Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

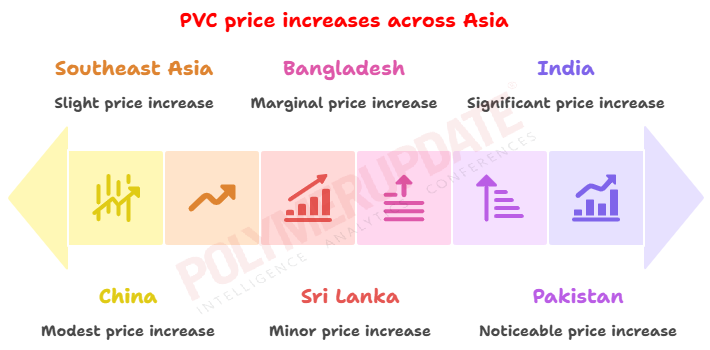

This week, PVC prices marched higher in the Asian region.

An industry source in Asia, on condition of anonymity, informed a Polymerupdate team member, "Global crude oil prices have experienced a sharp decline due to easing geopolitical tensions following the Iran-Israel ceasefire, which lowered fears of supply disruptions of crude from the Middle East. Additionally, weaker-than-expected demand data from key economies like China and the U.S., along with a drop in U.S. consumer confidence in June, put further downward pressure on energy prices.”

The source added, “Meanwhile there was a significant rise in the number of PVC offers from a leading Taiwanese manufacturer despite a generally subdued buying atmosphere. This trend was mainly linked to cost-related pressures instead of a revival in demand. A major factor in the higher offers was the increase in ethylene production costs and shipping costs, influenced by stronger freight rates. Heightened shipping costs stemming from frequently arising global supply chain issues, rising fuel expenses, and limited vessel availability have increased the total cost of imports. As a result, sellers increased their prices to account for these additional logistical costs. This increase in offers bolstered spot PVC prices.”

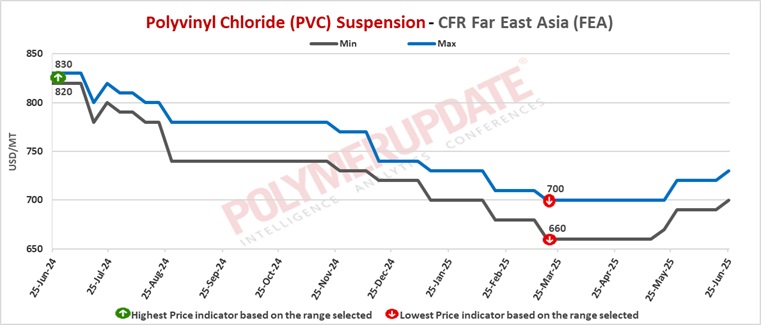

In China, PVC prices were assessed at the USD 700-730/mt CFR levels, a week on week rise of USD (+10/mt) from the previous week.

In China, a Taiwanese producer has offered its PVC resin suspension grades at the USD 720/mt, for shipment in July 2025.

In China, despite lower PVC futures on the Dalian Commodity Exchange (DCE) and a generally sluggish demand trend, the PVC market showed some level of resilience. Trading activity stayed constrained, mainly because of a mix of low-priced spot trades and high inventory levels in major markets. Nonetheless, a slight increase in pre-shipment offers suggested the rise of cost-push pressures, especially related to logistics. Increasing freight charges and insurance expenses seemed to be slowly impacting offer prices, despite the overall lack of market enthusiasm. Moreover, logistical factors significantly influenced the formation of regional supply conditions.

Exporters are increasingly focusing on rerouting shipping pathways to prioritize containers heading to the US, taking advantage of a short-lived tariff pause. This strategic change increased the pressure on container availability in intra-Asia trade routes, leading to localized supply constraints. Overall, these factors suggest that although demand fundamentals continue to be weak, supply-side changes, particularly in logistical cost inflation and container reallocation, are starting to apply upward pressure on prices, bolstering market stability in the near term.

