This week, Polypropylene (PP) prices gained in some parts of Asia.

An industry source in Asia informed a Polymerupdate team member, “PP prices in parts of Asia have moved higher, aligning with firmer supplier offers, with deals concluded at elevated levels. While trading activity has slowed due to the Lunar New Year holidays in China and Vietnam, buying interest remains steady for prompt requirements, supporting expectations that near-term shipment offers will stay firm.”

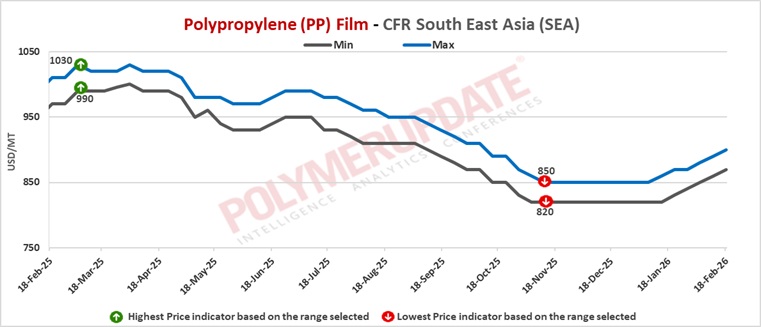

In South East Asia, PP raffia and PP injection grade prices were assessed at USD 840-860/mt CFR levels, both week-on-week higher by USD (+10/mt). PP film prices were assessed at USD 870-900/mt CFR levels while BOPP prices were assessed at USD 850-880/mt CFR levels, both increased by USD (+10/mt) from the previous week. PP block copolymer prices were assessed at USD 880-900/mt CFR levels, a rise of USD (+10/mt) from the previous week.

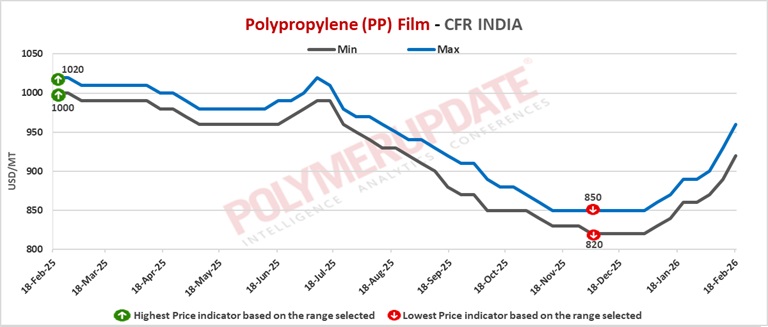

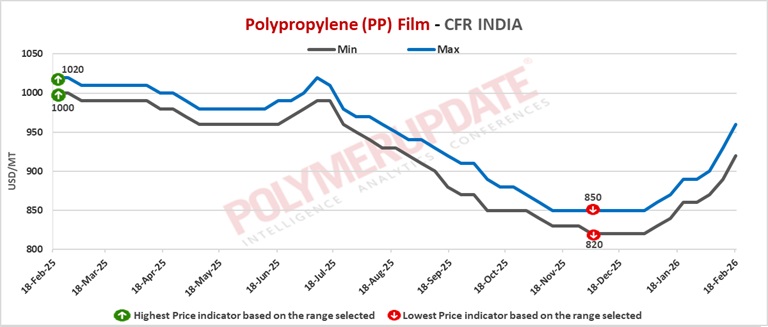

In India, PP raffia and PP injection prices were assessed at USD 900-930/mt CFR levels, both higher by USD (+30/mt) from last week. PP film prices were assessed at USD 920-960/mt CFR levels, up USD (+30/mt) from last week. BOPP prices were assessed at USD 910-950/mt CFR levels while PP block copolymer prices were assessed at USD 920-950/mt CFR levels, both week-on-week increased by USD (+30/mt).

A domestic industry source informed a Polymerupdate team member, “Reliance Industries Limited (RIL) has rolled over PP prices, with effect from February 15, 2026.”

In Pakistan, PP raffia and PP injection grade prices were assessed at USD 910-930/mt levels, a rise of USD (+20/mt) from the previous week. PP film prices were assessed at USD 940-970/mt CFR levels, up USD (+20/mt) from last week. BOPP prices were assessed at USD 940-970/mt CFR levels while PP block copolymer prices were assessed at USD 950-1000/mt CFR levels, both week-on-week higher by USD (+20/mt).

In Bangladesh, PP raffia and PP injection prices were assessed at USD 900-930/mt CFR levels, both higher by USD (+20/mt) from the previous week. PP film and BOPP prices were assessed at USD 920-940/mt CFR levels, both week-on-week increased by USD (+20/mt). PP block copolymer prices were assessed at USD 960-1000/mt CFR levels, up USD (+20/mt) from the previous week.

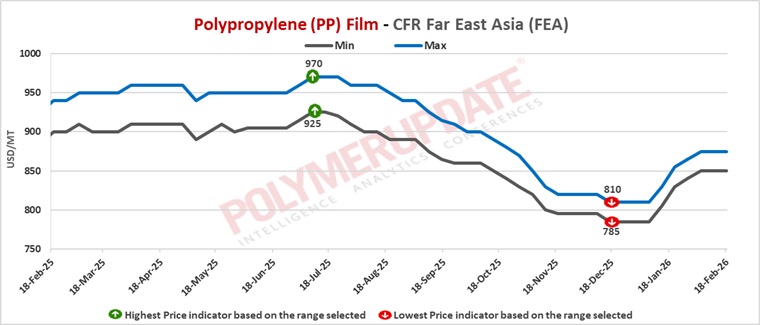

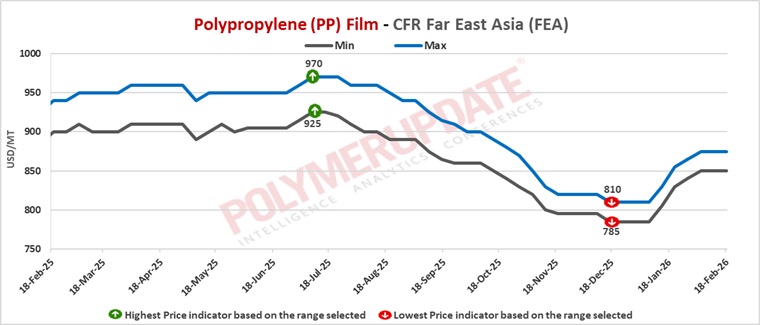

Meanwhile, in Far East Asia, PP raffia and PP injection prices were assessed as stable at USD 820-840/mt CFR levels. PP film prices were assessed at USD 850-875/mt CFR levels while BOPP prices were assessed at USD 835-850/mt CFR levels, both steady week-on-week. PP block copolymer prices were also assessed flat at USD 865-880/mt CFR levels.

In Sri Lanka, PP raffia and PP injection grade prices were assessed at USD 900-930/mt CFR levels, rolled over from the previous week. PP film and BOPP prices were assessed at USD 960-980/mt CFR levels while PP block copolymer prices were assessed at USD 970-990/mt CFR levels, both constant from last week.

Meanwhile, propylene feedstock prices were assessed at USD 830-840/mt CFR China levels, week-on-week higher by USD (+10/mt). FOB Korea propylene prices were assessed at USD 785-795/mt levels, a gain of USD (+5/mt) from the previous week.