Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

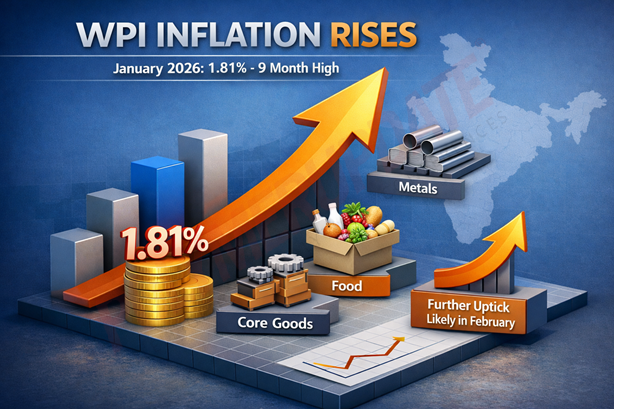

India’s bulk commodities inflation, measured by the Wholesale Price Index (WPI), more than doubled to 1.81 percent in January, marking its highest level in nine months, driven by a favourable base effect and higher prices of non-food articles, including base metals. A substantial increase in precious metal prices also supported overall bulk inflation. Headline inflation rose from (-)1 percent in October to (-)0.13 percent in November, then turned positive at 0.8 percent in December and 1.8 percent in January. A statement from the Ministry of Commerce and Industry said, “The annual rate of inflation based on the All India Wholesale Price Index (WPI) number is 1.81 percent (provisional) for the month of January 2026 (over January 2025). The positive rate of inflation in January 2026 is primarily due to an increase in prices of the manufacture of basic metals, other manufacturing, non-food articles, food articles and textiles, etc. Prices of non-food articles (5.32 percent) and crude petroleum and natural gas (4.27 percent) increased in January 2026 compared with December 2025.”

A statement from the Ministry of Commerce and Industry said, “The annual rate of inflation based on the All India Wholesale Price Index (WPI) number is 1.81 percent (provisional) for the month of January 2026 (over January 2025). The positive rate of inflation in January 2026 is primarily due to an increase in prices of the manufacture of basic metals, other manufacturing, non-food articles, food articles and textiles, etc. Prices of non-food articles (5.32 percent) and crude petroleum and natural gas (4.27 percent) increased in January 2026 compared with December 2025.”

The uptick in bulk inflation was primarily led by the core WPI (non-food manufactured items) segment, with inflation in this category rising to a 38-month high of 3.2 percent from 2 percent in the previous month. The hardening of global commodity prices and depreciation in the USD/INR pair over the past few months likely put upward pressure on the core index, which rose 1.4 percent month-on-month in January 2026 — the sharpest uptick in 45 months. Within the core segment, basic metals recorded a sharp 5.8 percent month-on-month increase in January 2026.

Madan Sabnavis, Chief Economist at Bank of Baroda, commented, “WPI inflation for January remains benign at 1.8 percent. However, since October, there has been a tendency for inflation to increase gradually, reflecting base effects, as supplies in general have been normal. Inflation in primary articles was one of the drivers of higher inflation at 2.2 percent, with food items registering 1.6 percent and non-food items 7.6 percent.”

Food inflation

The food index, consisting of ‘food articles’ from the primary articles group and ‘food products’ from the manufactured products group, decreased from 196 in December 2025 to 194.2 in January 2026. The year-on-year inflation rate based on the WPI Food Index increased to 1.41 percent in January 2026. For November 2025, the final Wholesale Price Index and inflation rate for ‘All Commodities’ stood at 156.2 and (-)0.13 percent, respectively.

On the food side, vegetables witnessed a spike in inflation to 6.8 percent, even as inflation for potatoes and onions remained negative. Supply shortfalls and base effects pushed up prices. On the non-food side, oilseeds registered higher inflation of 19.3 percent, which propped up overall inflation. This trend was not seen in oils in the manufacturing category, where inflation for the consolidated group was only 0.5 percent.

The food segment also, as expected, witnessed a base-led hardening to an eight-month high of 1.4 percent in January 2026 after remaining flat on a year-on-year basis in December 2025. Within food, vegetables returned to inflationary territory in January 2026 after a gap of 11 months, while other items such as eggs, meat and fish, and condiments and spices also saw a hardening in their year-on-year prints.

Rahul Agrawal, Senior Economist at ICRA Ltd., stated, “Going forward, food inflation is set to harden further as the effect of an unfavourable base intensifies; WPI food prints had eased from 8.9 percent in December 2024 to 1.9 percent in May 2025 and then turned into deflation, printing at (-)5 percent in October 2025. Besides, global commodity prices have continued to rise in February 2026, which, along with the lagged impact of depreciation pressure in the USD/INR pair over the last few months, is likely to continue to weigh on the landed cost of imports. Overall, we expect WPI inflation to inch up further to around 2.0–2.2 percent in February 2026.”

Segment-wise performance

Fuel inflation remained negative at (-)4.6 percent, compared with (-)1.9 percent last year. Manufactured goods inflation witnessed an uptick to 2.9 percent, attributable to higher metal prices, which rose 6 percent. This reflects global trends, as the segment has seen a rally amid evolving economic and political conditions. Another industry category reporting relatively higher inflation — above 2 percent — was textiles.

The WPI inflation numbers are unlikely to have a bearing on monetary policy but still indicate relatively benign price conditions from a corporate standpoint, suggesting that input costs may remain under control. If lower customs duty rates on several commodities are taken into account, there could be a downward tendency in prices of manufactured products, which will be an important factor in the coming year.

Outlook

As the date for the announcement of a new series has not yet been indicated, this means that the new GDP series will continue to use the existing WPI as deflators for various segments of the national product. The Government of India announced a new CPI series and base year last month, which may have a bearing on WPI inflation with a lag effect of two to three months.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com