Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, PVC prices firmed in the Asian region. An industry source in Asia, on condition of anonymity, informed a Polymerupdate team member, "PVC prices in Asia rose as a leading Taiwanese producer raised its offers, establishing a stronger sentiment in the regional market. The upward trend was bolstered by increased import offers from foreign suppliers, which provided extra support to sentiment. Regional buyers are demonstrating cautious interest due to anticipated tighter supply and strong upstream expenses, leading to a market outlook that leans towards stability, with a possibility of additional gains if demand picks up in downstream sectors.”

An industry source in Asia, on condition of anonymity, informed a Polymerupdate team member, "PVC prices in Asia rose as a leading Taiwanese producer raised its offers, establishing a stronger sentiment in the regional market. The upward trend was bolstered by increased import offers from foreign suppliers, which provided extra support to sentiment. Regional buyers are demonstrating cautious interest due to anticipated tighter supply and strong upstream expenses, leading to a market outlook that leans towards stability, with a possibility of additional gains if demand picks up in downstream sectors.”

The source added, “Ukrainian strikes on Russian energy infrastructure have heightened supply concerns, though prices have moderated slightly as markets adapt to the situation. Geopolitical tensions, particularly the Russia–Ukraine conflict, continue to drive short-term volatility. Despite forecasts of oversupply, futures markets point to near-term tightness. Elevated prices may sustain inflation in the short run, but an expected decline over the medium to long term could help ease global energy costs.”

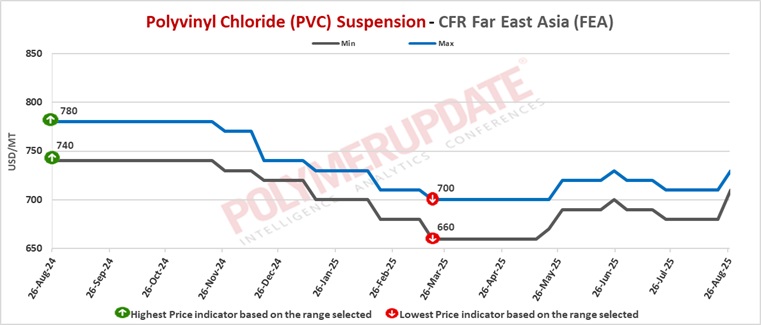

In China, PVC prices were assessed at the USD 710-730/mt CFR levels, higher by USD (+20/+30/mt) week on week.

In China, a Taiwanese producer has offered its PVC resin suspension grade at the USD 710/mt levels, for shipment in September 2025. A producer from Asia has offered its PVC resin suspension grade at the USD 730/mt levels, for shipment in September 2025.

In China, major Asian PVC producers increased their offer prices, yet the proposed levels were seen as exceeding current regional anticipations, resulting in a pushback from purchasers. The alteration in policy prompted a cautious outlook, leading numerous market players to take a wait-and-see stance prior to engaging in new purchases. Even with these external pressures, the core aspects of China’s domestic spot market stayed generally stable.

Supply remained fairly balanced due to planned maintenance at specific facilities, which helped avoid oversupply, while demand from downstream sectors like construction and infrastructure projects stayed stable, offering some support for local price stability. However, uncertainty regarding regional trade dynamics and the effect of ADD on Indian consumer behaviour persists, complicating the short-term forecast and increasing the likelihood that producers may have to adjust their pricing approaches to stay competitive in export markets.

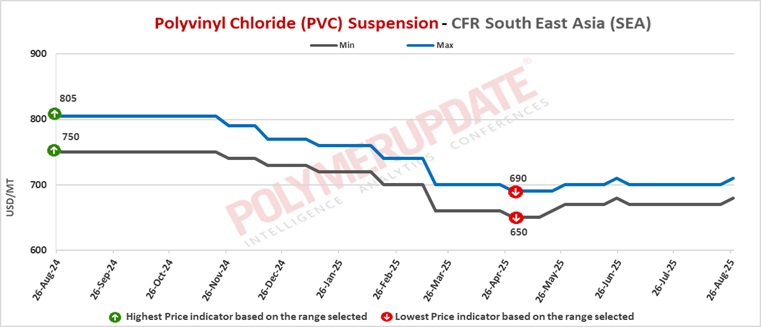

In Southeast Asia, PVC prices were assessed at the USD 680-710/mt CFR levels, an increase of USD (+10/mt) from the previous week.

In South East Asia, overseas producers have offered their PVC resin suspension grades in the range of USD 680-710/mt levels, for shipment in September 2025.

In Southeast Asia, elevated import offers drove prices higher. Simultaneously, scattered restocking efforts were noted, as purchasers restricted acquisitions to their urgent needs. Wider demand continued to be weak as orders decreased after the introduction of US tariffs earlier this month, maintaining an overall subdued market activity

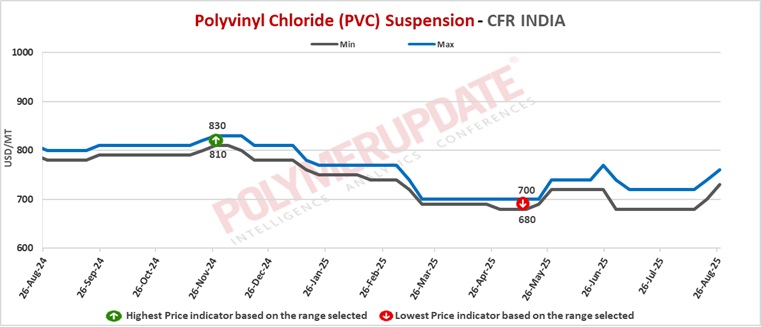

In India, PVC prices were assessed at the USD 730-760/mt CFR levels, up USD (+20/+30/mt) week on week.

