Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, HDPE spot prices down adjusted, while contract prices quoted flat in the European region. An industry source in Europe informed a Polymerupdate team member, "The European High-Density Polyethylene (HDPE) market commenced June with a bearish outlook, marked by weak demand. The soft demand environment has led to a decline in prices, despite the fact that the June monthly contract price (MCP) for feedstock ethylene has remained stable. The dynamics within the HDPE market are still quite fluid, particularly due to attractive import arbitrage opportunities from the U.S. However, uncertainty clouding surrounding trade tariffs has continued to weigh on overall market sentiment. With just over a month remaining in the 90-day tariff suspension, many sellers are exercising caution and steering clear of committing to further import purchases. Nevertheless, some participants may still be inclined to engage in incremental trade if they perceive that the potential benefits outweigh the associated risks."

An industry source in Europe informed a Polymerupdate team member, "The European High-Density Polyethylene (HDPE) market commenced June with a bearish outlook, marked by weak demand. The soft demand environment has led to a decline in prices, despite the fact that the June monthly contract price (MCP) for feedstock ethylene has remained stable. The dynamics within the HDPE market are still quite fluid, particularly due to attractive import arbitrage opportunities from the U.S. However, uncertainty clouding surrounding trade tariffs has continued to weigh on overall market sentiment. With just over a month remaining in the 90-day tariff suspension, many sellers are exercising caution and steering clear of committing to further import purchases. Nevertheless, some participants may still be inclined to engage in incremental trade if they perceive that the potential benefits outweigh the associated risks."

The source added, "Amid ongoing trade negotiations, the European Union and the United States have managed to avoid further tensions, keeping hopes alive for either a formal trade agreement or an extension of the current tariff suspension. Yet, there's lingering speculation that the U.S. could introduce a blanket 10% tariff on EU imports, potentially prompting reciprocal actions from the EU. Should this occur, U.S.-sourced HDPE entering Europe might face slightly higher import tariffs.”

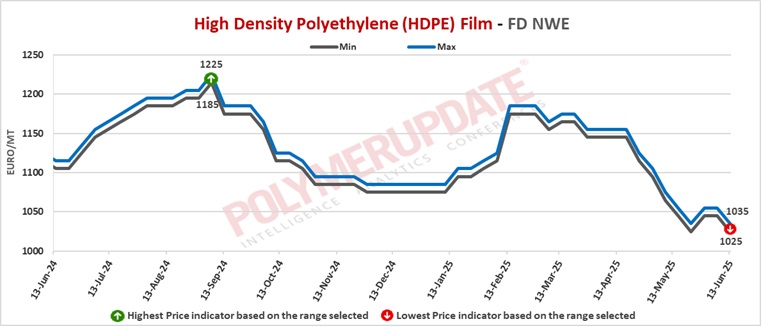

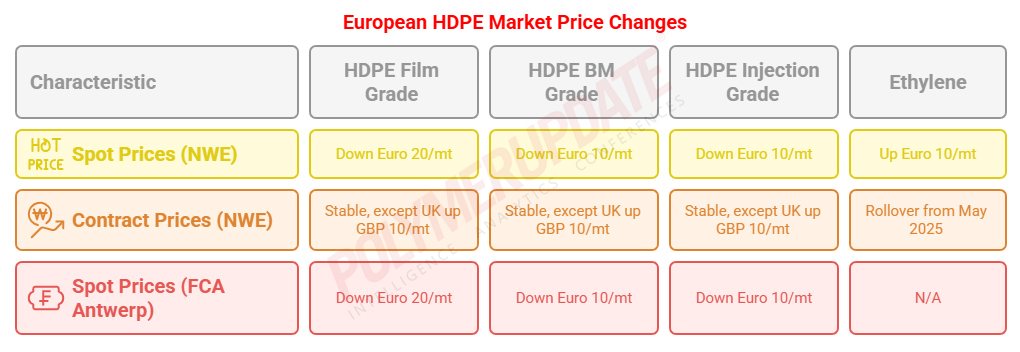

In the spot markets, HDPE Film grade prices were assessed at the Euro 1025-1035/mt FD North West Europe levels, a drop of Euro (-20/mt) from last week. HDPE BM grade prices were assessed at the Euro 1015-1025/mt FD North West Europe levels, while HDPE Injection grade prices were assessed at the Euro 985-995/mt FD North West Europe levels, both falling by Euro (-10/mt) from the previous week.

