This week, PP spot prices trended lower while contract prices were left unchanged in Europe.

An industry source in Europe informed a Polymerupdate team member, "The decline in European PP spot prices was primarily driven by weak demand and ample regional supplies. A decline in overseas price offers is further indicative of a sluggish market outlook."

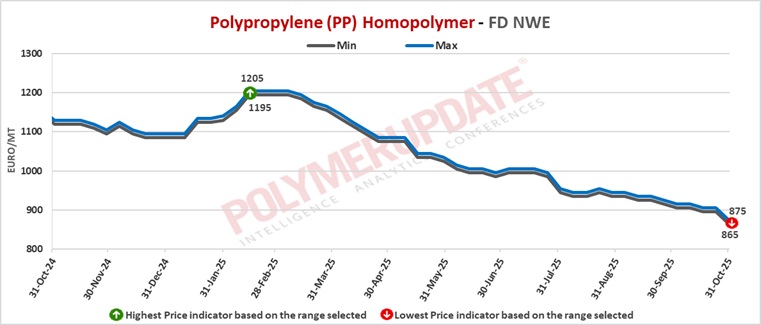

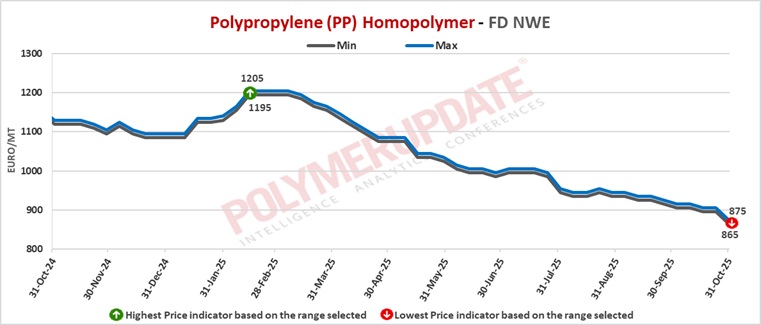

In the spot markets, PP injection molding grade prices were assessed at Euro 865-875/mt FD North West Europe while PP block copolymer grade prices were assessed at the Euro 965-975/mt FD Northwest Europe levels, both declined by Euro (-30/mt) from last week.

Meanwhile, in the contract markets, PP injection moulding grade prices were assessed at the Euro 1330-1335/mt FD NWE Germany and FD NWE France levels, both steady from the previous week. PP injection molding grade prices were assessed at the Euro 1320-1325/mt FD NWE Italy levels, stable from last week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1170-1175/mt FD NWE UK levels, a week-on-week rise of GBP (+15/mt).

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1430-1435/mt FD NWE Germany and FD NWE France levels, both unchanged from last week. PP block copolymer grade prices were assessed at the Euro 1420-1425/mt FD NWE Italy levels, remaining flat from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1260-1265/mt FD NWE UK levels, a week-on-week rise of GBP (+20/mt).

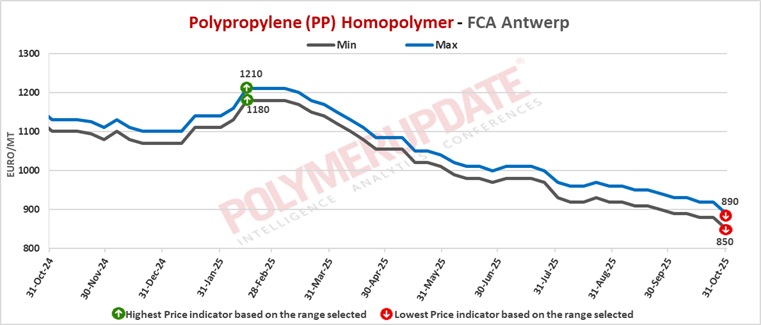

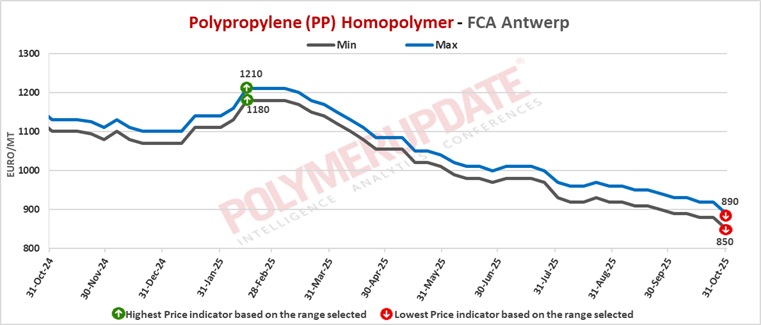

FCA Antwerp PP homopolymer prices were assessed at the Euro 850-890/mt levels while FCA Antwerp PP copolymer prices were assessed at the Euro 950-980/mt levels, both lower by Euro (-30/mt) from the previous week.

Feedstock propylene spot prices were assessed at the Euro 695-705/mt FD Northwest Europe levels, a week-on-week increase of Euro (+25/mt).