A domestic Industry source informed a Polymerupdate team member, “RIL has increased PVC prices by Rs.2/kg basic, wef August 21, 2025.”

In India, producers experiencing positive duty outcomes have independently increased offers to India with some success, as buyers began to lock in shipments before the ADD implementation. A major Taiwanese producer has offered its PVC suspension grades (S65D/S65/S60/S70) and (B57) grade at the USD 760/mt levels respectively while (S57) grade is on offer at the USD 770/mt level. These offers are on CIF Nhava Sheva/Mundra/Chennai ports basis with shipment for September 2025 (LC at sight). These offers are higher by USD 30/mt from the previous month offers. Add USD 40/mt for CIF Pipavav port. For LC 90 days (Add USD 10/mt). _prices_climb_in_Asia_-_visual_selection.png) India’s PVC sector experienced a significant shift with the government proposing to implement anti-dumping duties (ADD) on imports of suspension-grade PVC (S-PVC). The proposed move to impose ADD on S-PVC imports quickly boosted sentiment, causing increases in both import and domestic prices. In response, Formosa increased its offers, taking advantage of the improved market outlook following the intention to implement ADD, which is anticipated to limit cheaper imports into India and establish a more advantageous pricing landscape for domestic producers. Even with this optimistic shift, seasonal monsoon rains persisted in impacting downstream demand from construction and agriculture industries, moderating the rate of purchasing interest while sellers sought stronger offers.

India’s PVC sector experienced a significant shift with the government proposing to implement anti-dumping duties (ADD) on imports of suspension-grade PVC (S-PVC). The proposed move to impose ADD on S-PVC imports quickly boosted sentiment, causing increases in both import and domestic prices. In response, Formosa increased its offers, taking advantage of the improved market outlook following the intention to implement ADD, which is anticipated to limit cheaper imports into India and establish a more advantageous pricing landscape for domestic producers. Even with this optimistic shift, seasonal monsoon rains persisted in impacting downstream demand from construction and agriculture industries, moderating the rate of purchasing interest while sellers sought stronger offers.

In Pakistan, PVC prices were assessed at the USD 730-760/mt CFR levels, a gain of USD (+10/NC/mt) from last week.

In Pakistan, a producer from Indonesia has offered its PVC resin suspension grade at the USD 730/mt levels, for shipment in September 2025. An overseas producer has offered its PVC resin suspension grade at the USD 760/mt levels, for shipment in September 2025.

In Pakistan, PVC demand sentiment has dampened with ongoing monsoon conditions keeping activity subdued in major end-use sectors. Concurrently, spot supply conditions have experienced an uptick compared to last week, reducing immediate availability worries despite weak purchasing interest

In Sri Lanka, PVC prices were assessed at the USD 720-750/mt CFR levels, a week on week rise of USD (+10/NC/mt).

In Sri Lanka, overseas producers have offered their PVC resin suspension grades in the range of USD 720-750/mt levels, for shipment in September 2025.

In Bangladesh, PVC prices were assessed at the USD 690-720/mt CFR levels, a hike of USD (+10/mt) from the previous week.

In Bangladesh, overseas producers have offered their PVC resin suspension grades in the range of USD 690-720/mt levels, for shipment in September 2025.

Feedstock EDC prices were assessed at the USD 175-185/mt CFR China levels while CFR South East Asia EDC prices were assessed at the USD 185-195/mt levels, both rolled over week on week.

CFR South East Asia VCM prices were assessed flat at the USD 520-530/mt levels and CFR China VCM prices were left unchanged at the USD 545-555/mt levels.

Feedstock ethylene prices on Monday were assessed at the USD 825-835/mt CFR South East Asia levels, a gain of USD (+10/mt) from last week. CFR North East Asia ethylene prices were assessed at the USD 835-845/mt levels, a week on week rise of USD (+15/mt).

In plant news, Hanwha Solutions is likely to shut down its Polyvinyl chloride (PVC) unit in November 2025 for a maintenance turnaround. The exact date and duration of the shutdown could not be ascertained. Located in Ulsan, South Korea, the unit has a PVC suspension production capacity of 210,000 mt/year and emulsion production capacity of 95,000 mt/year.

In other plant news, Taiwan VCM has undertaken a planned shutdown at its Ethylene dichloride (EDC) unit in mid-August 2025 for maintenance. The unit is expected to remain offline until mid-September 2025. Located in Lin Yuan, Taiwan, the EDC unit has a production capacity of 470,000 mt/year.

In another plant news, Sulfindo Adiusaha continues to run its Ethylene dichloride (EDC) plant at 65% of production capacity levels since mid-August 2025. The reason behind the curtailed capacity levels could not be ascertained. Located in Bojonegara, Indonesia, the plant has a production capacity of 370,000 mt/year.