Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

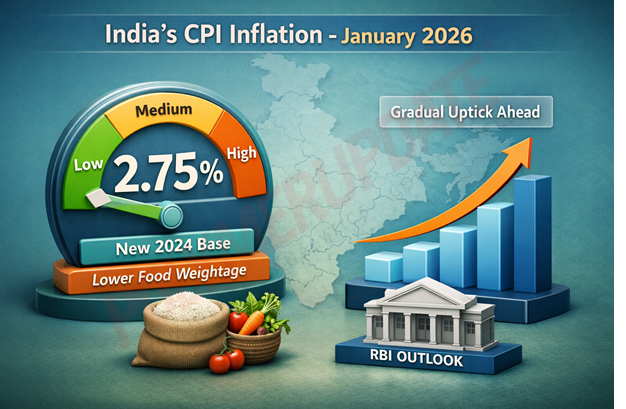

India’s retail inflation measured by the Consumer Price Index (CPI) moderated to 2.75 percent (provisional) year-on-year (yoy) for January 2026, marking the first print under the new series with the revised base year of 2024, said the data from the Ministry of Statistics and Programme Implementation (MoSPI). The corresponding inflation rates stood at 2.73 percent for rural areas and 2.77 percent for urban areas. The retail inflation print works out to 3.13 percent for December 2025. The new series of CPI inflation is calculated based on the item basket and the corresponding weights as per Household Consumption Expenditure Survey 2023-24. The exercise is being done for enhancing the coverage and representativeness of the inflation measure. The revision introduces more granular data enabling policymakers, financial institutions, businesses and citizens with precise data-driven decisions.

The new series of CPI inflation is calculated based on the item basket and the corresponding weights as per Household Consumption Expenditure Survey 2023-24. The exercise is being done for enhancing the coverage and representativeness of the inflation measure. The revision introduces more granular data enabling policymakers, financial institutions, businesses and citizens with precise data-driven decisions.

“Based on these exercise, the Consumer Price Index based inflation rate based on All India Consumer Price Index with base year 2024 for the month of January 2026 over January 2025 stood at 2.75 percent (provisional). Corresponding inflation rates for rural and urban are 2.73 percent and 2.77 percent, respectively,” said a MoSPI statement.

Madan Sabnavis, Chief Economist, Bank of Baroda, commented, “Inflation for January has come in at 2.75 percent which is similar to what we had projected at 2.9 percent. First, a backdrop of the new index. There has been considerable change in the composition of the index with the weight of food items now being brought down to 36.8 percent. This makes a difference for the index and inflation as these prices tend to be more volatile and hence have brought large shifts in the inflation numbers in the past.”

Food inflation

Food inflation based on the Consumer Food Price Index (CFPI) stood at 2.13 percent, with rural food inflation print recording at 1.96 percent and urban food inflation print at 2.44 percent. Housing inflation for January 2026 stood at 2.05 percent, with rural housing inflation at 2.39 percent and that of urban at 1.92 percent. The notable change is that food inflation now stands out of the negative territory and will remain so in future. Negative numbers exist for garlic, onions and potatoes as also witnessed for pulses like tur, coconut and coconut oil are the only two products with high inflation. With the base effect now getting diluted, there will be a tendency for this component to rise.

This noise element gets reduced in the new index. Further, there is a new item of housing represented by rents which are calculated and comes in a category of housing, water, electricity, fuel. Information and communication appears separately with a weight of 3.6 percent including both the hardware and user charges. The same holds for transport which includes prices of vehicles as well as fuel used and other transport services. Recreation finds special mention as do restaurants and hotels.

Distinct groupings

There are now 12 distinct groupings in the index. Pan and tobacco has inflation of 2.9 percent which is one of the highest numbers and clearly reflects the GST impact (if personal care which includes gold and silver is excluded). Clothing and footwear registered 3% inflation with clothing driving up inflation here.

Inflation in furnishing, household goods etc. and housing, water and gas, electricity at 1.5 percent is moderate and will remain so as these numbers are sticky and revisions happen only periodically. Health inflation at 2.2 percent is low but is one which tends to change periodically during the year and is something that would need monitoring. Transport and communication have low inflation numbers in the new series at 0.09 percent and 0.2 percent. These prices do change on a regular basis and hence would accordingly affect the headline index.

Education has witnessed high inflation of 3.4 percent with higher and secondary education contributing the most. Restaurants and hotels show inflation of 2.9% with the former driving the number. Personal care has the highest inflation with gold and silver pushing up the prices. At the state level, the trend witnessed in the earlier series continues with Telangana, TN, Kerala, Karnataka and Rajasthan witnessing highest inflation in January. The north-eastern states have relatively low inflation of less than 2 percent in most cases.

“Given the composition of the index and the dilution of the base effect for food items, we may expect inflation to climb upwards in the coming months. This would mean a long pause from the point of view of the RBI on rates. There may not be too much of alteration in the inflation forecasts by the RBI for next year,” Sabnavis added.

Composition changes

India cut the weightage of food and beverages by a sharp 9.11 percentage points in the new Consumer Price Index (CPI) inflation series to make retail inflation less volatile, while expanding the coverage of services and beauty care to bridge the gap, according to a statement from the Ministry of Statistics and Programme Implementation (MoSPI). The revised weightage of food and beverages will stand at 36.75 percent in the overall CPI basket, compared with 45.86 percent earlier.

The ministry has also revised the CPI base year to 2024 from 2012, alongside updating the consumption basket and weights for both rural and urban households. In addition, the base year for gross domestic product (GDP) estimates has been revised to 2022–23 from 2011–12, while the Index of Industrial Production (IIP) base year has also been reset to 2022–23. While the timeline for the rollout of the new CPI series remains unclear, experts expect it to be implemented soon.

RBI estimates

The Reserve Bank of India (RBI) said in its February policy review, “Headline inflation during November–December 2025 remained below the tolerance band of the inflation target. Headline CPI inflation stayed low in November and December, even as it firmed up by one percentage point over these two months, driven largely by a lower rate of deflation in the food group. Excluding gold, core inflation remained stable at 2.6 percent in December.”

The near-term outlook suggests that food supply prospects remain bright, supported by healthy kharif production, sufficient buffer stocks of foodgrains, favourable rabi sowing, and adequate reservoir levels. Core inflation, barring potential volatility induced by precious metal prices, is expected to remain range-bound. However, geopolitical uncertainty, coupled with volatility in energy prices and adverse weather events, poses upside risks to inflation.

In terms of the headline inflation trajectory, despite muted underlying momentum, unfavourable base effects stemming from the large decline in prices observed during January–March 2025 are expected to lead to an uptick in year-on-year inflation in the corresponding period this year. Considering all these factors, CPI inflation for the full financial year 2025–26 (April–March) is now projected at 2.1 percent, with the January–March 2026 quarter at 3.2 percent. CPI inflation for the April–June 2026 and July–September 2026 quarters is projected at 4.0 percent and 4.2 percent, respectively. Excluding precious metals, underlying inflationary pressures remain muted.

Inflation outcomes remain heterogeneous across jurisdictions, staying above target in most major advanced economies, prompting a divergence in monetary policy actions as central banks approach the end of their current easing cycles. Against an increasingly cautious global backdrop, bond market sentiment remains bearish, reflecting concerns over fiscal sustainability. However, equity markets, driven by technology stocks, remain upbeat.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com