This week, HDPE prices displayed a mixed undertone in Europe.

A European industry source told a Polymerupdate team member, “Spot market prices dipped slightly, largely reflecting softer trading activity. Buyer interest was uneven throughout the week, with some participants making advance purchases for March, while others saw limited activity. Downstream demand was comparatively stronger, as converters reported stable to slightly improved consumption compared to January.”

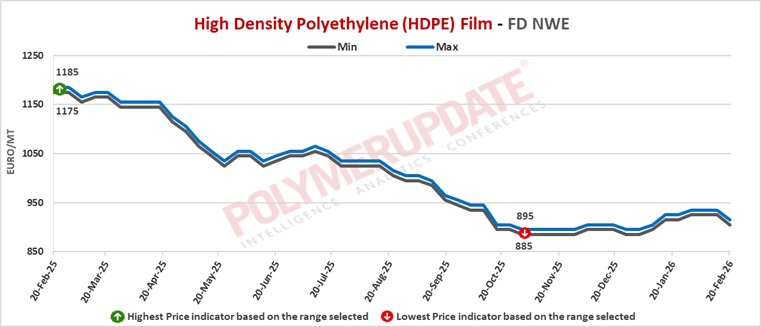

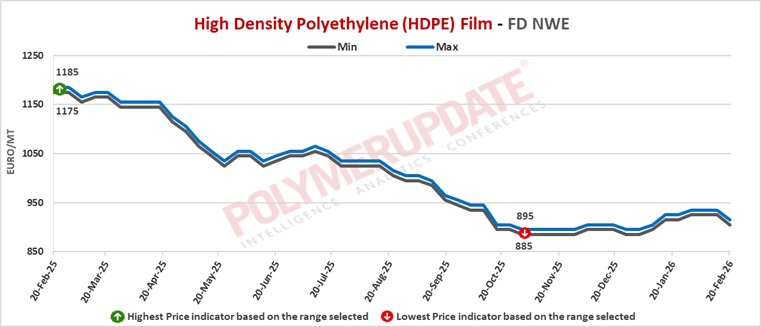

In the spot markets, HDPE Film grade prices were assessed at Euro 905-915/mt FD North West Europe levels, a fall of Euro (-20/mt) from last week. Meanwhile, HDPE BM grade prices were assessed at Euro 905-915/mt FD North West Europe levels, week-on-week down Euro (-10/mt). HDPE injection grade prices were assessed at Euro 925-935/mt FD North West Europe levels, a drop of Euro (-20/mt) from the previous week.

The source added, “In contrast, contract market prices trended higher as domestic buyers raised their bids, supported by steady order flows and ongoing restocking. Limited carryover inventories from the end of last year added further upward pressure. However, some converters continued to rely on earlier purchases, which helped keep overall demand balanced despite firmer market conditions.”

In the contract markets, HDPE film grade prices were assessed at Euro 1500-1505/mt FD NWE Germany and FD NWE Italy levels, both higher by Euro (+5/mt) week-on-week. HDPE film grade prices were assessed at Euro 1500-1505/mt FD NWE France levels, a marginal increase of Euro (+5/mt) from the previous week. Meanwhile, HDPE film grade prices were assessed at GBP 1305-1310/mt FD NWE UK levels, a gain of GBP (+10/mt) from last week.

In the contract markets, HDPE BM grade prices were assessed at Euro 1480-1485/mt FD NWE Germany and FD NWE Italy levels, both up Euro (+5/mt) from last week. HDPE BM grade prices were assessed at Euro 1480-1485/mt FD NWE France levels, week-on-week higher by Euro (+5/mt). Meanwhile, HDPE BM grade prices were assessed at GBP 1290-1295/mt FD NWE UK levels, a rise of GBP (+10/mt) from the previous week.

In the contract markets, HDPE injection grade prices were assessed at Euro 1450-1455/mt FD NWE Germany and FD NWE Italy levels, both higher by Euro (+5/mt) from last week. HDPE injection grade prices were assessed at Euro 1450-1455/mt FD NWE France levels, up Euro (+5/mt) from the previous week. Meanwhile, HDPE injection grade prices were assessed at GBP 1265-1270/mt FD NWE UK levels, a rise of GBP (+10/mt) from last week.

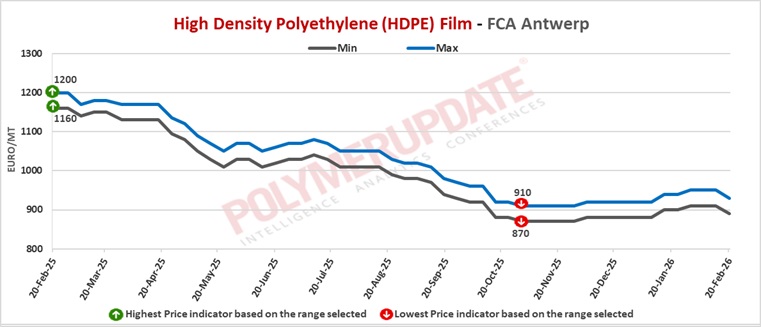

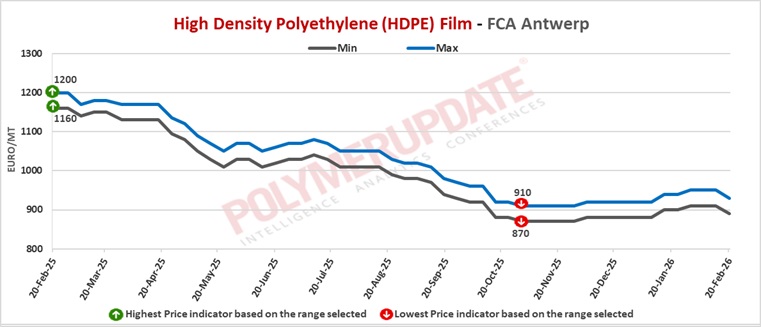

FCA Antwerp HDPE film prices were assessed at Euro 890-930/mt levels, while HDPE injection prices were assessed at Euro 910-930/mt levels, both lower by Euro (-20/mt) from last week. Meanwhile, FCA Antwerp HDPE BM prices were assessed at Euro 890-920/mt levels, a fall of Euro (-10/mt) from the previous week.

Ethylene feedstock spot prices were assessed at Euro 755-765/mt FD North West Europe levels, higher by Euro (+20/mt) from last week.