Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

Gujarat has once again demonstrated its dominance in India’s chemical exports during the financial year 2024-25, as revealed by data compiled by the Basic Chemicals, Cosmetics & Dyes Export Promotion Council (Chemexcil). The western Indian state accounted for 46.16% of India’s total chemical exports, valued at USD 12.885 billion, out of the nation’s total exports of USD 28.699 billion in FY 2024-25. Chemexcil, a non-profit organization established by the Ministry of Commerce and Industry, Government of India, promotes the export of chemicals, dyes, and related products.

According to Chemexcil data, Maharashtra and Telangana secured the second and third positions, with export shares of 18.06% and 8.71%, respectively. However, overall exports experienced a marginal decline in FY25 compared to FY24. Experts attribute Gujarat’s performance to its strong base in chemical manufacturing and export infrastructure, which has cemented its status as a chemicals hub.

With a combination of proactive intent, favourable government policies, industrial capability, and a focus on environmental sustainability, Gujarat is rapidly evolving into India’s chemical heartland and positioning itself as a globally competitive chemical powerhouse. Demography of chemical industry in Gujarat

Demography of chemical industry in Gujarat

The Indian chemical industry comprises approximately 8,000 commercial products, making it highly diversified and contributing around 8% to the country’s gross domestic product (GDP). Although chemical manufacturing is spread across various states, around 53% of India’s chemical production units are concentrated in Gujarat.

Over the past five years, Gujarat has rapidly developed into India’s chemical hub. Addressing a national conference in Ahmedabad, Gujarat, Susanta Kumar Purohit, Joint Secretary of the Department of Chemicals and Petrochemicals, recently stated, “The state government has drafted plans to accelerate the growth of Gujarat's chemical sector by infusing new funds and attracting global investments. Currently, Gujarat has over 11,000 chemical units capable of producing 3–4 million tonnes of chemicals, meeting high export demand. The chemical industry is set to receive an investment of ₹8 lakh crore by 2025 and is projected to grow at a rate of 9.3% annually.”

India’s Finance Minister, Nirmala Sitharaman, has also announced incentives for domestic chemical manufacturers. Under the Production Linked Incentive (PLI) Scheme, the government will prioritize the specialty chemical segment, which has the highest domestic and international demand.

Ankit Patel, Chairman (Northern Region) of Chemexcil, remarked, “Gujarat continues to lead in chemical exports, including dyes, dye intermediates, and organic and inorganic chemicals. Despite the challenges posed by fluctuating global demand, Gujarat has consistently contributed over 45% of the country’s chemical exports. While other states are experiencing some growth, Gujarat’s well-established ecosystem gives it a significant advantage in the chemicals industry.”

Large corporate

Notably, some prominent names in the petrochemical and chemical industry are based in Gujarat, including Reliance Industries, which has achieved a compounded annual growth rate (CAGR) of 10–11% in recent years. These companies benefit from the state government’s business-friendly policies and robust infrastructure for chemical manufacturing. Experts are now comparing Gujarat’s emerging chemical hub to global giants like Saudi Arabia.

Nayara Energy Ltd, another significant player in Gujarat’s chemical and petrochemical sector, is an Indo-Russian oil refining and marketing company. It owns and operates the Vadinar refinery, located in the Dwarka district of Kutch, Gujarat. With a crude oil refining capacity of 20 MMTPA (million metric tonnes per annum), it is the second-largest refinery in India.

Gujarat’s chemical industry accounts for 62% of India’s petrochemical production, 53% of its chemical production, and 45% of its pharmaceutical production. As the 'Petrochemical and Chemical Capital of India,' Gujarat plays a pivotal role in driving the country’s growing economy.

Focus on sustainability

Gujarat is now prioritizing sustainability and inclusivity as key components of its growth strategy. As one of India's leading states with significant chemical hubs, Gujarat boasts numerous advantages. Infrastructure development has been a cornerstone of this transformation. Facilities like the Dahej PCPIR and mega chemical parks in Bharuch, Ahmedabad, Vapi, and Ankleshwar are rapidly emerging as prominent chemical hubs. Additionally, sustainability and innovation are becoming integral to Gujarat's growth narrative.

Looking ahead, the state requires holistic development and greater collaboration. Biomass holds significant potential to provide sustainable solutions, and all stakeholders must come together to ensure a successful transition toward bio-based products. There is an urgent need for well-defined long-term policies, practical technologies, and real-life scenarios to enable ecosystem growth.

The Indian chemical industry ranks sixth globally in terms of production and plays a substantial role in supporting the national economy. Key growth drivers include rising domestic demand and rapidly evolving consumer behavior. The sector employs approximately 2 million people and has a presence in 175 countries. Reports suggest that India is poised to triple its current growth within a stipulated timeframe.

Experts believe Gujarat has become a new investment hub for the chemical and petrochemical industries over the past two decades, largely due to the easy availability of raw materials supported by local manufacturing units. Clusters such as Dahej, Padra, Vatva, Ankleshwar, Vapi, and Naroda are among the largest in the country. The state also operates around 35 common effluent treatment plants (CETPs) to ensure environmental compliance. This focus on compliance is critical in international markets and provides a competitive edge to India’s chemicals industry.

Challenges

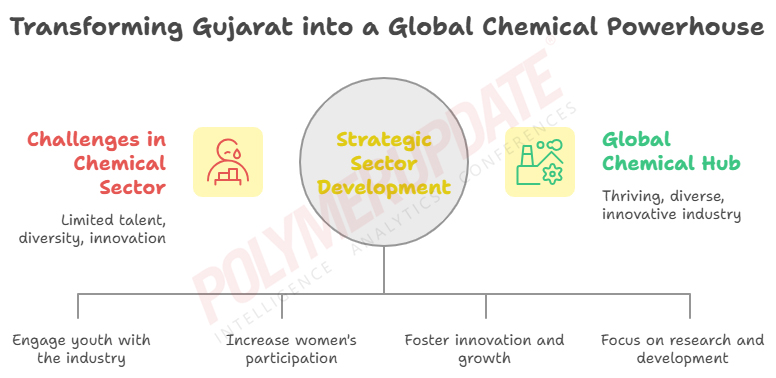

Vishal Sharma, Executive Director and Chief Executive Officer (CEO) of Godrej Industries (Chemicals), stated at an event in Gujarat, "We need to make the naysayers understand that chemicals are the foundation of all materials. Whether less or more hazardous, chemicals come in various forms but are indispensable. It is crucial to educate the younger generation about these facts. Gender diversity is another area that requires attention, as societal misconceptions and issues currently result in lower participation of women in the industry."

The chemical industry faces significant challenges in increasing the representation of women employees. Additionally, the lack of unicorns and startups in the sector remains a major obstacle to achieving the ambitious goal of reaching a market value of USD 1 trillion. In terms of engineering talent, only 0.8% of India’s engineers specialize in chemical engineering—just 11,000 out of 1.5 million—a figure far below what is needed. Many colleges have discontinued chemical engineering courses due to declining interest among students.

Moving forward, it is essential to inspire the younger generation to engage with the industry; otherwise, it risks stagnation rather than growth. Treating talent appropriately and investing in research and development, as well as infrastructure, require immediate focus. Entrepreneurs must be supported with a conducive environment and expedited approval processes to foster innovation and growth.

Growth forecasts

According to McKinsey & Company, the Indian chemical industry is projected to grow at a CAGR of 7–10% between 2021 and 2027. Currently, India ranks 6th globally and 3rd in Asia as a chemical producer, with Gujarat contributing over 30% to the country’s chemical production and exports.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com