Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

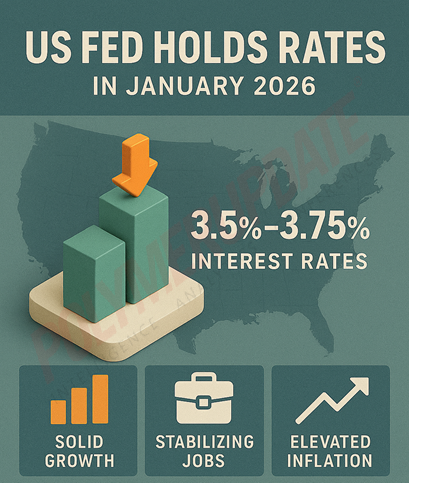

The United States Federal Reserve (US Fed) on Wednesday decided to leave the key interest rate unchanged at the 3.5–3.75 percent target range at its January 2026 meeting, citing solid expansion in economic activity, moderating job gains, and a stabilising unemployment rate, even as inflation remains somewhat elevated. Three cumulative rate cuts last year pulled borrowing costs to their lowest level since 2022. The decision was taken by a 10–2 majority following the conclusion of the two-day Federal Open Market Committee (FOMC) meeting on Wednesday. Governors Stephen Miran and Christopher Waller voted against the decision to hold rates, with both advocating another 25-basis-point cut. Policymakers noted that economic activity has been expanding at a solid pace, job gains have moderated, and the unemployment rate has shown signs of stabilisation, while inflation remains somewhat elevated.

The decision was taken by a 10–2 majority following the conclusion of the two-day Federal Open Market Committee (FOMC) meeting on Wednesday. Governors Stephen Miran and Christopher Waller voted against the decision to hold rates, with both advocating another 25-basis-point cut. Policymakers noted that economic activity has been expanding at a solid pace, job gains have moderated, and the unemployment rate has shown signs of stabilisation, while inflation remains somewhat elevated.

Addressing the media, US Fed Chair Jerome Powell said, “The US economy expanded at a solid pace last year and is coming into 2026 on a firm footing. While job gains have remained low, the unemployment rate has shown some signs of stabilisation, and inflation remains somewhat elevated. In support of our goals, today the FOMC decided to leave our policy rate unchanged. Having lowered our policy rate by 75 basis points over the course of our previous three meetings, we see the current stance of monetary policy as appropriate to promote progress toward both our maximum employment and 2 percent inflation goals.”

Powell added that the Committee seeks to achieve maximum employment and inflation at a rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated, and the Committee remains attentive to risks on both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at its existing level.

Focus on employment

The Committee seeks to achieve maximum employment and inflation at a rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated, and the Committee is attentive to risks on both sides of its dual mandate. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee remains strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee stands ready to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of its goals. These assessments will take into account a wide range of information, including readings on labour market conditions, inflation pressures and expectations, and financial and international developments.

Commenting on the decision, James Knightley, Chief International Economist at ING Economics, said, “The key takeaway is a slightly hawkish twist to the accompanying statement. Downside risks to employment had risen in recent months, but that language was removed today. Other than that, growth is described as ‘solid’, while policymakers acknowledge ‘some signs of stabilisation’ in the unemployment rate. Chair Powell acknowledged data distortions related to the pandemic, but suggested that the growth outlook has improved in recent months.”

Stabilising labour market

Indicators suggest that conditions in the labour market may be stabilising after a period of gradual softening. The unemployment rate stood at 4.4 percent in December and has changed little in recent months. Job gains have remained low. Total nonfarm payrolls declined at an average pace of 22,000 per month over the past three months; excluding government employment, private payrolls rose at an average pace of 29,000 per month.

A significant portion of the slowdown in job growth over the past year reflects a decline in labour force growth, due to lower immigration and reduced labour force participation, although labour demand has also clearly softened. Other indicators, including job openings, layoffs, hiring, and nominal wage growth, have shown little change in recent months.

Elevated inflation

Inflation has eased significantly from its mid-2022 highs but remains somewhat elevated relative to the 2 percent longer-run goal. Estimates based on the Consumer Price Index indicate that total Personal Consumption Expenditures (PCE) prices rose 2.9 percent over the 12 months ending in December, while core PCE prices—excluding the volatile food and energy categories—increased 3.0 percent.

These elevated readings largely reflect inflation in the goods sector, which has been boosted by the effects of tariffs. In contrast, disinflation appears to be continuing in the services sector. Near-term measures of inflation expectations have declined from last year’s peaks, as reflected in both market- and survey-based indicators. Most measures of longer-term expectations remain consistent with the 2 percent inflation goal.

Duel goal mandate

The Federal Reserve has been assigned two goals for monetary policy—maximum employment and stable prices. The US Fed remains committed to supporting maximum employment, bringing inflation sustainably to its 2 percent goal, and keeping longer-term inflation expectations well anchored. Success in delivering on these goals matters to all Americans. The Fed will continue to carry out its responsibilities with objectivity, integrity, and a deep commitment to serving the American people.

Since last September, the Fed has lowered its policy rate by 75 basis points (bps), or three-quarters of a percentage point, bringing it within a range of plausible estimates of neutral. This normalisation of the policy stance should help stabilise the labour market while allowing inflation to resume its downward trend toward 2 percent once the effects of tariff increases have passed through. The US Fed is well positioned to determine the extent and timing of additional adjustments to the policy rate based on incoming data, the evolving outlook, and the balance of risks.

A more upbeat growth assessment

There were no new forecasts published at this meeting, but Chair Powell suggested that, had an update been released, it would have been firmer than the projections published in December. At that time, policymakers revised up fourth-quarter year-on-year 2026 GDP growth to 2.3 percent from 1.8 percent and indicated that unemployment would end the year at 4.4 percent, with the core PCE deflator at 2.5 percent.

Against this backdrop, they projected that just one further rate cut this year would be the most appropriate policy path. The latest consensus survey points to US GDP growth of 2.1 percent, unemployment of 4.4 percent, and a core PCE deflator of 2.5 percent, suggesting that the Fed is broadly in line with market expectations. Nonetheless, the consensus among economists is for two rate cuts this year, with markets currently pricing in around 46 basis points of easing.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com