Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

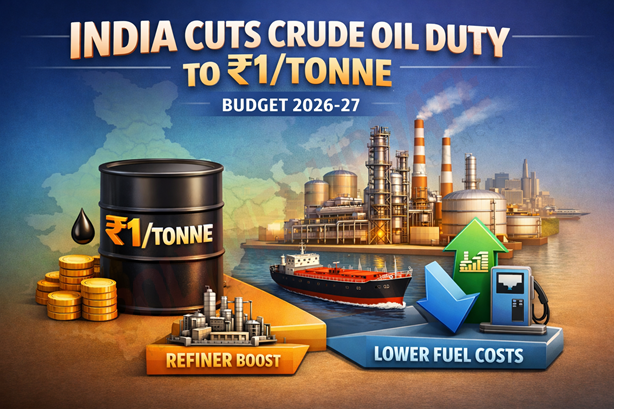

India has cut the basic customs duty on crude petroleum to Re 1 per tonne in the Union Budget 2026–27, from the existing 5 percent ad valorem rate, to provide major relief to domestic refiners and position New Delhi as a global refining hub. The announcement was made by Union Finance Minister Nirmala Sitharaman while presenting the Union Budget 2026–27 in Parliament (Lok Sabha) on Sunday. The import duty cut will help refineries to pass on the downstream energy products such as diesel, petrol, Aviation Turbine Fuel (ATF), kerosene, and others cheaper. Additionally, the derivatives such as polymers are also likely to become cheaper now. India’s crude oil imports for the 2024–25 fiscal year (ending March 2025) are estimated at 244.5 million metric tonnes (MMT), up from 231.46 MMT in 2023–24. As the world’s third-largest oil consumer after the United States and China—the largest and second-largest respectively—India imports over 87 percent of its crude oil requirements, with daily imports averaging around 4.79 million barrels per day (bpd) as of December 2024.

India’s crude oil imports for the 2024–25 fiscal year (ending March 2025) are estimated at 244.5 million metric tonnes (MMT), up from 231.46 MMT in 2023–24. As the world’s third-largest oil consumer after the United States and China—the largest and second-largest respectively—India imports over 87 percent of its crude oil requirements, with daily imports averaging around 4.79 million barrels per day (bpd) as of December 2024.

While India sources crude oil from across the globe based on availability and price considerations, the major suppliers continue to be Russia, Iraq, Saudi Arabia, and the United Arab Emirates (UAE). Import dependence remained at around 87.7 percent in 2023–24. Russia continues to be a key supplier, although imports have been volatile, with a sharp 38 percent year-on-year decline in volumes recorded in October 2025. More recently, Venezuela has also reopened its market to Indian importers.

Current refining capacity

India’s crude oil refining capacity is likely to rise by 20 percent over the next five years, driven by a surge in domestic energy demand and growing export potential. Hardeep Singh Puri, Minister of Petroleum and Natural Gas, Government of India, recently said, “India’s energy journey reflects remarkable progress, driven by visionary policy frameworks, rapid innovation, and sustained investment across refining, biofuels, and green energy segments.”

The country’s current petroleum refining capacity stands at around 258 million metric tonnes per annum (MMTPA) and is on track to reach approximately 310 MMTPA by 2030. The government’s long-term plan is to raise refining capacity to 400–450 MMTPA. However, the timeline for achieving the upper end of 450 MMTPA remains unclear. Several government-owned and private-sector refiners have announced continuous capacity expansion plans in both the short and long term.

A global leader

While the global energy market is expected to grow at a slower pace, with several refineries worldwide facing closure, India stands out as a bright spot and is projected to contribute nearly 30–33 percent of global energy demand growth in the coming decades. These expansions are expected to consolidate India’s position among the top three global refining hubs, as around 20 percent of existing global refining capacity—spread across more than 100 refineries—faces potential closure by 2035.

Indian refineries are world-class, globally integrated, and export-ready. At present, India is already the world’s fourth-largest refining nation and among the top seven exporters of petroleum products, supplying to more than 50 countries and generating export revenues of over US$ 45 billion in FY 2024–25. The refining sector contributes nearly one-fifth of the country’s revenues, with both public- and private-sector entities demonstrating strong financial and operational performance. Additionally, domestic petroleum consumption has risen from around 5 million barrels per day (bpd) in 2021 to approximately 5.6 million bpd currently and is expected to reach 6 million bpd in the near term, supported by robust economic growth and rising per capita incomes.

Biofuel blending

India has achieved significant progress in ethanol blending over the past two decades. New Delhi advanced from a 5 percent blending target in 2006 to achieving a 10 percent ethanol blend five months ahead of schedule in 2022. Building on this success, the government advanced the target for 20 percent blending from 2030 to 2025–26. Well-designed policies and robust support systems have enabled these accelerated achievements, demonstrating India’s ability to set and meet ambitious energy goals.

India’s petrochemical utilisation remains at only about one-third of the global average, offering substantial scope for growth. The petrochemical intensity index has already risen from 7.7 percent to 13 percent, reflecting the sector’s upward trajectory. New refinery expansions are increasingly being planned as integrated petrochemical complexes to enhance efficiency, value addition, and export competitiveness.

Towards sustainability

The country’s energy strategy encompasses both fuel and petrochemical growth as part of a calibrated transition toward sustainability. While the share of traditional fuels will gradually decline, they will continue to play a major role for decades as India moves toward its 2047 goals. Simultaneously, the share of natural gas in the energy mix is being raised from 6 percent to 15 percent, green hydrogen is being scaled up, and renewable energy capacity is expanding rapidly—underscoring India’s commitment to meeting its climate goals without compromising energy security.

Recalling India’s historic refining legacy—from the first refinery at Digboi in 1901 to today’s global-scale facilities—the Minister said that post-2014 reforms and ecosystem strengthening have unlocked a new era of growth and innovation. Ongoing projects such as the Barmer Refinery and the Andhra Refinery were cited as key examples of the sector’s forward momentum. With over 100 biogas plants operational and another 70 in the pipeline, India is building an ecosystem that connects technology, investment, and sustainability.

As India advances toward becoming a US$ 10 trillion economy, its energy sector will not only meet domestic requirements but also serve global markets. By 2035, India is expected to move from being the world’s fourth-largest to potentially the second-largest refining power. A young demographic profile, rising energy demand, and a proactive policy environment will ensure that the country not only participates in but actively shapes the global energy future.

Investment potential

India’s energy sector lies at the centre of the country’s aspirations and offers investment opportunities worth around US$ 500 billion, Prime Minister Narendra Modi said while recently inaugurating the latest edition of the flagship energy event, Energy Week. Modi called upon the global community with the message: Make in India, Innovate in India, Scale with India, and Invest in India. He emphasised that India, as the world’s fastest-growing major economy, is a land of immense opportunities for the energy sector, with demand for energy products continuing to rise steadily.

India also offers strong opportunities to meet global energy demand. The country is among the world’s top five exporters of petroleum products, with exports reaching more than 150 countries. This capacity, Modi said, would be of great benefit to the global community. He further stressed that Energy Week serves as an excellent platform to explore partnerships and extended his best wishes to all participants.

India is actively working to build global partnerships across sectors. In the energy space alone, vast investment opportunities exist across multiple segments of the energy value chain. The country has significantly opened up its exploration sector and has also highlighted its deep-sea exploration initiative, the Samudra Manthan Mission. By the end of this decade, India aims to raise investments in the oil and gas sector to US$ 100 billion, with a target of expanding the exploration area to one million square kilometres.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com