Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, PP spot prices drifted lower, while contract prices quoted flat in the European region._spot_prices_trend_lower_in_Europe_-_visual_selection.png) An industry source in Europe informed a Polymerupdate team member, "The European polypropylene (PP) market maintained its soft pricing as consistently low demand applied pressure on spot prices. Market players indicated minimal purchasing interest, as several producers expressed worries about diminishing margins and the overall economic feasibility of PP manufacturing. Market players pointed to a limited number of suppliers facing shortages, which complicates efforts to demand higher prices in a market with ample supply. The negative production margins are causing certain participants to reconsider their operating rates. Even with the generally low demand environment, the packaging sector continued to stand out, showing consistent offtake, as reported by market sources.”

An industry source in Europe informed a Polymerupdate team member, "The European polypropylene (PP) market maintained its soft pricing as consistently low demand applied pressure on spot prices. Market players indicated minimal purchasing interest, as several producers expressed worries about diminishing margins and the overall economic feasibility of PP manufacturing. Market players pointed to a limited number of suppliers facing shortages, which complicates efforts to demand higher prices in a market with ample supply. The negative production margins are causing certain participants to reconsider their operating rates. Even with the generally low demand environment, the packaging sector continued to stand out, showing consistent offtake, as reported by market sources.”

In the meantime, the price difference between homopolymer and copolymer PP experienced a modest decrease. This was linked to an increase in copolymer imports, especially from South Korea. In the past, copolymer prices were bolstered by restricted import supply and fairly inelastic demand from niche applications, including automotive and medical goods. The arrival of competitively priced imports has now increased pressure on copolymer prices.

Looking forward, market players are monitoring possible supply changes and whether demand will recover after summer to further stabilize the market.

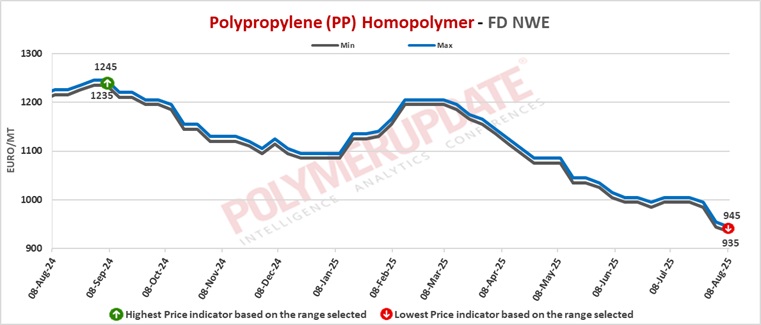

In the spot markets, PP injection moulding grade prices were assessed at the Euro 935-945/mt FD North West Europe mark, a week on week drop of Euro (-10/mt) from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the Euro 1035-1045/mt FD Northwest Europe levels, a decline of Euro (-30/mt) from the previous week.

Meanwhile in the contract markets, PP injection moulding grade prices were assessed at the Euro 1390-1395/mt FD NWE Germany and FD NWE France levels, both left unchanged from last week. PP injection moulding grade prices were assessed at the Euro 1380-1385/mt FD NWE Italy levels, stable week on week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1210-1215/mt FD NWE UK levels, a rise of GBP (+10/mt) from last week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1460-1465/mt FD NWE Germany and FD NWE France levels, both steady week on week. PP block copolymer grade prices were assessed at the Euro 1450-1455/mt FD NWE Italy levels, unchanged from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1275-1280/mt FD NWE UK levels, a week on week gain of GBP (+15/mt).

Trading activity in the European polypropylene (PP) market stayed muted, primarily because of the seasonal lull caused by extensive summer holiday shutdowns. The majority of buyers have covered their minimal restocking requirements, which were additionally limited by the temporary closures at various converters' plants from late July to August. The market is still dealing with an oversupply scenario, heightening stress on sellers to offload inventory in a low-demand environment. The situation is especially difficult for PP homopolymer grades, as the ongoing supply surplus is greatly affecting market sentiment.

Demand is anticipated to remain weak for the majority of August, further intensifying the already negative outlook. Compounding the market’s difficulties is the backwardated pricing outlook for August, supported by a drop in the monthly contract price (MCP) for propylene. This reduction was prompted by an increase in spot propylene availability in July, along with weakened short-term demand outlooks in major end-use industries. Unless a significant increase in demand occurs by the end of the month, PP producers might have to contemplate additional output reductions or more assertive export tactics to control inventory volumes.

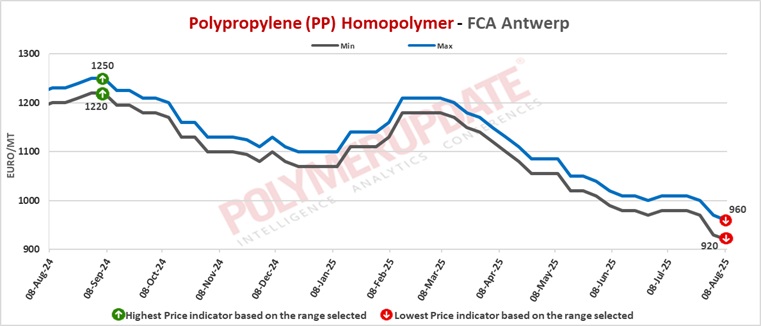

FCA Antwerp PP homopolymer prices were assessed at the Euro 920-960/mt level, a decrease of Euro (-10/mt) from the previous week. Meanwhile, FCA Antwerp PP copolymer prices were assessed at the Euro 1020-1050/mt levels, sharply lower by Euro (-30/mt) from last week.

Upstream propylene spot prices on Thursday were assessed at the Euro 750-760/mt FD Northwest Europe levels, marginally higher by Euro (+5/mt) from last week.

European propylene contract price for August 2025 settled at the Euro 1005/MT FD North West Europe levels. This price represents a fall of Euro (-10/mt) from its July 2025 settlement levels.