Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, PP spot prices journeyed southward, while contract prices were assessed steady in the European region. An industry source in Europe informed a Polymerupdate team member, "The European polypropylene (PP) spot market experienced dampened purchase interest, with decreased spot prices noted for both homopolymer injection and copolymer grades. Weak demand continued throughout the sector, while heightened competition from import offers further impacted prices. Overall market activity was restricted, as purchasers kept inventory levels low even as numerous participants opted to stay away from the market because of summer holidays. The lowered demand led to increased material availability. A trader pointed to an excess of homopolymer and some surplus in copolymer while opining that purchasing interest might stay consistent in September. Pre-buying activity in August is projected to be less robust than in prior years.”

An industry source in Europe informed a Polymerupdate team member, "The European polypropylene (PP) spot market experienced dampened purchase interest, with decreased spot prices noted for both homopolymer injection and copolymer grades. Weak demand continued throughout the sector, while heightened competition from import offers further impacted prices. Overall market activity was restricted, as purchasers kept inventory levels low even as numerous participants opted to stay away from the market because of summer holidays. The lowered demand led to increased material availability. A trader pointed to an excess of homopolymer and some surplus in copolymer while opining that purchasing interest might stay consistent in September. Pre-buying activity in August is projected to be less robust than in prior years.”

A leading supplier stated that packaging continued to be the sole reliable source of healthy demand, especially in tray applications. A spurt in competitive import offers continued to exert downward pressure on spot prices, particularly for injection-grade products from the Middle East. Market participants additionally noted that CIF NWE offers for copolymer from South Korea were being reported at reduced prices. Although traders are advocating for reduced prices, they are not seeking increased volumes. August contract pricing decreased due to weak market conditions.

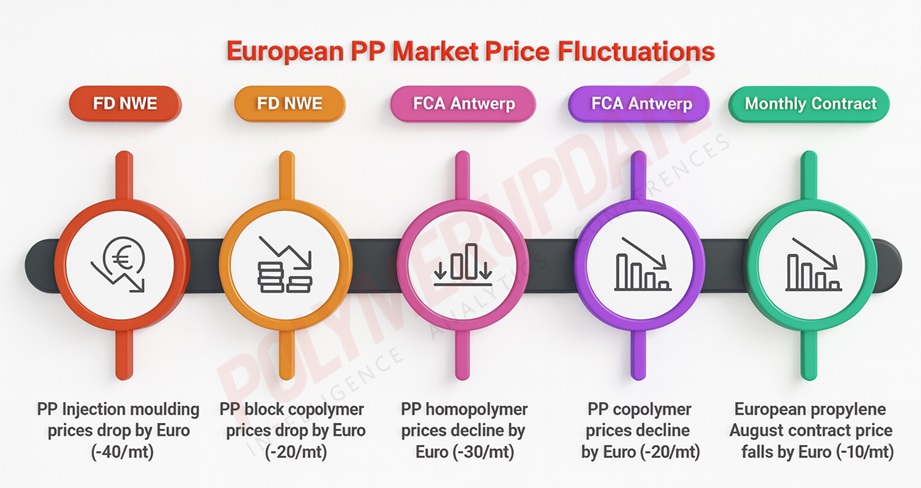

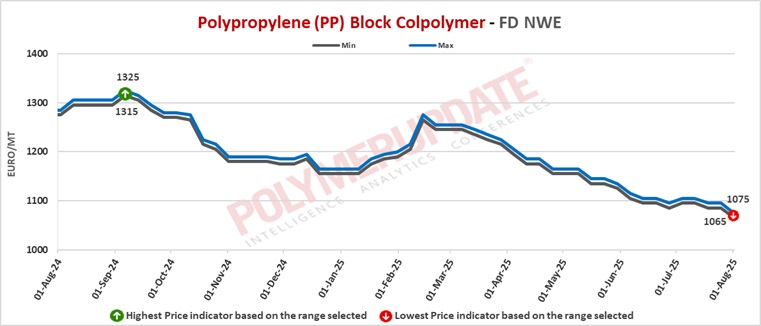

In the spot markets, PP injection moulding grade prices were assessed at the Euro 945-955/mt FD North West Europe mark, a sharp week on week drop of Euro (-40/mt) from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the Euro 1065-1075/mt FD Northwest Europe levels, a fall of Euro (-20/mt) from the previous week.

Meanwhile in the contract markets, PP injection moulding grade prices were assessed at the Euro 1390-1395/mt FD NWE Germany and FD NWE France levels, both stable from last week. PP injection moulding grade prices were assessed at the Euro 1380-1385/mt FD NWE Italy levels, steady week on week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1200-1205/mt FD NWE UK levels, unchanged from last week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1460-1465/mt FD NWE Germany and FD NWE France levels, both left unchanged week on week. PP block copolymer grade prices were assessed at the Euro 1450-1455/mt FD NWE Italy levels, flat from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1260-1265/mt FD NWE UK levels, week on week rolled over.

Trading activity in the European polypropylene (PP) market continued to be quiet, mainly because of the seasonal downturn caused by the summer holiday season. Purchasers have mostly met their restocking requirements, which were already diminished because of seasonal closures at numerous converters' facilities during the latter part of July and extending into August. The PP market is still experiencing oversupply, putting sellers under growing pressure to sell their volumes. Market conditions for PP homopolymer grades are especially poor, as a continuous supply surplus significantly impacts sentiment. Demand is anticipated to remain mostly subdued until late August, exacerbating the existing pessimistic perspective. The price forecast for August stays backwardated, partly influenced by a drop in the monthly contract price (MCP) for propylene. This decrease was affected by an accumulation of spot supply in July and negative demand predictions for the short term.

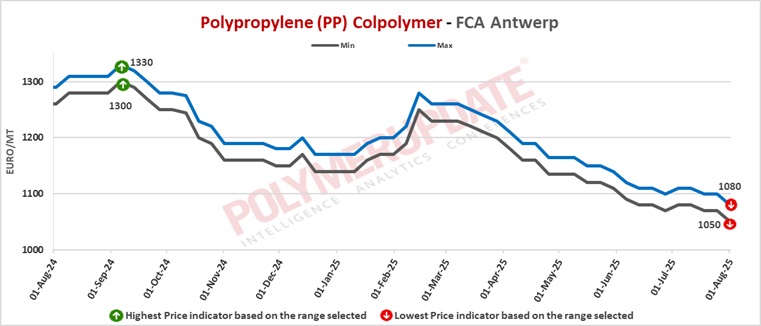

FCA Antwerp PP homopolymer prices were assessed at the Euro 930-970/mt level, a decline of Euro (-30/mt) from the previous week. Meanwhile, FCA Antwerp PP copolymer prices were assessed at the Euro 1050-1080/mt levels, down Euro (-20/mt) from last week.

Upstream propylene spot prices on Thursday were assessed at the Euro 745-755/mt FD Northwest Europe levels, constant from last week.

European propylene contract price for August 2025 settled at the Euro 1005/MT FD North West Europe levels. This price represents a fall of Euro (-10/mt) from its July 2025 settlement levels.