In the contract markets, HDPE film grade prices were assessed at the Euro 1570-1575/mt FD NWE Germany and FD NWE Italy levels, both stable week on week. HDPE film grade prices were assessed at the Euro 1570-1575/mt FD NWE France levels, unchanged from last week. Meanwhile, HDPE film grade prices were assessed at the GBP 1330-1335/mt FD NWE UK levels, a rise of GBP (+10/mt) from the previous week.

In the contract markets, HDPE BM grade prices were assessed at the Euro 1550-1555/mt FD NWE Germany and FD NWE Italy levels, both stable week on week. HDPE BM grade prices were assessed at the Euro 1550-1555/mt FD NWE France levels, left unchanged from the previous week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1315-1320/mt FD NWE UK levels, a gain of GBP (+10/mt) from last week.

In the contract markets, HDPE injection grade prices were assessed at the Euro 1510-1515/mt FD NWE Germany and FD NWE Italy levels, both flat week on week. HDPE injection grade prices were assessed at the Euro 1510-1515/mt FD NWE France levels, rolled over from the previous week. Meanwhile, HDPE injection grade prices were assessed at the GBP 1280-1285/mt FD NWE UK levels, up GBP (+10/mt) from last week.

Another market source stated, "This development might provide a competitive relief to local European HDPE manufacturers, allowing them to regain some of the market share they have lost. Nonetheless, it is still too early to reach definitive conclusions, as the results of trade policy are still uncertain. From a macroeconomic viewpoint, although there are indications of stabilization, the overall downturn in the European industrial sector seems to be far from concluded. The final reading of the Eurozone’s manufacturing Purchasing Managers' Index (PMI) for May increased marginally to a 33-month peak of 49.4, rising from 49.0 in April. Nevertheless, it stayed below the neutral 50 threshold signifying ongoing contraction. The index has consistently stayed in contraction territory each month since July 2022.”

Germany, the biggest economy in the Eurozone, experienced its manufacturing PMI drop to a two-month low of 48.3 in May, highlighting the weak condition of the industrial sector. In conclusion, the European HDPE market remains challenged by a mix of weak demand, uncertain trade policies, and wider economic weakness that will probably influence market dynamics in the upcoming weeks.

This week, the European Central Bank (ECB) reduced its main lending rate by 25 basis points to 2%, with the goal of protecting the economy from possible spillover impacts due to ongoing tariff-related uncertainties. Although the rate reduction indicates a favourable monetary policy approach, its short-term effect on boosting consumption is anticipated to be minimal. Consumer affordability continues to face challenges, especially for expensive purchases, as elevated living costs and economic uncertainty persistently impact household spending habits.

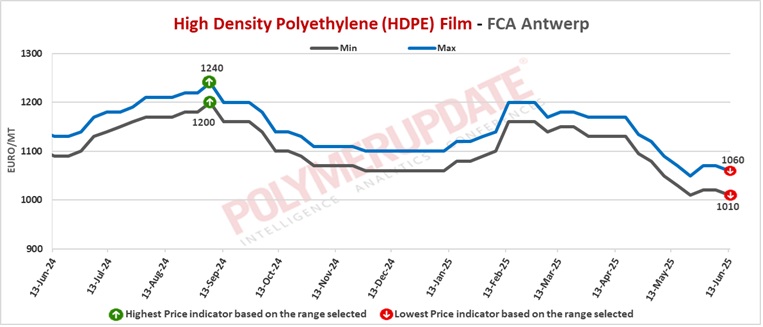

FCA Antwerp HDPE film prices were assessed at the Euro 1010-1050/mt levels, lower by Euro (-20/mt) week on week. FCA Antwerp HDPE BM prices were assessed at the Euro 1000-1030/mt levels while HDPE injection prices were assessed at the Euro 970-990/mt levels, both decreased by Euro (-10/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 695-705/mt FD North West Europe levels, a gain of Euro (+10/mt) week on week.

European ethylene contract price for June 2025 settled at the Euro 1135/MT FD North West Europe levels. This price represents a rollover from its May 2025 settlement levels.