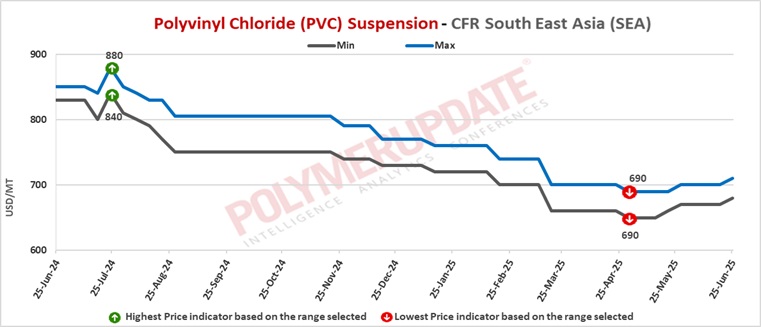

In Southeast Asia, PVC prices were assessed at the USD 680-710/mt CFR levels, higher by USD (+10/mt) from last week.

In Southeast Asia, a producer from Taiwan has offered its PVC resin suspension grade at the USD 750/mt, for shipment in July 2025.

In Southeast Asia, the PVC market stayed quiet as demand remained persistently weak. Local converters expressed minimal interest in acquiring more volumes, pointing to sufficient inventory levels and expecting additional supply from China's new PVC capacities anticipated to be operational by the end of Q2. This cautious purchasing approach indicated a feeling of market excess and deliberate stock control. Nonetheless, in spite of the tepid downstream demand, import offers notably from a major Taiwanese manufacturer were increased, indicating rising cost pressures on the manufacturing front. These increased bids probably result from rising costs of raw materials, energy, and transportation, rather than any genuine enhancement in local demand. Consequently, the gap between buyer sentiment and supplier costs underscores the increasing impact of cost-push elements on pricing, even when demand is limited.

In Vietnam, Malaysia, and Thailand, the PVC market exhibited a cautious purchasing behaviour, as converters were wary in their buying approaches. This limitation indicated a delicate but stable balance between supply and demand in the region. Although supply was not deemed constrained, it was suitably matched with present consumption rates, enabling buyers to take a wait-and-see stance without facing imminent shortages. The cautious position was bolstered by current inventories and anticipations of more supply from China's forthcoming capacity increases. This balance, however, stayed fragile and vulnerable to changes in upstream costs or logistical issues, as indicated by increased import bids from major producers resulting from escalating production and shipping costs.

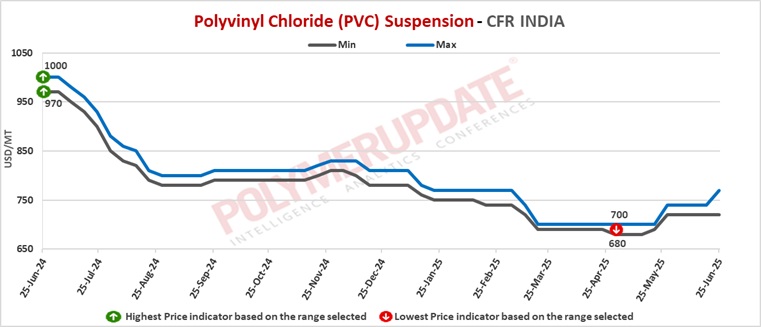

In India, PVC prices were assessed at the USD 720-770/mt CFR levels, a week on week gain of USD (NC/+30/mt). A domestic industry source informed a Polymerupdate team member, “Reliance Industries Limited has announced APR linked Incentive scheme in PVC for the month of June 2025.”

A major Taiwanese producer has offered its PVC suspension grades (S65D/S65/S60/S70) at the USD 765/mt levels while grade (S57 & B57) is on offer at the USD 775/mt levels on CIF Nhava Sheva/Mundra/Chennai port basis with shipment for August 2025 (LC at sight). These offers are higher by USD 45/mt as compared to previous month offers. For LC 90 days (Add USD 10/mt).

Another producer from Taiwan has offered its PVC resin suspension grade at the USD 765/mt levels for shipment in July 2025 (LC at sight).

