Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

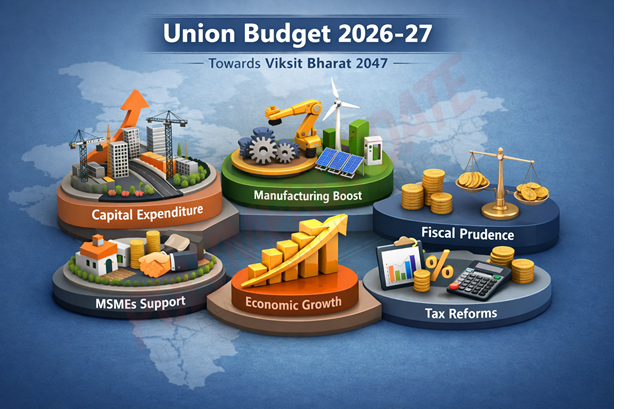

India’s Union Finance Minister Nirmala Sitharaman presented her ninth consecutive Budget—Union Budget 2026–27—in Parliament (Lok Sabha) on February 1, 2026. The Budget outlines a strategic blend of growth and inclusion, supporting Prime Minister Narendra Modi’s vision of transforming India into a Viksit Bharat (Developed India) by the centenary year of Independence in 2047. The Budget focuses on attracting both private and government investment in technology (AI) development, rare earth minerals, green energy, and inclusive growth for farmers across various strata, as well as small and medium enterprises (SMEs), which remain the backbone of the country’s economy. Adopting a balanced strategy—blending growth-oriented investments, structural tax reforms, and targeted social support—while continuing the long-term agenda of economic consolidation, the Finance Minister sustained a strong focus on public capital expenditure. The government has raised capital expenditure (capex) to Rs 12.2 lakh crore for FY’27 (April 2026–March 2027) to accelerate infrastructure creation, marking a nearly 9 percent year-on-year increase. This funding will underpin critical projects in transportation, energy, and logistics.

Adopting a balanced strategy—blending growth-oriented investments, structural tax reforms, and targeted social support—while continuing the long-term agenda of economic consolidation, the Finance Minister sustained a strong focus on public capital expenditure. The government has raised capital expenditure (capex) to Rs 12.2 lakh crore for FY’27 (April 2026–March 2027) to accelerate infrastructure creation, marking a nearly 9 percent year-on-year increase. This funding will underpin critical projects in transportation, energy, and logistics.

Commenting on the Budget, Arvind Singhania, Chairman & CEO, Ester Industries Ltd, said, “The Union Budget 2026 lays out a clear and forward-looking direction for strengthening India’s advanced materials and textile manufacturing ecosystem. The government’s integrated programme for the textile sector, with its focus on man-made and new-age fibres, technology modernisation, and expanded skilling under SAMARTH 2.0, directly enhances the competitiveness of segments that are both employment-intensive and export-oriented. For specialty materials players like Ester, this policy direction supports faster capacity creation, higher value addition, and deeper integration into global supply chains.”

Three kartavyas (duties)

Sitharaman proposed three kartavyas (duties) to accelerate and sustain the reform momentum towards Viksit Bharat. The first is to accelerate and sustain economic growth by enhancing productivity and competitiveness and building resilience against volatile global dynamics. The second is to fulfil the aspirations of the people and build their capacity, making them strong partners in India’s path to prosperity. The third is aligned with the vision of Sabka Saath, Sabka Vikas (growth with togetherness).

The Finance Minister said that in an external environment where trade and multilateralism are imperilled and access to resources and supply chains is disrupted, new technologies are transforming production systems while sharply increasing demand for water, energy, and critical minerals. The government has rolled out over 350 reforms since August 2025, including GST simplification, notification of Labour Codes, and rationalisation of mandatory Quality Control Orders.

Fiscal consolidation

The debt-to-GDP ratio is estimated at 55.6 percent of GDP in the Budget Estimates (BE) for 2026–27, compared with 56.1 percent of GDP in the Revised Estimates (RE) for 2025–26. A declining debt-to-GDP ratio is expected to gradually free up resources for priority-sector expenditure by reducing interest payment outgo. In RE 2025–26, the fiscal deficit is estimated at par with the BE for 2025–26 at 4.4 percent of GDP. In line with the new fiscal prudence path of debt consolidation, the fiscal deficit in BE 2026–27 is estimated at 4.3 percent of GDP.

