Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, PP prices down adjusted in the European region.

This week, PP prices down adjusted in the European region.

An industry source in Europe informed a Polymerupdate team member, "Spot prices in the European polypropylene market decreased marginally, as declining oil prices muted expectations for higher pricing. Fluctuations in oil markets affected sentiment through the week, while prices for injection-grade products stayed steady in the initial half of the week in light of anticipated increases in production costs. Nonetheless, this expected rise in costs did not result in increased polypropylene prices, which continued to be affected by sluggish demand fundamentals and abundant supply. Prices for injection-grade polypropylene remained steady at the beginning of the week but weakened later as the optimistic outlook linked to oil price changes diminished. Market participants pointed to a muted environment, with no signs of heightened activity. Ample supply continued to weigh on prices, especially with the slower summer holiday season approaching.”

The market is keeping a close eye on changes in the propylene sector, as talks are about to start regarding the settlement of the industry’s monthly contract price (MCP) for July. The MCP is being settled amid persistent market instability following significant volatilities seen in the naphtha market. Given the market’s sensitivity to geopolitical developments, the situation remains highly fluid.

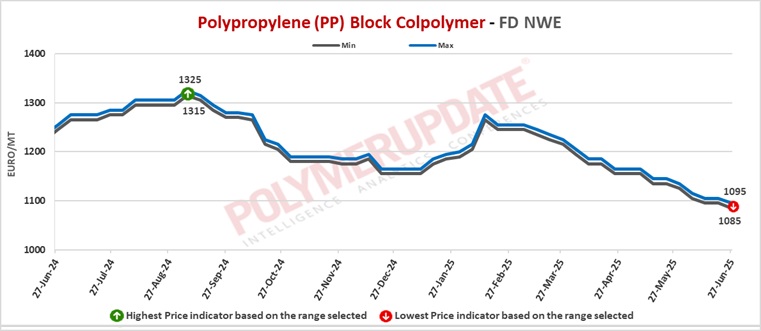

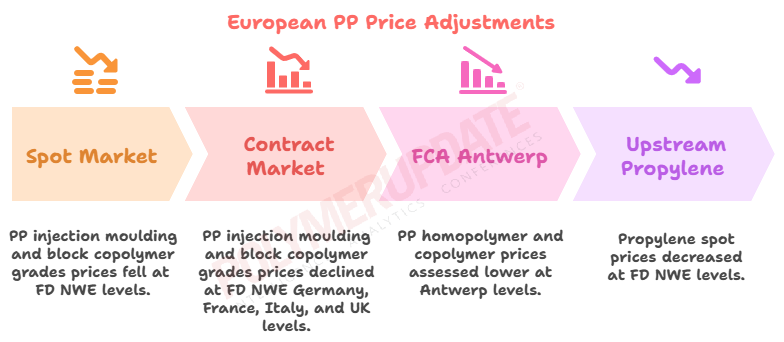

In the spot markets, PP injection moulding grade prices were assessed at the Euro 985-995/mt FD North West Europe mark while PP block copolymer grade prices were assessed at the Euro 1085-1095/mt FD Northwest Europe levels, both lower by Euro (-10/mt) from the previous week.

Meanwhile in the contract markets, PP injection moulding grade prices were assessed at the Euro 1400-1405/mt FD NWE Germany and FD NWE France levels, both dropped by Euro (-10/mt) from last week. PP injection moulding grade prices were assessed at the Euro 1390-1395/mt FD NWE Italy levels, a fall of Euro (-10/mt) week on week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1195-1200/mt FD NWE UK levels, down GBP (-10/mt) from the previous week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1470-1475/mt FD NWE Germany and FD NWE France levels, both decreased by Euro (-10/mt) from last week. PP block copolymer grade prices were assessed at the Euro 1460-1465/mt FD NWE Italy levels, a week on week decline by Euro (-10/mt). Meanwhile, PP block copolymer grade prices were assessed at the GBP 1255-1260/mt FD NWE UK levels, lower by GBP (-10/mt) from the previous week.

The source added, "The market stayed mostly idle this week after a significant rise in upstream crude prices. Market participants have been exercising caution and taking a wait-and-see stance even as they await clearer indications regarding the pricing forecast for July, which is largely anticipated to depend on shifts in feedstock costs.”

The underlying demand remains tepid, and the recent increase in crude prices did not translate into bolstered polypropylene fundamentals. No indication of pre-buying actions for July has been noted, indicating continued market reluctance.

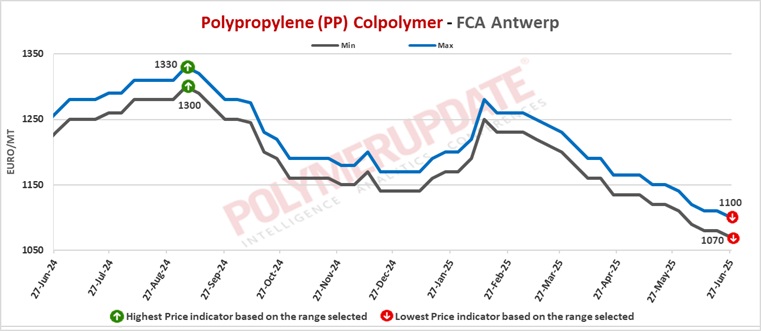

FCA Antwerp PP homopolymer prices were assessed at the Euro 970-1000/mt level while FCA Antwerp PP copolymer prices were assessed at the Euro 1070-1100/mt levels, both declining by Euro (-10/mt) week on week.

Upstream propylene spot prices on Thursday were assessed at the Euro 790-800/mt FD Northwest Europe levels, a drop of Euro (-10/mt) from last week.

European propylene contract price for June 2025 settled at the Euro 1015/MT FD North West Europe levels. This price represents a rollover from its May 2025 settlement levels.