This week, PVC spot prices tumbled while contract prices remained constant in the European region.

An industry source in Europe informed a Polymerupdate team member, "The European PVC market experienced a downtrend in spite of a key derivative sector like construction witnessing a seasonal upswing. Market participants cited excess supplies, slowdown in material offtake, and a drop in feedstock rates as key factors weighing on the overall market conditions. General demand sentiments were weak, with material replenishment initiatives by customers experiencing a decelerated momentum. While output was held stable by producers in Europe, demand is unlikely to witness a rebound in the immediate future."

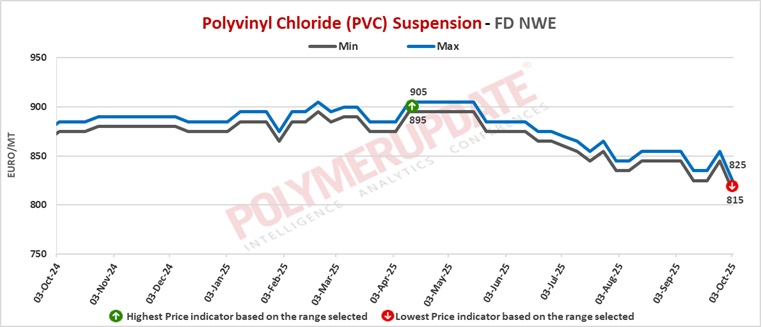

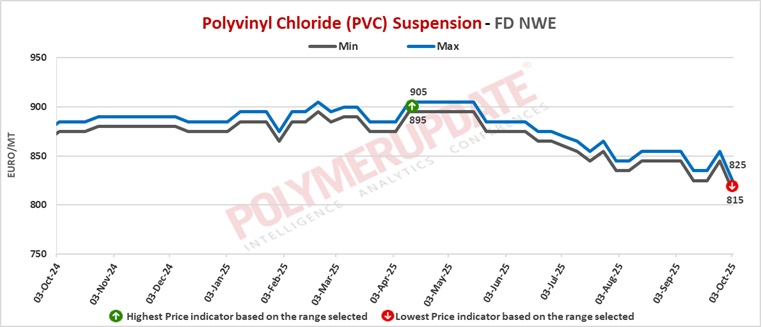

In the spot markets, FD North West Europe PVC prices were assessed at the Euro 815-825/mt levels, a week on week decline of Euro (-30/mt).

In the contract markets, PVC Suspension grade prices were assessed at the Euro 950-955/mt FD NWE Germany and FD NWE France levels, both unchanged from the previous week. PVC Suspension grade prices were assessed at the Euro 960-965/mt FD NWE Italy levels, stable from last week. Meanwhile, PVC prices were assessed at the GBP 825-830/mt FD NWE UK levels, a fall of GBP (-5/mt) week on week.

Meanwhile, feedstock EDC prices were assessed at the USD 100-110/mt FOB North West Europe levels, marginally up USD (+5/mt) from last week while VCM prices were assessed at the USD 485-495/mt FOB North West Europe levels, a rise of USD (+10/mt) from the previous week.

Ethylene spot prices on Thursday were assessed at the Euro 660-670/mt FD North West Europe levels, a week on week fall of Euro (-5/mt).

European ethylene contract price for October 2025 settled at the Euro 1130/MT FD North West Europe levels. This price represents a roll over from its September 2025 settlement levels.