Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, HDPE spot prices down adjusted, while contract prices rolled over in the European region._spot_prices_decline_in_Europe_-_visual_selection.png) An industry source in Europe informed a Polymerupdate team member, "Intense import competition persisted, exerting pressure on the European high density polyethylene (HDPE) spot market, resulting in prices remaining within a narrow range. Import offers were more appealing than domestic levels, especially in the context of low demand. Trading activity further declined with the arrival of the summer holiday season, restricting overall transactions and adding to the downward pressure on spot prices. Although most PE grades saw weaker pricing, the HDPE injection market varied somewhat, showing an increase in spot prices because of the limited availability of offers. Nonetheless, the basics of supply and demand stayed mostly the same, while market sentiment was affected by uncertainty regarding upcoming tariff decisions. Numerous market players indicated challenges in assessing trading conditions because of unclear tariff ramifications."

An industry source in Europe informed a Polymerupdate team member, "Intense import competition persisted, exerting pressure on the European high density polyethylene (HDPE) spot market, resulting in prices remaining within a narrow range. Import offers were more appealing than domestic levels, especially in the context of low demand. Trading activity further declined with the arrival of the summer holiday season, restricting overall transactions and adding to the downward pressure on spot prices. Although most PE grades saw weaker pricing, the HDPE injection market varied somewhat, showing an increase in spot prices because of the limited availability of offers. Nonetheless, the basics of supply and demand stayed mostly the same, while market sentiment was affected by uncertainty regarding upcoming tariff decisions. Numerous market players indicated challenges in assessing trading conditions because of unclear tariff ramifications."

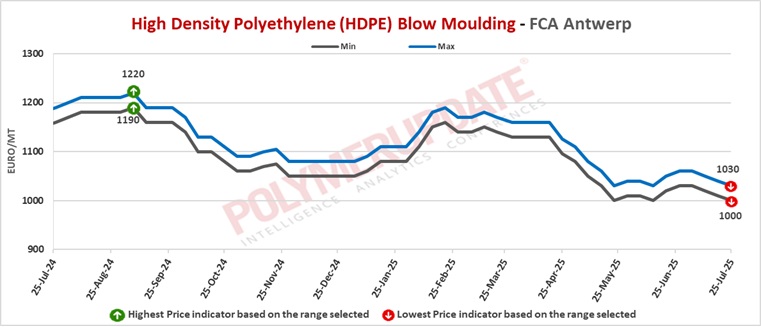

The source added, "In general, PE spot prices maintained a downward trend, as some producers decreased previously high prices to align more closely with current market conditions. The requirement for quick delivery volumes stayed restricted, leading sellers to modify offers toward the lower side of the price range. Some indications of forward purchasing interest for September deliveries emerged, as several buyers attempted to hedge against possible price hikes, reasoning that market prices might be approaching a low point. Nonetheless, the availability of HDPE blow moulding material is plentiful, and the price difference between European and U.S. imports continues to be considerable. This indicates that additional pricing pressure may arise if sellers encounter impediments in selling their stock.”

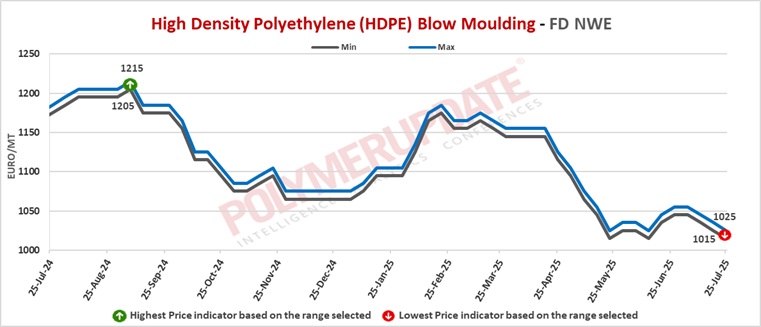

In the spot markets, HDPE film grade prices were assessed at the Euro 1025-1035/mt FD North West Europe levels, a drop of Euro (-20/mt) from the previous week. HDPE BM grade prices were assessed at the Euro 1015-1025/mt FD North West Europe levels, a week on week decrease of Euro (-10/mt). Meanwhile, HDPE injection grade prices were assessed at the Euro 1005-1015/mt FD North West Europe levels, a sharp fall of Euro (-30/mt) from last week.

