Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

The Reserve Bank of India (RBI) maintained the status quo on policy rates and kept the repo rate unchanged at 5.5 percent, despite softer-than-expected retail inflation prints and a significant downward revision in inflation forecasts. The Monetary Policy Committee (MPC) voted unanimously to retain the policy repo rate under the Liquidity Adjustment Facility (LAF). Consequently, the Standing Deposit Facility (SDF) rate remains unchanged at 5.25 percent, while the Marginal Standing Facility (MSF) rate and the Bank Rate stay at 5.75 percent. The decision was taken unanimously during the MPC’s three-day meeting held from August 4 to 6, after assessing macroeconomic challenges emerging from US President Donald Trump’s imposition of a 25 percent tariff on Indian goods and his threat of further punitive measures of up to 100 percent tariffs. These actions are in response to New Delhi’s crude oil and defence equipment imports from Russia. The newly announced 25 percent tariff will come into effect on August 8, with experts projecting a modest 0.2 percent negative impact on the Indian economy.

The decision was taken unanimously during the MPC’s three-day meeting held from August 4 to 6, after assessing macroeconomic challenges emerging from US President Donald Trump’s imposition of a 25 percent tariff on Indian goods and his threat of further punitive measures of up to 100 percent tariffs. These actions are in response to New Delhi’s crude oil and defence equipment imports from Russia. The newly announced 25 percent tariff will come into effect on August 8, with experts projecting a modest 0.2 percent negative impact on the Indian economy.

RBI Governor Sanjay Malhotra stated, “The current macroeconomic conditions, outlook, and prevailing uncertainties call for the continuation of the policy repo rate as we await further transmission of the front-loaded rate cuts to credit markets and the broader economy. After a detailed assessment of evolving macroeconomic and financial developments, the MPC voted unanimously to keep the policy repo rate unchanged.”

The Governor further added, “The MPC also decided to continue with its neutral stance. The Committee resolved to maintain a close vigil on incoming data and evolving domestic growth-inflation dynamics to chart out the appropriate monetary policy path. Accordingly, all members decided to persist with the neutral stance.”

Commenting on the repo rate decision, Sujan Hajra, Chief Economist & Executive Director at Anand Rathi Group, said, “With medium-term inflation now projected to hover around the 4 percent mark, we expect the terminal repo rate in this cycle to settle near 5 percent. This indicates room for an additional 50 basis points (bps) reduction, with the possibility of a further 25 bps cut if inflation consistently remains below 4 percent. Overall, today’s policy announcement and outlook reinforce a constructive backdrop for both equity and debt markets.”

Economic growth

Domestic growth is holding up and broadly evolving along expected lines, even though some high-frequency indicators showed mixed signals during May-June. Rural consumption remains resilient, while the revival in urban consumption—particularly discretionary spending—continues to be tepid. Fixed investment, supported by buoyant government capital expenditure, continues to sustain economic activity.

On the supply side, a steady southwest monsoon is supporting kharif sowing, replenishing reservoir levels, and boosting agricultural activity. Moreover, services activity remains steady, though some high-frequency indicators recorded only modest expansions. The Services PMI rose to an 11-month high in July, and construction activity continues to exhibit resilience. However, growth in the industrial sector remains subdued and uneven across segments, dragged down by weakness in electricity and mining.

Meanwhile, supportive monetary, regulatory, and fiscal policies, including robust government capital expenditure, are expected to boost demand. With sustained growth in construction and trade segments, the services sector is likely to remain buoyant in the coming months. However, prospects for external demand remain uncertain amid ongoing tariff escalations and trade negotiations. Headwinds from prolonged geopolitical tensions, persistent global uncertainties, and volatility in global financial markets pose risks to the growth outlook.

Mahendra Patil, Founder and Managing Partner of MP Financial Advisory Services LLP, said, “The RBI’s decision to maintain policy rates with a neutral stance reflects a judicious balance between domestic stability and global uncertainty. Meanwhile, tariff escalations by the US have added fresh pressure on India’s export competitiveness. In this context, the RBI’s signal of not responding impulsively with monetary easing, but instead relying on structural resilience and leaving room for fiscal measures to counter external shocks, is prudent.”

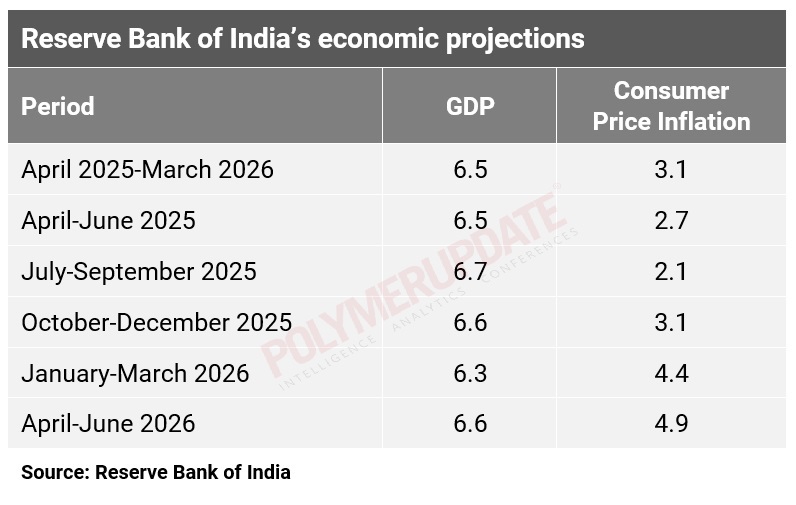

Taking all these factors into account, real GDP growth for the financial year 2025-26 (April-March) is projected at 6.5 percent, with growth in April-June at 6.5 percent, July-September at 6.7 percent, October-December at 6.6 percent, and January-March 2026 at 6.3 percent. Real GDP growth for April-June 2026 is projected at 6.6 percent. Overall, the RBI’s stance is one of cautious optimism, aimed at supporting domestic demand and financial stability, while keeping policy levers ready for deployment should global headwinds intensify further.

Retail inflation

India’s headline inflation, as measured by the Consumer Price Index (CPI), declined for the eighth consecutive month to a 77-month low of 2.1 percent in June. This was primarily driven by a sharp decline in food inflation, aided by improved agricultural activity and various supply-side measures. Food inflation recorded its first negative print since February 2019, at (-) 0.2 percent in June. Double-digit deflation in vegetables and pulses contributed significantly to this contraction. Fuel group inflation also moderated for the second consecutive month, easing to 2.6 percent in June.

The inflation outlook for 2025-26 has become more benign than anticipated in June. Large favourable base effects, coupled with the steady progress of the southwest monsoon, healthy kharif sowing, adequate reservoir levels, and comfortable buffer stocks of foodgrains, have all contributed to this moderation. However, weather-related shocks continue to pose risks to the inflation trajectory. Taking all these factors into account, CPI inflation for 2025-26 is now projected at 3.1 percent.

Arsh Mogre, Economist at PL Capital, said, “The RBI’s decision to hold the repo rate was not merely an act of prudence but a calibrated pause at the intersection of global fragility and domestic resilience. While headline inflation remains benign and the front-loaded 50 bps rate cut from June is still transmitting through the system, the MPC appears acutely aware that downside risks to growth from tariff spillovers are not yet fully priced in. Therefore, today’s decision preserves both credibility and flexibility, acknowledging that we are in an uncertain world where macroeconomic policy must avoid both premature celebration and pre-emptive exhaustion.”

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com