A South Korean producer has offered its PVC resin suspension grade at the USD 765/mt levels for shipment in July 2025 (LC at sight). Another producer from South Korea has offered its PVC resin suspension grade at the USD 765/mt levels (LC at sight) & USD 775/mt levels (LC usance) for shipment in July 2025 .

Meanwhile, a Chinese producer has offered its PVC (ethylene-based) grade at the USD 690-700/mt CFR levels, for shipment in July 2025.

In India, the domestic PVC market has recently experienced a significant regulatory change as the Government of India has extended the deadline for implementing the Bureau of Indian Standards (BIS) quality certification requirements for PVC imports. The revised implementation date is now scheduled for December 24, 2025. This postponement has resulted in immediate market effects, especially by relaxing import restrictions that were previously deterring non-compliant deliveries.

Consequently, several offers from Chinese vendors have reappeared in the Indian market, taking advantage of the prolonged chance to re-enter a price-conscious and strategically vital market. This surge of competitive Chinese offers could temporarily elevate supply-side pressure, possibly affecting local pricing patterns and importer choices. Although the postponement of BIS enforcement provides temporary relief to traders and converters, it highlights the need for proactive quality compliance strategies in preparation for the 2025 deadline.

In India, the arrival of the monsoon season, typically a sluggish time for construction work, has significantly impacted sentiment. Adding to the resistance is the six-month prolongation of the BIS implementation deadline, which has diminished the immediate urgency for replenishing stock. Meanwhile, PVC shipments from China have appeared at sub-USD 700/ton CIF prices, which further weakens the competitiveness of the latest offer from a Taiwanese producer. Consequently, Indian buyers have displayed minimal excitement, with multiple sources questioning the supplier's capacity to finalize agreements at the newly announced levels. Market participants expect that discussions might ensue, yet any firm commitment from Indian buyers could depend on price changes and overall market clarity.

In Pakistan, PVC prices were assessed at the USD 730-770/mt CFR levels, up USD (+20/mt) from the previous week.

In Pakistan, overseas producers have offered PVC resin suspension grades in the range of USD 730-770/mt, for shipment in July 2025.

In Sri Lanka, PVC prices were assessed at the USD 710-760/mt CFR levels, a rise of USD (+10/mt) from last week.

In Sri Lanka, overseas producers have offered PVC resin suspension grades in the range of USD 710-760/mt, for shipment in July 2025.

In Bangladesh, PVC prices at the USD 730-760/mt CFR levels, week on week higher by USD (+10/mt).

In Bangladesh, overseas producers have offered PVC resin suspension grades in the range of USD 710-760/mt, for shipment in July 2025.

In the PVC markets of Pakistan, Sri Lanka and Bangladesh, there was a noticeable rise in import offers. However, buyers remained largely unresponsive, reflecting weak demand conditions. Market activity was significantly affected by sluggish downstream demand, particularly from the construction and infrastructure sectors. Broader economic challenges—such as currency volatility, inflationary pressures, and difficulties securing import financing—further dampened purchasing appetite. As a result, despite suppliers’ efforts to pass on cost increases through higher price offers, overall transaction volumes remained limited.

Feedstock EDC prices were assessed at the USD 170-180/mt CFR China level while CFR South East Asia EDC prices were assessed at the USD 175-185/mt levels, both rolled over from the previous week.

Feedstock CFR South East Asia VCM prices were assessed flat at the USD 560-570/mt levels while CFR China VCM prices were assessed stable at the USD 520-530/mt levels.

Feedstock ethylene prices on Tuesday were assessed at the USD 855-865/mt CFR South East Asia levels, an increase of USD (+10/mt) from the previous week. CFR North East Asia ethylene prices were assessed at the USD 845-855/mt levels, a week on week increase of USD (+30/mt).

In plant news, China General Plastics Corporation (CGPC) is likely to take off stream its Polyvinyl chloride (PVC) in July 2025 for maintenance. Further details on the duration of the shutdown could not be ascertained. Located in Toufen, Taiwan, the plant has a production capacity of 230,000 mt/year.