In the contract markets, HDPE film grade prices were assessed at the Euro 1570-1575/mt FD NWE Germany and FD NWE Italy levels, both steady week on week. HDPE film grade prices were assessed at the Euro 1570-1575/mt FD NWE France levels, flat from the previous week. Meanwhile, HDPE film grade prices were assessed at the GBP 1355-1360/mt FD NWE UK levels, a week on week fall of GBP (-5/mt).

In the contract markets, HDPE BM grade prices were assessed at the Euro 1550-1555/mt FD NWE Germany and FD NWE Italy levels, both stable from last week. HDPE BM grade prices were assessed at the Euro 1550-1555/mt FD NWE France levels, rolled over week on week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1340-1345/mt FD NWE UK levels, a drop of GBP (-5/mt) from the previous week.

In the contract markets, HDPE injection grade prices were assessed at the Euro 1510-1515/mt FD NWE Germany and FD NWE Italy levels, both unchanged week on week. HDPE injection grade prices were assessed at the Euro 1510-1515/mt FD NWE France levels, constant from last week. Meanwhile, HDPE injection grade prices were assessed at the GBP 1305-1310/mt FD NWE UK levels, down GBP (-5/mt) week on week.

The source informed, “Contract negotiations mainly indicated price rollovers from June, mirroring the steady settlement for feedstock ethylene in July. Nonetheless, discussions for HDPE grades continued, as producers sought to implement moderate price hikes. Activity in the European HDPE market has started to decline, as numerous buyers have already obtained the majority of their July supplies. Market sentiment stays largely stable, although purchasing interest is slowly diminishing in anticipation of extensive downstream plant closures for the summer holiday season. Negotiations for the contract price are currently in progress, and the pricing has exhibited relative stability to this point. No evident sign of excess supply has impacted the market. Discussions are occurring amid the rollover of July's monthly contract price (MCP) for ethylene.”

Producers are persisting in their efforts to uphold contract margins, although their attempts to raise prices have mostly failed. Conversely, purchasers are advocating for lower prices, claiming that the euro's recent rise against the US dollar since June should influence pricing. The shift in the exchange rate has additionally led to a decrease in naphtha's average price so far in July, possibly aiding producers in their attempts to stabilize prices or at least lessen the pressure to make concessions. Numerous purchasers significantly replenished their stocks in late June and early July, aiming to protect themselves from potential price increases due to geopolitical instability in the Middle East. As a result, their buying activity in July has been restricted. Continued low demand throughout various value chains, combined with high levels of finished goods inventory, is anticipated to postpone additional restocking until late August.

Purchasers are additionally seeking reduced contract prices to close the expanding difference between contract and spot market prices. Emphasis is placed on feedstock development, as some participants expect possible price drops, especially for HDPE, if manufacturers encounter piling up of inventory. Currently, the majority of contract settlements for small July volumes have taken place at rollovers, but the price trend in the latter half of the month will hinge on real restocking patterns and overall supply situation.

FCA Antwerp HDPE film prices were assessed at the Euro 1010-1050/mt levels, a decrease of Euro (-20/mt) from the previous week. FCA Antwerp HDPE BM prices were assessed at the Euro 1000-1030/mt levels, a week on week decline of Euro (-10/mt). HDPE injection prices were assessed at the Euro 990-1010/mt levels, lower by Euro (-30/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 720-730/mt FD North West Europe levels, a week on week rise of Euro (+15/mt).

European ethylene contract price for July 2025 settled at the Euro 1135/MT FD North West Europe levels. This price represents a rollover from its June 2025 settlement levels.