The Revised Estimates of non-debt receipts stand at Rs 34 lakh crore, of which the Centre’s net tax receipts are Rs 26.7 lakh crore. The Revised Estimate of total expenditure is Rs 49.6 lakh crore, of which capital expenditure accounts for about Rs 11 lakh crore. For 2026–27, non-debt receipts and total expenditure are estimated at Rs 36.5 lakh crore and Rs 53.5 lakh crore, respectively, while the Centre’s net tax receipts are projected at Rs 28.7 lakh crore.

The Finance Minister said that public capital expenditure has increased manifold from Rs 2 lakh crore in FY2014–15 to an allocation of Rs 11.2 lakh crore in BE 2025–26, and is proposed to be raised further to Rs 12.2 lakh crore in FY2026–27 to sustain momentum. To finance the fiscal deficit, net market borrowings through dated securities are estimated at Rs 11.7 lakh crore, with the remaining financing expected to come from small savings and other sources. Gross market borrowings are estimated at Rs 17.2 lakh crore.

Proposals

In the marine, leather, and textile sectors, the limit for duty-free imports of specified inputs used for processing seafood products for export is proposed to be increased from the current 1 percent to 3 percent of the FOB value. Duty-free imports of specified inputs, which are currently available for exports of leather or synthetic footwear, will be allowed. In the energy sector, the basic customs duty (BCD) exemption on capital goods used for manufacturing lithium-ion cells for batteries will be extended, while the BCD on imports of sodium antimonate for use in the manufacture of solar glass will be exempted.

The Budget 2026–27 also proposes extending the existing BCD exemption on imports of goods required for nuclear power projects until 2035 and exempting BCD on specified parts used in the manufacture of microwave ovens. The BCD on imports of capital goods required for the processing of critical minerals will be exempted, and the entire value of biogas will be excluded while calculating the central excise duty payable on biogas-blended CNG.

In the civil and defence aviation sector, BCD on components and parts required for the manufacture of civilian, training, and other aircraft will be exempted. Additionally, BCD on raw materials imported for the manufacture of aircraft parts used in maintenance, repair, and overhaul (MRO) operations by defence sector units will be exempted. Further, a special one-time measure is proposed to facilitate sales by eligible manufacturing units in Special Economic Zones (SEZs) to the Domestic Tariff Area (DTA) at concessional duty rates.

STT hike

The Union Budget 2026–27 proposes to raise the Securities Transaction Tax (STT) on futures to 0.05 percent from the current 0.02 percent. The STT on options premium and on the exercise of options is also proposed to be increased to 0.15 percent, from the present rates of 0.10 percent and 0.125 percent, respectively. In the interest of minority stakeholders, buybacks for all types of shareholders will be taxed as capital gains. This will require promoters to pay an additional buyback tax, resulting in an effective tax rate of 22 percent for corporate promoters and 30 percent for non-corporate promoters.

The Tax Collected at Source (TCS) rate for sellers of specified goods—namely alcoholic liquor, scrap, and minerals—is proposed to be rationalised at 2 percent, while the TCS rate on tendu leaves will be reduced from 5 percent to 2 percent. To encourage companies to shift to the new tax regime, the Budget proposes that the set-off of brought-forward Minimum Alternate Tax (MAT) credit be allowed only under the new regime.

Set-off using available MAT credit will be permitted up to one-fourth of the tax liability under the new regime. Proposing to make MAT the final tax, the Finance Minister said there would be no further accumulation of MAT credit from April 1, 2026. The final tax rate will be reduced to 14 percent from the current MAT rate of 15 percent. However, brought-forward MAT credit accumulated up to March 31, 2026, will continue to be available for set-off as outlined above.

Raamdeo Agrawal, Chairman and Co-Founder of leading equity broking firm Motilal Oswal Financial Services Ltd (MOFSL), estimated a 15–20 percent decline in equity market volumes, noting that smaller trades, such as those by day traders, may become unviable due to the sharp increase in STT.

Conclusion

The Union Budget 2026–27 reflects a calibrated approach to India’s economic challenges. By prioritising infrastructure investment, manufacturing self-reliance, MSME growth, and digital empowerment, the government aims to sustain momentum toward its broader vision of a Viksit Bharat (Developed India). Strategic reforms in taxation and technology adoption seek to enhance competitiveness while preserving fiscal prudence.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com