This week, LDPE prices climbed in the Asian region.

An industry source in Asia, on condition of anonymity, informed a Polymerupdate team member, “LDPE import market prices remained elevated due to tight supply from the Middle Eastern region and supportive upstream energy sentiment.”

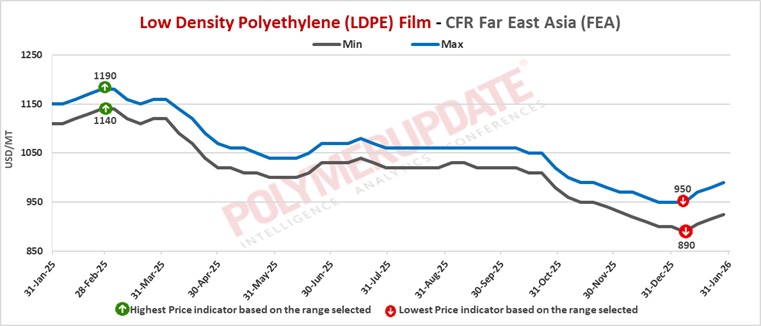

In Far East Asia, LDPE film grade prices were assessed at USD 925-990/mt CFR levels, a week-on-week increase of USD (+10/mt).

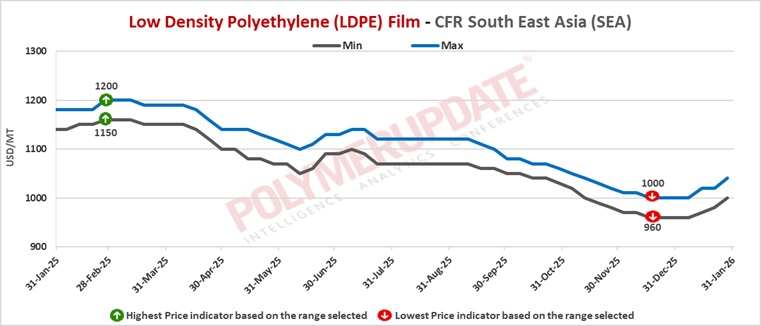

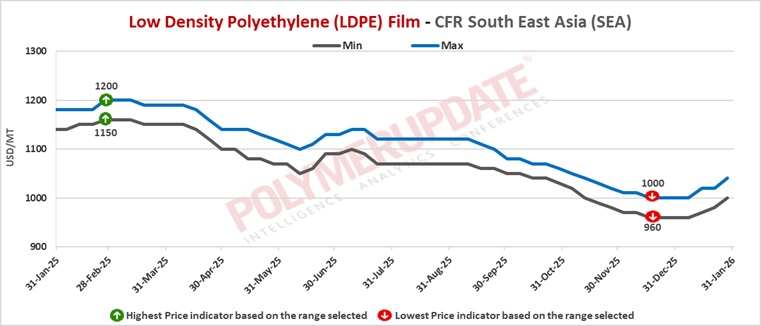

In South East Asia, LDPE film grade prices were assessed at USD 1000-1040/mt CFR levels, higher by USD (+20/mt) from the previous week.

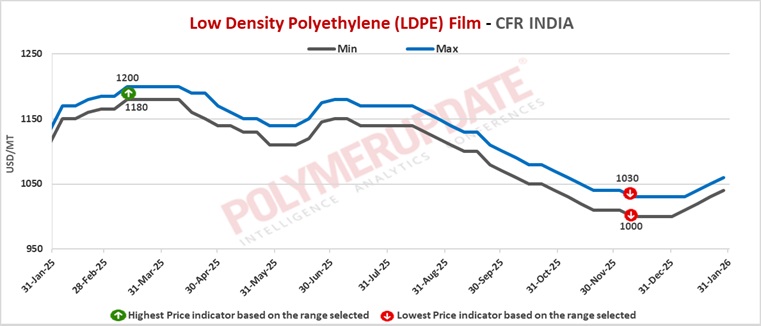

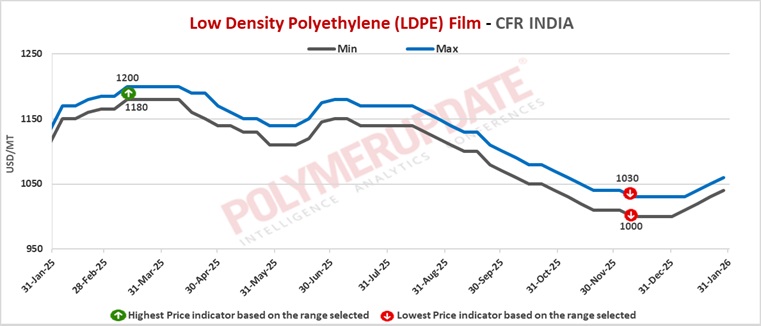

In India, LDPE prices were assessed at USD 1040-1060/mt CFR levels, up USD (+10/mt) from last week. Although import prices trended higher in the Indian market, weak downstream demand and rising cost pressures from the depreciation of the Indian rupee weighed on the market.

In Pakistan, LDPE prices were assessed at USD 1040-1060/mt CFR levels, a week-on-week rise of USD (+10/mt).

In Sri Lanka, LDPE prices were assessed at USD 1110-1140/mt CFR levels, an increase of USD (+10/+20/mt) from the previous week.

In Bangladesh, LDPE prices were assessed at USD 1040-1070/mt CFR levels, a rise of USD (+10/mt) from last week.

Feedstock ethylene prices were assessed at USD 695–705/mt CFR North East Asia levels, a week-on-week drop of USD (-10/mt). CFR South East Asia ethylene prices were assessed at USD 680–690/mt levels, lower by USD (-5/mt) from the previous week.