Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

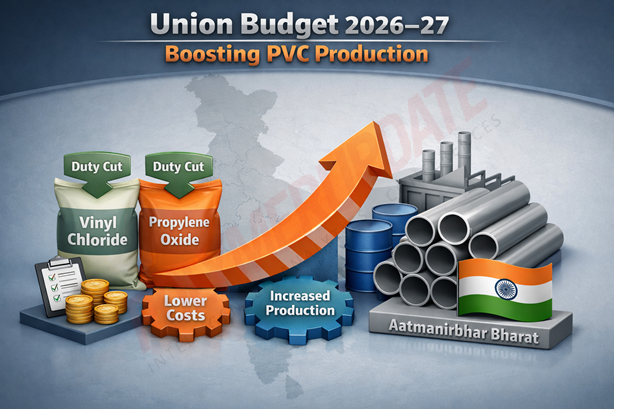

India has reduced the basic customs duty on vinyl chloride to 7.5 percent from the existing 10 percent to support domestic production of polyvinyl chloride (PVC) resin and promote Aatmanirbhar Bharat in this key plastic raw material. Vinyl chloride is a colourless, flammable, and toxic gas primarily used as a monomer in the production of PVC plastic. It is widely used in polymer manufacturing because it readily polymerises into durable, versatile, and cost-effective PVC resin, which is used in pipes, construction materials, cable coatings, and medical devices. The import duty cut will make cost of input such as vinyl chloride monomer (VCM), PVC resin and other associated products cheaper, which eventually render pipes and fittings proportionately cost-effective. Consequently, the same capex on the domestic manufacturing of PVC and allied downstream products would lower the project cost and yield higher returns. Additionally, primary producers of these input or finished products may pass on the duty cut to consumers.

The import duty cut will make cost of input such as vinyl chloride monomer (VCM), PVC resin and other associated products cheaper, which eventually render pipes and fittings proportionately cost-effective. Consequently, the same capex on the domestic manufacturing of PVC and allied downstream products would lower the project cost and yield higher returns. Additionally, primary producers of these input or finished products may pass on the duty cut to consumers.

Announcing the decision while presenting the Union Budget 2026–27 in Parliament (Lok Sabha) on Sunday, Union Finance Minister Nirmala Sitharaman said, “The import duty on polymers of vinyl chloride or of other halogenated olefins, in primary forms, is reduced to 7.5 percent from the existing 10 percent. The basic customs duty on ammonium nitrate, whether or not in aqueous solution, has also been reduced to 5 percent from 10 percent earlier.”

Vinyl chloride monomer (VCM), or chloroethene, is an organochloride compound manufactured on a large scale by converting ethylene and chlorine into ethylene dichloride, which is then heated to produce VCM. Vinyl chloride is crucial for manufacturing PVC, one of the most widely used plastics globally. India’s total vinyl chloride monomer market volume was estimated at around 795,120 metric tonnes in 2024, with projections indicating steady growth driven by strong demand for PVC in construction and infrastructure. The market is expected to grow at a compound annual growth rate (CAGR) of 2.84 percent through 2030.

Rising imports

India accounted for 14.64 percent of global vinyl chloride imports in 2024. Total vinyl chloride imports into India during the year were valued at US$ 357.31 million, with volumes amounting to around 0.5 million tonnes. In 2024, imports declined by 5.22 percent in value terms, while volumes rose by 2.15 percent year on year. The average import price of vinyl chloride into India fell in 2024 compared with the previous year, translating into an annual price decline of 7.22 percent.

The largest exporters of vinyl chloride to India were Qatar, accounting for 57.3 percent of total imports, followed by Japan (24.7 percent), China (10.2 percent), France (3.3 percent), and the United States (1.9 percent). While vinyl chloride monomer (VCM) is a key feedstock, India’s imports of finished polyvinyl chloride (PVC) are also substantial, having surged to more than 3 million tonnes annually. Domestic PVC production capacity remains insufficient to meet strong demand, resulting in nearly 60 percent of total consumption being met through imports.

Propylene oxide

Additionally, the Finance Minister reduced the basic customs duty on methyloxirane (propylene oxide) to 2.5 percent from the existing 5 percent. Methyloxirane is a highly volatile, colourless, and flammable liquid with an ether-like odour, primarily used as a key chemical intermediate in the production of polyether polyols for polyurethane plastics. It is also a critical industrial chemical used in the manufacture of propylene glycol, glycol ethers, and various surfactants.

The vast majority of propylene oxide is used to manufacture polyether polyols, which are subsequently utilised in polyurethane foams, coatings, adhesives, and sealants. It is also used in the production of propylene glycol—commonly used in antifreeze and food products—and as a chemical intermediate for surfactants and lubricants. Propylene oxide is extremely flammable, and its vapours can form explosive mixtures with air. It is classified as a hazardous chemical, with potential carcinogenic effects observed in laboratory animals.

India imports methyloxirane (propylene oxide) worth approximately US$ 50 million annually, making it the world’s 10th-largest importer. Key source countries include Singapore, Saudi Arabia, China, Thailand, and the United States. These imports, largely used for polyol production, are concentrated within the chemical sector, with substantial and consistent volumes sourced from the Middle East and Southeast Asia.

Outlook

Demand continues to be driven by PVC production for construction and industrial applications. While import demand remains high, India’s overall dependence on imported raw materials for PVC is projected to decline to less than 30 percent by FY 2026–27. Imports are closely linked to the rapid expansion of India’s construction and infrastructure sectors, which use PVC extensively for pipes and other applications.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com