Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

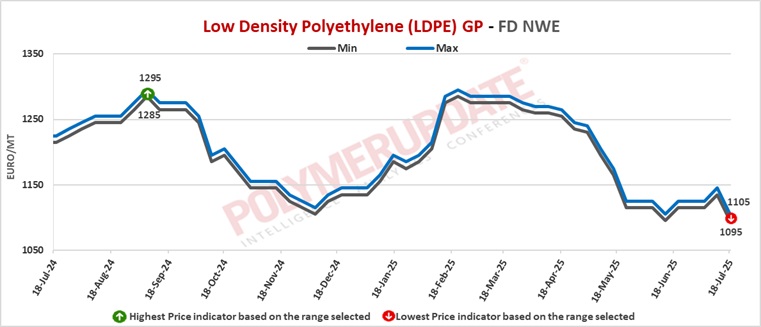

This week, LDPE spot prices dropped sharply in the European region.

An industry source in Europe informed a Polymerupdate team member, "The presence of competitive imports in the European polyethylene markets during the week continued to pressure spot prices. There was a significant fluctuation in spot prices throughout the week, as offers for imported goods were competitively priced against domestic prices, influenced by weak demand. Trading activity in the spot markets had slowed down in the past week, as the summer holidays took effect. This has affected spot prices throughout the week, given the restricted trading activity. The basic principles of demand and supply in the market stayed largely consistent, as participants continued to express uncertainty due to the unclear information regarding tariffs.”

PE spot prices have been declining, as several producers have lowered prices that were previously high. The demand for prompt delivery cargoes is noted to be fairly restricted, prompting some producers to lower their offers to the bottom of the price spectrum. Some pockets of demand were noted for forward purchases for September delivery, as buyers aim to protect themselves against potential price increases, believing that prices may have hit a low at the current rates.

In the spot markets, LDPE prices were assessed at the Euro 1095-1105/mt FD Northwest Europe mark, a sharp week on week fall of Euro (-40/mt).

In the contract markets, General Purpose LDPE grade prices were assessed at the Euro 1910-1915/mt FD NWE Germany and FD NWE Italy levels, both stable from last week. LDPE General Purpose grade prices were assessed at the Euro 1910-1915/mt FD NWE France levels, steady week on week. Meanwhile, LDPE grade prices were assessed at the GBP 1660-1665/mt FD NWE UK levels, a hike of GBP (+15/mt) from the previous week.

Contractual indications observed throughout the week were typically of agreements at a rollover from June, consistent with the ethylene feedstock settlement for the month. Nevertheless, discussions persisted for LDPE grades, as producers sought modest hikes.

Activity in the European polyethylene (PE) market is steadily declining as numerous buyers have majorly taken care of their replenishment requirements for July volumes. Sentiment is seen as stable prior to summer holiday shutdowns at numerous buyers' facilities, which has consequently lowered their needs for July. Discussions for PE contract prices are still taking place, and thus far they seem fairly steady since there are no indications of pressure from heightened supply in the market. This occurred while the July monthly contract price (MCP) for feedstock ethylene settled at rollover rates. Producers are concentrating on safeguarding their PE contract margins, as efforts to raise prices are largely ineffective in most instances. However, purchasers are advocating for reductions, insisting on the need to account for the effect of the euro’s rising exchange rate against the US dollar since June. Fluctuating foreign exchange rates have also contributed to reducing naphtha's average thus far in July, in comparison to June's average.

A relative stability in the feedstock forecast might assist producers in justifying price rollovers or alleviate some of the pressure to accept reductions. Purchasers contend that restocking carried out in late June to mitigate potential price increases during a period of heightened volatility in upstream feedstock prices due to Middle Eastern tensions has influenced their July restocking needs. This has coincided with ongoing demand softness across various value chains and elevated stock levels of finished goods, which will lessen the need for restocking until late August. Additionally, purchasers are contending for a decrease in PE contract prices due to larger discrepancies with spot prices. Consequently, purchasers are monitoring feedstock changes attentively and, in certain instances, anticipate reductions in the latter part of July. Fundamental pricing and restocking needs will be crucial in assessing the extent of price drops, given that buyers sourcing comparatively minor quantities in July have thus far indicated freely negotiated contract price settlements at rollovers.

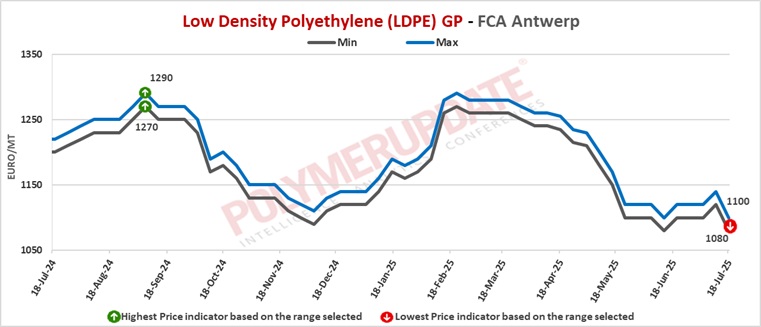

FCA Antwerp LDPE General Purpose film prices were assessed at the Euro 1080-1100/mt levels, a week on week tumble of Euro (-40/mt).

Ethylene spot prices on Thursday were assessed at the Euro 705-715/mt FD North West Europe levels, steady from last week.

European ethylene contract price for July 2025 settled at the Euro 1135/MT FD North West Europe levels. This price represents a rollover from its June 2025 settlement levels.