for end products leads converters to adopt a more cautious approach. Many players are keeping their feedstock inventories low and are hesitant to make purchases unless prices become particularly appealing. Market sentiment is further affected by ongoing economic uncertainties and ambiguity regarding the results of the 90-day suspension of U.S. tariffs.

Consequently, some converters are prioritizing cash flow preservation over investing in resin stockpiles. Despite the sluggish demand, supply remains plentiful—especially in domestic markets—providing converters with easy access to raw materials when necessary. This readily available supply has limited buying activity. Additionally, non-dutiable cargoes from ASEAN countries are experiencing a downward price trend, diverting attention from dutiable imports, which have seen little discussion.

Dutiable suppliers are refraining from significant price reductions due to concerns over profit margins, avoiding engagement in what some perceive as an emerging price war. Chinese-origin PP cargoes, which are less competitive in Indonesia, have garnered more interest in markets such as Malaysia, Thailand, and Vietnam, where they benefit from non-dutiable status. However, ASEAN-origin cargoes are still favoured due to shorter shipping times. In Vietnam, purchasing activity has decreased ahead of an extended holiday, with many converters opting to observe post-holiday price movements before making commitments. Some transactions bound for Vietnam were completed at lower prices, although the decline was not as pronounced as in Indonesia. Furthermore, block copolymer PP prices in Southeast Asia are facing downward pressure. In Indonesia, local traders have reduced their offers to clear inventory, prompting importers to adjust their prices as buyers align their expectations with domestic market levels.

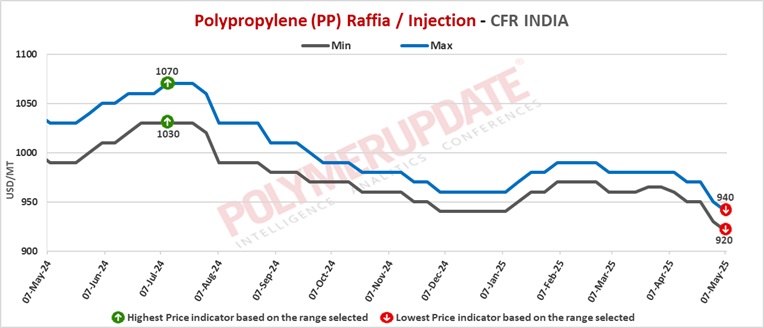

In India, PP raffia and PP injection prices were assessed at the USD 920-940/mt CFR levels, a week on week fall of (-20/mt). PP film and block copolymer prices were assessed at the USD 960-980/mt CFR levels, both lower by USD (-10/mt) from the previous week. BOPP prices were assessed at the USD 950-980/mt CFR levels, down adjusted by USD (-10/-20/mt) from the previous week. In the Indian open market, local producers have announced several incentive schemes to finalize Memorandums of Understanding (MoU)s, while buyers have been hesitant to accept them.

In India, Middle Eastern producers have offered their PP raffia and PP injection at the USD 920-940/mt levels, for shipment in May 2025.

In India, the sentiment regarding polypropylene (PP) prices has remained subdued due to lower offers, primarily influenced by aggressive pricing strategies from Chinese suppliers. Buyers have limited their purchases to immediate needs, steering clear of bulk transactions amid a generally pessimistic market outlook.

The availability of ample domestic stock has further contributed to a decline in price levels. Competitive pricing for Chinese-origin cargoes, including certain coal-to-olefins (CTO)-based products, has persisted, with transactions being finalized under advanced payment conditions. Ongoing supply pressures from China continue to significantly impact market sentiment. Looking ahead, it is anticipated that Chinese suppliers will boost exports to India prior to the Bureau of Indian Standards (BIS) certification deadline on June 24. However, should the enforcement of the BIS regulation be postponed—similar to previous occurrences—this may exacerbate the existing oversupply challenges.

In Pakistan, PP raffia and PP injection grade prices were assessed at the USD 930-970/mt CFR levels, both down USD (-10/mt) from the previous week. PP film and BOPP prices were assessed at the USD 970-1020/mt CFR levels, both week on week declined by USD (-10/mt). PP block copolymer prices were assessed at the USD 980-1050/mt CFR levels, a drop of USD (-10/mt) from the previous week.

In Sri Lanka, PP raffia and PP injection grade prices were assessed at the USD 980-1020/mt CFR levels, both decreased by USD (-10/mt) from the previous week. PP film and BOPP prices were assessed at the USD 1030-1050/mt CFR levels, both week on week down adjusted by USD (-10/mt). PP block copolymer prices were assessed at the USD 1050-1060/mt CFR levels, lower by USD (-10/mt) from last week.

In Sri Lanka, Middle Eastern producers have offered their PP raffia and PP injection at the USD 980-1020/mt levels, for shipment in May 2025.

In Bangladesh, PP raffia and PP injection prices were assessed stable at the USD 950-980/mt CFR levels. PP film and BOPP prices were assessed at the USD 970-990/mt CFR levels, both week on week down USD (NC/-10/mt). PP block copolymer prices were assessed at the USD 1010-1050/mt CFR levels, a week on week fall of USD (NC/-10/mt).

In Bangladesh, overseas producers have offered their PP raffia and PP injection at the USD 950-980/mt levels, for shipment in May 2025.

In both Sri Lanka and Bangladesh, market activity has continued to be slow due to persistent currency shortages and escalating geopolitical tensions. These economic and political challenges have limited liquidity and heightened uncertainty, prompting buyers to take a more cautious approach. Purchasing behaviour has evolved to focus solely on meeting immediate needs while steering clear of building inventory. This prudent strategy illustrates a wider market reluctance and a lack of confidence in short-term stability.

Feedstock propylene prices on Tuesday were assessed at the USD 805-815/mt CFR China levels, a drop of USD (-5/mt) from the previous week. Meanwhile, FOB Korea propylene prices were assessed steady at the USD 775-785/mt levels.

In plant news, CNOOC Ningbo Daxie Petrochemical has restarted its Polypropylene (PP) unit in early May 2025. The unit was shut for maintenance on April 19, 2025. Located in Ningbo, Zhejiang in China, the unit has a production capacity of 300,000 mt/year.

In other plant news, PetroChina Lanzhou Petrochemical is likely to shut its Polypropylene (PP) unit on May 15, 2025 for maintenance. The plant is slated to remain offline until May 17, 2025. Located in Lanzhou, Gansu province of China, the unit has a production capacity of 300,000 mt/year.

Juzhengyuan has taken off stream its No.1 Polypropylene (PP) unit in early May 2025 for maintenance. The unit is slated to remain offline for about one and a half month. Located in Dongguan, Guangdong province of China, the No.1 PP unit has a production capacity of 300,000 mt/year.